France’s political uncertainty adds to market risks

Real yields near positive territory

Equities under pressure

Key Events

The selloff in US Treasuries deepened on Monday and US futures on the Dow Jones, S&P 500, NASDAQ 100 and Russell 2000 all slid after European markets moved lower. The final round of voting in the French Presidential election is fueling market worries as the run-off between incumbent Emmanuel Macron and far-right candidate Marine Le Pen could be much closer than expected, adding to existing concerns on the coronavirus outbreak in China, global inflation and tightening US monetary policy.

Oil slid on demand worries.

Global Financial Affairs

European stocks opened the week on the back foot as investors sought out safe haven assets due to the continuing war in Ukraine, as well as the failure of strict lockdowns in China’s financial hub, Shanghai, to curb the spread of COVID-19 there, with daily cases topping 26,000.

In France, polls demonstrated that Macron has a narrow advantage over nationalist Marine Le Pen. Investors are concerned that Macron’s strategy of turning France into a favorable destination for foreign investment and his achievement of reducing unemployment to its lowest level on record will be undone if he loses.

The STOXX 600 Index opened almost 0.4% lower and extended its decline. France’s CAC 40 was volatile, whipsawing between sharp gains and losses.

NASDAQ futures were leading contracts on the Dow, S&P and Russell 2000 lower, agreeing with our analysis that the cyclical rotation would increase volatility.

Will the upcoming earnings season reshuffle the cards? Some expect US stocks to enjoy a reprieve thanks to accumulated excess liquidity and positive earnings boosted by inflation.

Asia was a sea of red with Australia’s ASX 200 the only bright spot. After wild swings, the index closed up 0.1%, as gains in banks on the outlook of improving margins offset a selloff in mining stocks.

Hong Kong’s Hang Seng fell 3.03% and China’s Shanghai Composite slid 2.61% as the pandemic fallout slammed heavyweights Alibaba (HK:9988) and Tencent (HK:0700) amid a stimulus policy void.

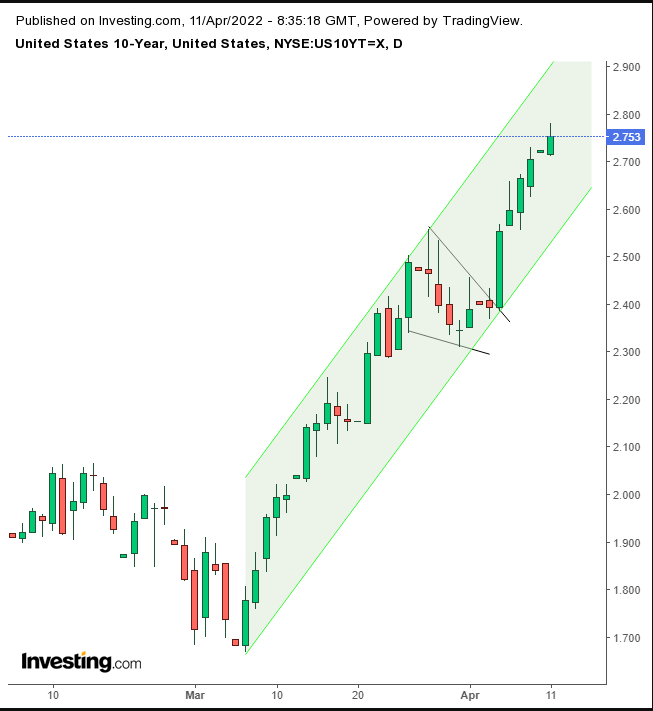

Yields on the 10-year Treasury note briefly reached the highest levels since 2018 and settled at 2.78% for the first time since Jan. 18, 2019. What is noteworthy is that US yields surpassed those of China’s sovereign bonds for the first time since 2010.

Moreover, after subtracting the inflation rate, real US yields are nearing positive territory, posing a risk to equities as investors will rotate into Treasuries.

10-year Treasuries Daily

10-year Treasuries Daily

We expect yields to keep rising toward 3%, after having completed a bullish wedge.

Rising yields boosted the dollar but only temporarily. On an intraday basis, the greenback ended a 7-day winning streak, probably on technicals.

Dollar Index Daily

Dollar Index Daily

The USD developed a bearish Shooting Star on Friday, a candlestick that demonstrates that bears managed to push back a significant bullish incursion. Today’s bearish confirmation increases the chance of a return move to a range that followed an H&S continuation pattern.

Gold climbed for the third straight day.

Gold Daily

Gold Daily

In yesterday’s post, we suggested that the yellow metal may have completed a Symmetrical Triangle, but we no longer think so. The breakout volume is underwhelming and more importantly, the price meandered through the supposed apex, rendering such a scenario moot. As of now, we think the price isn’t following any set pattern.

Bitcoin traded lower.

Bitcoin Daily

Bitcoin Daily

The cryptocurrency plunged as it blew out a potentially bullish wedge at the time of a rising channel. The preceding H&S top, whose pennant’s neckline was pressing, contained significantly more interest.

Oil returned to a selloff on concerns of lower demand from China due to the social restrictions there. The Asian nation is the world’s largest oil importer.

Oil Daily

Oil Daily

Prices opened lower after finding resistance on Friday below a Symmetrical Triangle, reinforced by the 50 DMA. The MACD has been bearish, and the RSI just confirmed that previous support turned into a resistance.

Up Ahead

On Tuesday US CPI figures are published.

We hear from Federal Reserve Governor Lael Brainard on Tuesday.

On Wednesday, JPMorgan (NYSE:JPM) reports Q1 2022 results.

Market Moves

Stocks

The STOXX 600 fell 0.3%

Futures on the S&P 500 fell 0.4%

Futures on the NASDAQ 100 fell 0.5%

Futures on the Dow Jones Industrial Average fell 0.3%

The MSCI Asia Pacific Index was little changed

The MSCI Emerging Markets Index rose 0.2%

Currencies

The Dollar Index rose 0.2%

The euro was up 0.5% at $1.0929

The Japanese yen rose 0.8% to 125.31 per dollar

The offshore yuan rose 0.2% to 6.3773 per dollar

The British pound rose 0.2% to $1.3053

Bonds

The yield on 10-year Treasuries advanced six basis points to 2.76%

Germany’s 10-year yield rose to 0.78%

Britain’s 10-year yield increased to 1.83%

Commodities

WTI crude dropped 1.2% to $96.08 a barrel

Brent crude fell 2% to $100.71 a barrel

Spot gold rose 0.6% to $1,958.39 an ounce

Source: Investing.com