Fed turns more hawkish, opening the possibility for half-point hike in May

Dollar, financials jump on spiking yields

Key Events

U.S. futures for the Dow Jones, S&P 500, NASDAQ and Russell 2000 joined global stocks on Tuesday in a cautious advance as the bond selloff continued. Investors have moved out of safe haven Treasuries and back into risk assets after the Fed signaled it would be taking a tougher approach to fighting red-hot inflation via the possibility of a 50 basis point rate hike going forward.

However, ongoing Russia-Ukraine jitters kept a lid on gains. Still, the dollar and Bitcoin both rose.

Global Financial Affairs

All four major US equity benchmark contracts were trading in the green this morning, with futures on the Russell 2000 outperforming at time of writing.

European stocks opened higher on Tuesday, boosted by energy sector companies, even as oil prices turned lower. Banks also outperformed after Federal Reserve Chair Jerome Powell yesterday made comments markets interpreted as more hawkish than the stance presented at last week’s policy decision meeting. Cyclicals like automakers also performed well.

The STOXX Europe 600 Index opened 0.1% higher and extended the rally to 0.5%, stretching its advance for a fifth consecutive session.

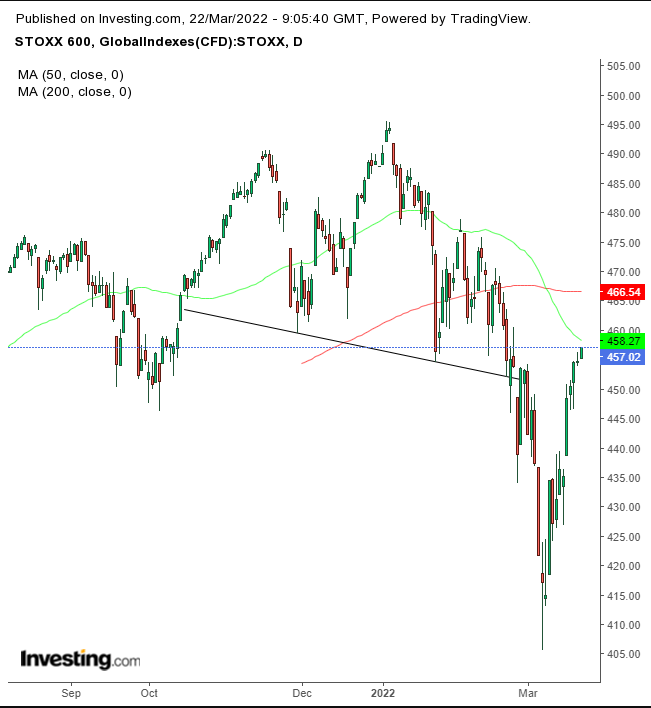

Technically, the pan-European benchmark is now a crossroad.

STOXX 600 Daily

STOXX 600 Daily

The European benchmark is trading in the area of an H&S top’s neckline, as it contends with the 50 DMA.

The FTSE 100 opened 0.25% higher and extended the rally to 0.6%. The UK index was leading among regional peers this morning, for a second straight day. The English benchmark, which is oil-exporter heavy, is highly sensitive to rising oil prices.

Earlier Tuesday, Asia-Pacific indices jumped. Hong Kong’s Hang Seng popped over 3% higher as shares of China’s Alibaba Group (HK:9988) surged more than 12% intraday after the Asian internet giant announced it was increasing its share buyback program to $25 billion.

Alibaba Daily

Alibaba Daily

Alibaba shares in Kong Kong closed up more than 11%, finishing right below the 50 DMA, which coincided with the neckline of an H&S Continuation pattern. It’s unclear how much resistance will remain at this level after the pattern more than realized its implied objective.

The increasing outlook for escalating interest rates has made current Treasury yields—including for the 10-year benchmark—seem paltry, causing investors to exit the safe haven assets. An oversupply forced sellers to find buyers at lower prices, widening the margin between the bond’s price and its payout.

UST 10Y Weekly

UST 10Y Weekly

Rates soared to their highest level since May 2019, after completing a massive H&S bottom in play since July 2019.

The dollar rose for a third day, as the prospect of higher interest rates increased demand for the currency’s escalating yield.

Dollar Daily

Dollar Daily

The greenback pared most of its advance upon reaching the top of a range that an upside breakout may prove is a falling flag. This would be doubly bullish right after the USD completed an H&S bottom.

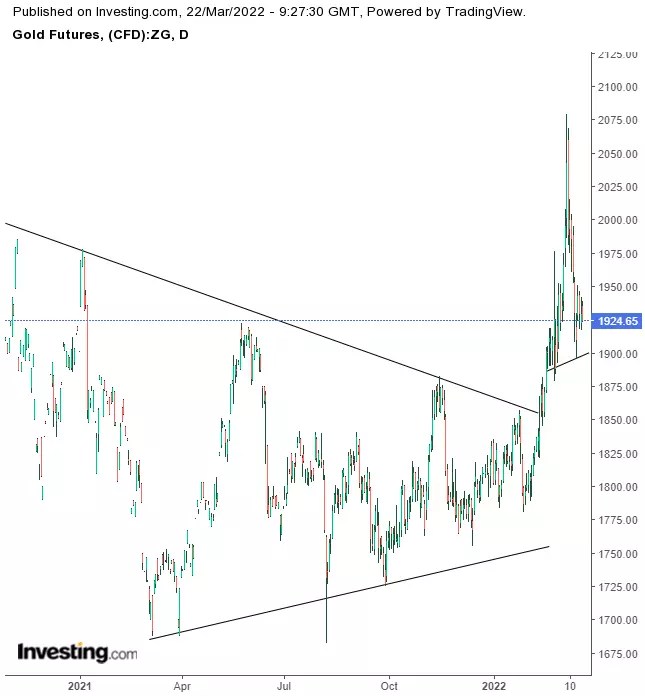

Gold lost some of its luster yesterday, after Powell’s hawkish remarks, as the precious metal slipped lower. However, concerns that the Fed could keep chasing inflation that got out of hand rather than contain it before that happens could bolster ongoing demand for precious metals, including gold.

Gold Daily

Gold Daily

That technical indecision is apparent on the chart. Gold may be forming a slight H&S top right above of a massive symmetrical triangle that’s lasted for over a year but has reached its implied target.

Bitcoin pushed higher, which is surprising considering the outlook for rising rates. Technically, we’re still bearish on the digital token.

BTC/USD Daily

BTC/USD Daily

The cryptocurrency is developing a symmetrical triangle after a sizeable H&S top.

Oil prices gave up gains and reversed, even as the Russia aggression versus Ukraine approached the one-month mark with no end in sight.

Oil 240-Minute Chart

Oil 240-Minute Chart

WTI may have performed a return move before it continued lower after developing an H&S top that reached only about 50% of its implied target. A decline below $93 will establish a short-term downtrend for the energy commodity.

Up Ahead

The US EIA reports Crude Oil Inventories on Wednesday

The UK’s Annual Budget Release takes place on Wednesday

US President Joe Biden attends a NATO emergency summit in Brussels on Thursday

Eurozone Manufacturing PMI prints on Thursday

US Initial Jobless Claims, Durable Goods Orders reports are released Thursday

Market Moves

Stocks

The Stoxx Europe 600 rose 0.5%

Futures on the S&P 500 rose 0.3%

Futures on the NASDAQ 100 rose 0.4%

Futures on the Dow Jones Industrial Average rose 0.4%

The MSCI Asia Pacific Index rose 1%

The MSCI Emerging Markets Index rose 1.1%

Currencies

The Dollar Index was little changed

The euro was little changed at $1.1006

The Japanese fell 0.8% to 120.43 per dollar

The offshore yuan was little changed at 6.3723 per dollar

The British pound rose 0.1% to $1.3186

Bonds

The yield on 10-year Treasuries advanced five basis points to 2.34%

Germany’s 10-year yield increased three basis points to 0.50%

Britain’s 10-year yield rose three basis points to 1.66%

Commodities

WTI crude dropped 3.74% to $107.94 a barrel

Brent crude fell 1.6% to $113.77

Spot gold fell 0.5% to $1,926.60 an ounce

Source: Investing.com