Shares of American Airlines have lost more than 4.5% in 2022

Despite the inflation in airfares the outlook for air travel demand remains firm

Long-term investors could consider buying AAL shares at current levels

For tools, data, and content to help you make better investing decisions, try InvestingPro+.

American Airlines (NASDAQ:AAL) stock, as well as its peers, has lost altitude this past year. The industry has faced significant headwinds during the coronavirus pandemic.

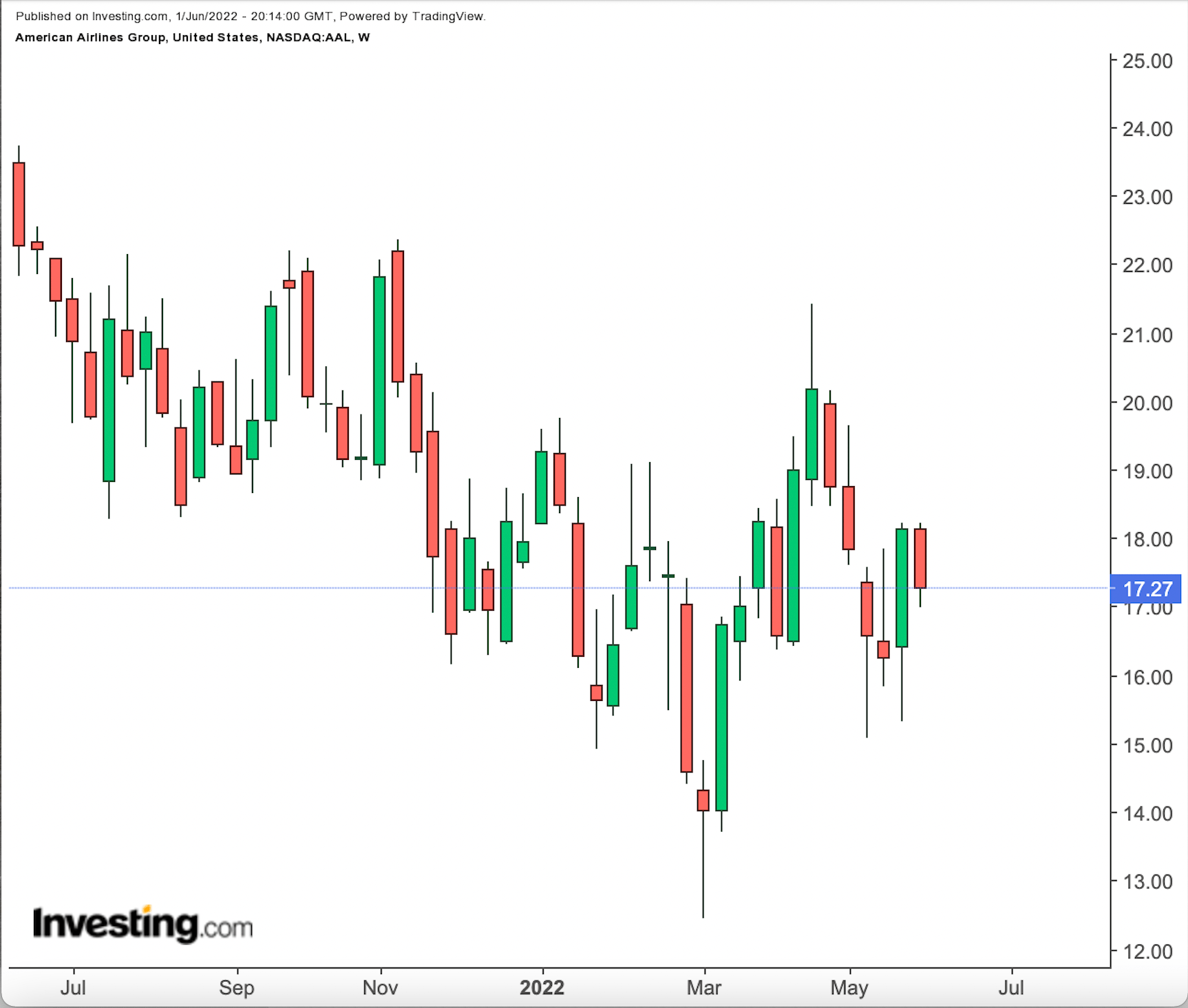

Shareholders of the Fort Worth, Texas-headquartered global airline operator have seen the value of their investment fall by 34.3% over the past 52 weeks and 4.6% so far this year.

American Airlines Weekly Chart.

American Airlines Weekly Chart.

Source: Investing.com

By comparison, the S&P 500 Airlines Industry Index has been flat in 2022 and other major airline shares, like United Airlines (NASDAQ:UAL) and Delta Airlines (NYSE:DAL) have gained 2.1% and 0.8% YTD, respectively.

On Mar. 8, AAL shares fell below $12.50, hitting a 52-week low. The stock’s 52-week range has been $12.44 – $26.04, while the market capitalization currently stands at $11.1 billion.

In terms of domestic market share in the US, American Airlines leads with close to 20% followed by Southwest Airlines (NYSE:LUV), Delta, and then United Airlines.

Analysts have been debating the impact of increasing fuel costs on airlines. However, most expect a strong travel season over the summer months, especially in the US.

Recent Metrics

American Airlines released Q1 figures Apr. 21. Revenue was $8.9 billion, with $7.8 billion coming from the passenger segment. Management noted that domestic business travel was on the rise.

During the quarter, adjusted loss per share declined to $2.32, compared with a loss of $4.32 per share in the same quarter last year. The airline ended the quarter with $15.5 billion of available liquidity.

On the results, CEO Robert Isom said:

“The demand environment is very strong, and as a result, we expect to be profitable in the second quarter based on our current fuel price assumptions.”

Based on current booking trends, the airline expects Q2 capacity to reach approximately 92% to 94% of what it was in pre-pandemic Q2 2019.

Prior to the release of the Q1 results, AAL stock was changing hands around $21. At the time of writing, it was trading at $17.10.

What To Expect From American Airlines Stock

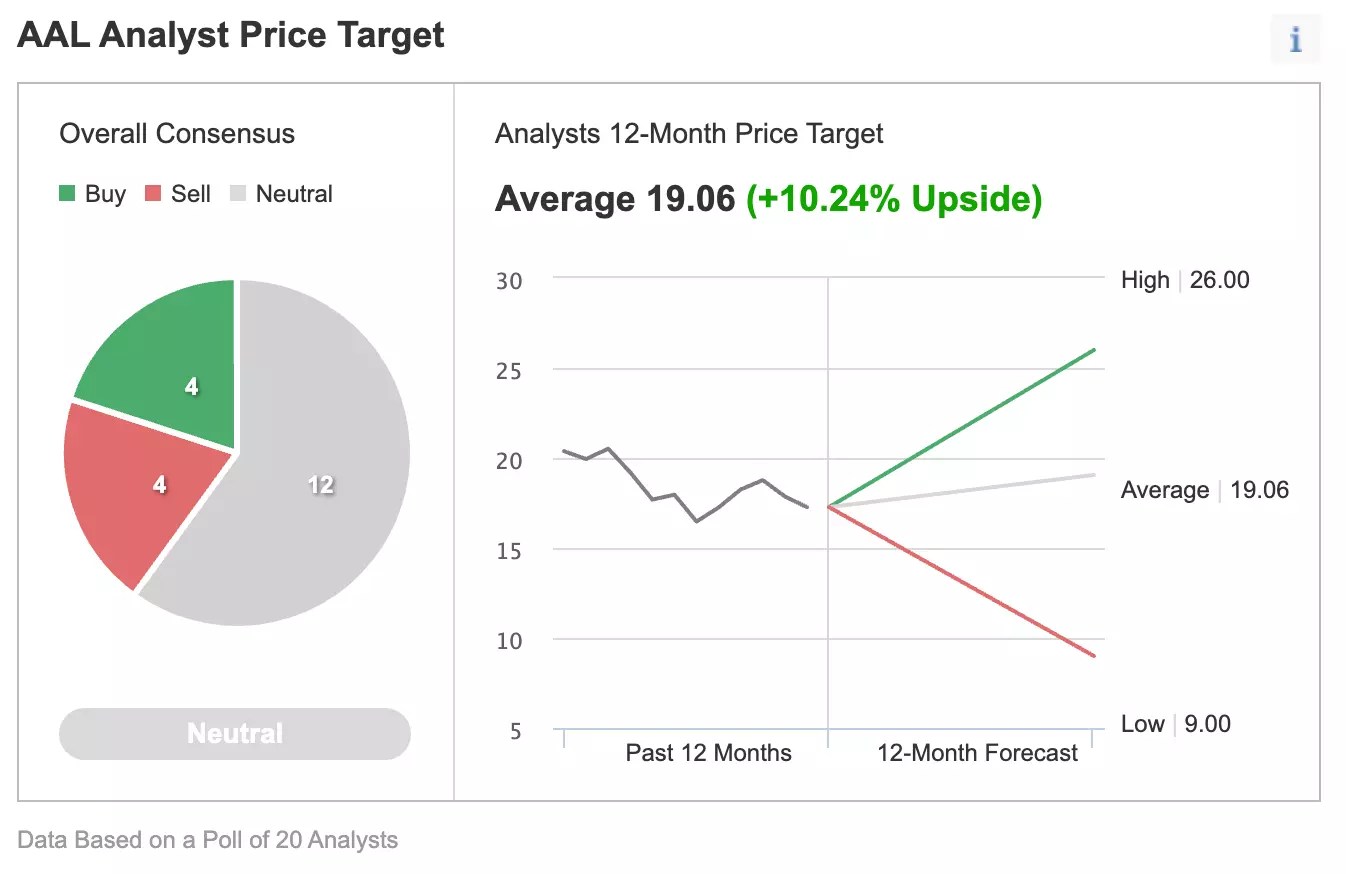

Among 20 analysts polled via Investing.com, AAL stock has a “neutral” rating, with an average 12-month price target of $19.06. Such a move would suggest an increase of more than 10% from the current price. The target range stands between $9 and $26.

Consensus Estimates of Analysts Polled By Investing.com.

Consensus Estimates of Analysts Polled By Investing.com.

Source: Investing.com

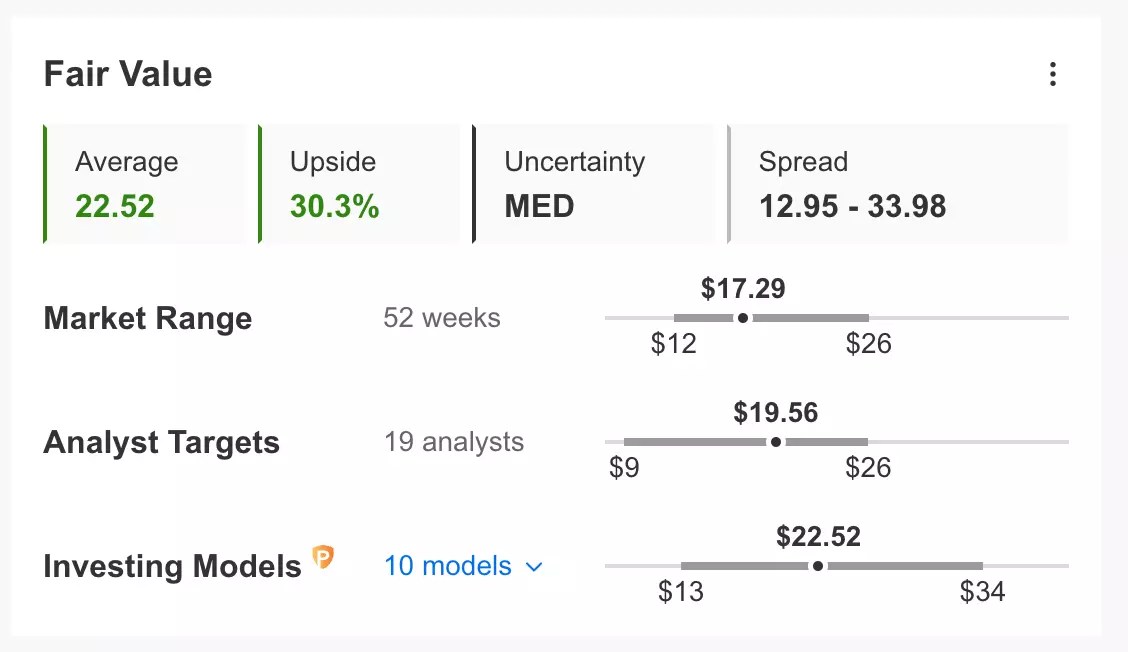

Similarly, according to a number of valuation models, such as P/E or P/S multiples or terminal values, the average fair value for AAL stock on InvestingPro stands at $22.52.

Valuation Models By InvestingPro.

Valuation Models By InvestingPro.

Source: InvestingPro

In other words, fundamental valuation suggests shares could increase more than 32%.

We can also look at AAL’s financial health as determined by ranking more than 100 factors against peers in the industrials sector.

For instance, in terms of cash flow, growth, and relative value, it scores 2 out of 5. Its overall score of 2 points is a fair performance ranking. However, these metrics understandably reflect the effect of COVID-19 on top and bottom-line numbers for the airline.

Our expectation is for AAL stock to build a base between $16.5 and $17.5 in the coming weeks. Afterwards, shares could potentially start a new leg up.

Adding AAL Stock To Portfolios

American Airlines bulls who are not concerned about short-term volatility could consider investing now. Their target price would be $19.06, as per the target provided by analysts.

Alternatively, investors could consider buying an exchange-traded fund (ETF) that has AAL stock as a holding. Examples include:

US Global Jets ETF (NYSE:JETS)

SonicShares™ Airlines, Hotels, Cruise Lines ETF (NYSE:TRYP)

Roundhill MEME ETF (NYSE:MEME)

SPDR® S&P Transportation ETF (NYSE:XTN)

VanEck Social Sentiment ETF (NYSE:BUZZ)

Finally, those who are experienced with options could also consider selling a cash-secured put option in AAL stock—a strategy we regularly cover. Such a bullish trade could especially appeal to those who want to receive premiums (from put selling) or to possibly own AAL shares for less than their current market price of $17.10.

Most option strategies are not suitable for all retail investors. Therefore, the following discussion on AAL stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Cash-Secured Puts On AAL

Price At Writing: $17.10

Let’s assume an investor wants to buy AAL stock, but does not want to pay the full price of $17.10 per share. Instead, the investor would prefer to buy the shares at a discount within the next several months.

One possibility would be to wait for AAL stock to fall further, which it might or might not do. The other possibility is to sell one contract of a cash-secured AAL put option.

So the trader would typically write an at-the-money (ATM) or an out-of-the-money (OTM) put option and simultaneously set aside enough cash to buy 100 shares of the stock.

Let’s assume the trader is putting in this trade until the option expiry date of Aug. 19. As the stock is $17.10 at the time of writing, an OTM put option would have a strike of $16.

The AAL Aug. 19 16-strike put option is currently offered at a price (or premium) of $1.45.

An option buyer would have to pay $1.45 X 100, or $145, in premium to the option seller. This premium amount belongs to the option seller no matter what happens in the future. It is also the seller’s maximum gain. The put option will stop trading on Friday, Aug. 19.

If the put option is in the money (meaning the market price of AAL stock is lower than the strike price of $16) any time before or at expiration on Aug. 19, this put option can be assigned. The seller would then be obligated to buy 100 shares of AAL stock at the put option’s strike price of $16 (i.e. at a total of $1,600).

The break-even point for our example is the strike price ($16) less the option premium received ($1.45), i.e., $14.55. This is the price at which the seller would start to incur a loss.

Bottom Line

Cash-secured put selling is a moderately more conservative strategy than buying shares of a company outright at the current market price. This can be a way to capitalize on the choppiness in AAL stock in the coming weeks.

Investors who end up owning AAL shares as a result of selling puts could further consider setting up covered calls to increase the potential returns on their shares. Thus, selling cash-secured puts on American Airlines could be regarded as the first step in stock ownership.

***

The current market makes it harder than ever to make the right decisions. Think about the challenges:

Inflation

Geopolitical turmoil

Disruptive technologies

Interest rate hikes

To handle them, you need good data, effective tools to sort through the data, and insights into what it all means. You need to take emotion out of investing and focus on the fundamentals.

For that, there’s InvestingPro+, with all the professional data and tools you need to make better investing decisions. Learn More »

Source: Investing.com