3/3

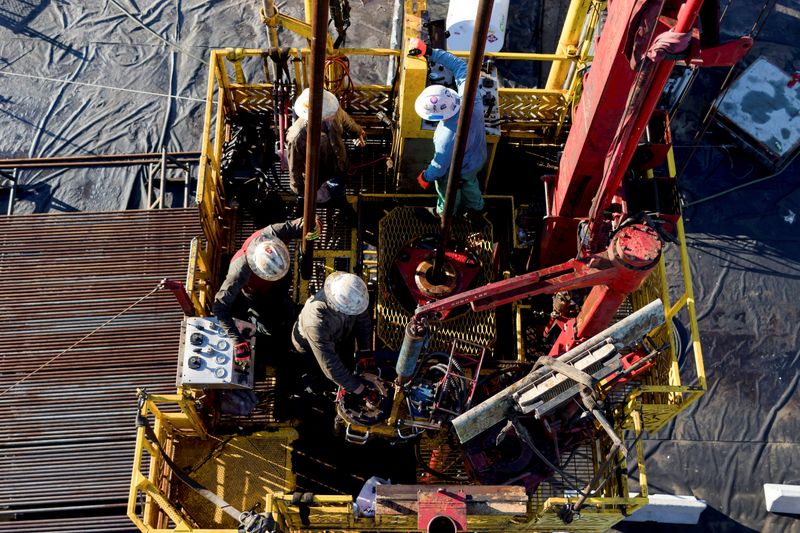

© Reuters. FILE PHOTO: An aerial view of a DWS Snubbing crew performing an Oil & Gas intervention on a well site located in the heart of the Appalachian Basin, U.S., June 2018. Deep Well Services/Handout via REUTERS

2/3

By Liz Hampton, Stephanie Kelly and Nia Williams

(Reuters) – When Jeremy Davis was laid off from his oilfield job in Texas in 2020, he did not want to leave the industry after 17 years in oil and gas.

But his next jobs brought one mishap after another. He was hospitalized for almost a week following a shift at a chemical manufacturing facility; another company he worked for never paid him, leaving him short $5,000.

“There comes a point and time where you also get extremely frustrated with the unpredictability and (lack of) stability,” said Davis, 38, who now works in construction closer to his home and family near Austin, Texas.

Davis says he would be open to returning to energy, but for now, he is one of thousands of workers in the United States and Canada who have left oil and gas jobs, put off by arduous conditions, remote locations, and insufficient compensation, or lured to the renewables sector as the world transitions to cleaner energy.

Governments are pushing oil and gas producers to increase output with prices hovering around $100 a barrel amid a worldwide supply shortage. The shortage of workers is limiting how much producers in the United States and Canada can increase oil output this year as governments try to find ways to offset the effect of lost Russian barrels following Moscow’s invasion of Ukraine.

Oil workers left the industry in droves after the COVID-19 pandemic started. Now, the U.S. unemployment rate has fallen to 3.6%, just a hair above the pre-pandemic low, but there are still roughly 100,000 fewer oil and gas workers now in the country than before the pandemic.

Oil industry employment in Canada has rebounded more swiftly, which has allowed workers to drive a harder bargain in negotiations for benefit and wage packages as companies try to maintain their workforce.

“At a job fair in a place like San Antonio, pre-COVID, maybe 200 people would show up. Now it’s 50 or 100,” said Andy Hendricks, chief executive of Patterson-UTI (NASDAQ:PTEN) Energy, which is currently running about a sixth of the 695 drilling rigs operating in the United States.

His company may hire another 3,000 workers this year after hiring back 3,000 in 2021, and even has recruiters set up at a shopping mall in Williston, North Dakota, to find potential workers.

HELP WANTED

Canadian producer Peyto Explorations and Development Corp would drill more wells if they could staff more rigs, said CEO Darren Gee. Calgary-based Peyto produces 98,000 barrels of oil equivalent per day of oil and natural gas.

“We probably would increase the capital budget this year if we could get people,” Gee said, adding that new workers often lack experience. He pointed to the University of Calgary’s move to suspend its oil and gas engineering program last year as an example of why the industry is struggling for new talent.

Employment in the U.S. oilfield services and equipment sector was nearly 609,000 in March, the highest since September 2021, but still below pre-pandemic levels of about 707,000, according to the Energy Workforce and Technology Council.

Mark Marmo, CEO of Deep Well Services, an oilfield firm based in Zelienople, Pennsylvania, said fracking work in places like West Texas is currently delayed about two weeks to a month because of a lack of labor.

“We hired 350. If we could hire another 350, we’d put them all to work,” he said.

In the mining and logging industries, which includes oil and gas work, an estimated 14,000 workers quit in January, the highest level since early 2020, according to data from the U.S. Bureau of Labor Statistics. About 13,000 workers were estimated to have quit in February.

“We’ve had companies in the Permian that have gone out and hired 100 new employees and within six months there’s only eight to nine original employees still working,” said Tim Tarpley, with the Energy Workforce and Technology Council, a trade group whose members include Halliburton (NYSE:HAL) Co and Schlumberger (NYSE:SLB).

U.S. and Canadian production is anticipated to grow even with a tight labor market, but executives said output could surpass expectations if more workers were available.

In the United States, output is expected to grow by about 800,000 barrels per day (bpd) in 2022 to average 12 million bpd, the Energy Information Administration (EIA) forecast, short of 2019’s all-time high of 12.3 million bpd. Canada’s production, including natural gas liquids, is forecast to rise by 190,000 bpd to 5.75 million bpd, the EIA said.

COMPETING WITH AMAZON

Fewer skilled workers are willing to travel to the remote Canadian oil sands region for turnaround season, when thousands are needed for essential maintenance on oil sands plants, said Terry Parker, executive director of the Building Trades of Alberta, because companies no longer pay a big enough premium for the inconvenience.

Parker said oil sands labor rates ranged from C$30 ($23.78) an hour for less skilled work, to C$50 an hour for high-skilled workers like pipefitters, boilermakers and millwrights.

Unite Here, a union representing hospitality workers in industry accommodation camps, negotiated agreements for better overtime for workers at camps operated by Civeo (NYSE:CVEO) Corp in the oil sands, the union’s Canadian director, Ian Robb, told Reuters.

In March, the union also secured a wage increase of up to 22% for workers at an Atco Ltd camp serving the long-delayed Trans Mountain oil pipeline expansion project, according to a news release.

In Alberta, the average weekly wage including overtime for all employees in mining, quarrying and oil and gas extraction is up 7.3% since February 2020, according to data from Statistics Canada.

In the United States, hourly wages for production and nonsupervisory employees are currently about 5% higher on average than the year-ago level, and oilfield wages are due to rise about 10% for the year, according to oilfield consultancy Spears & Associates.

However, average hourly wages in the U.S. oil and gas extraction industry are still below pre-pandemic levels, currently estimated at $45.45 an hour for February 2022, versus $48.37 an hour in February 2020, according to the Bureau of Labor Statistics.

Patterson-UTI raised wages last year because of competition from retailers that historically paid less than the oil industry, Hendricks said.

“We’re competing against Amazon (NASDAQ:AMZN) hiring drivers, or Target (NYSE:TGT) with positions in air-conditioned warehouses. It’s easier than a drilling rig in west Texas in the summer,” he said.

Oil and gas workers leave industry in droves https://globalrubbermarkets.com/wp-content/uploads/2024/08/n-american-oil-companies-scramble-to-find-workers-despite-boom.png

($1 = 1.2618 Canadian dollars)

Source: Investing.com