Tyre maker MRF Ltd appears to be on firm ground, with revenue growing at a stable pace and raw material prices declining. At first glance, investors may shy away from the stock, what with the company’s net profit falling by as much as 53% for the September quarter.

But as Angel Broking Ltd analyst Shareen Batatawala points out, “The September quarter’s profit looks understated in comparison to the year-ago period, because of adjustments pertaining to the change in depreciation norms by the company.” According to a number of analysts, adjusted for this change, net profit would have nearly quadrupled compared with the year-ago period.

On the revenue front, MRF reported 14.3% growth from the year-ago period to Rs.2,994 crore. In spite of challenging circumstances in the automotive industry, higher replacement market sales and exports culminated in a 21.8% growth in revenue for the full year ended September 2012.

Profit margins improved thanks to the drop in rubber prices. The price of rubber, which comprises nearly two-thirds of the cost of producing a tyre, was down 15% from a year ago and about 8% from the preceding quarter. As a percentage of sales, therefore, raw material costs dropped by a hefty 470 basis points (bps) from the year-ago period and 60 bps from the June quarter. Staff costs and other expenses were also contained. A basis point is 0.01%.

Consequently, MRF’s operating margin improved by 477 bps when compared with the year-before period, to 11.7%. Operating profit surged by 92.8% to Rs.349.5 crore. The balance sheet is in a healthy shape as well. MRF’s debt-to-equity ratio is around 0.3 with a debt-service coverage ratio (operating profit/interest plus principal repayment) of 8.9.

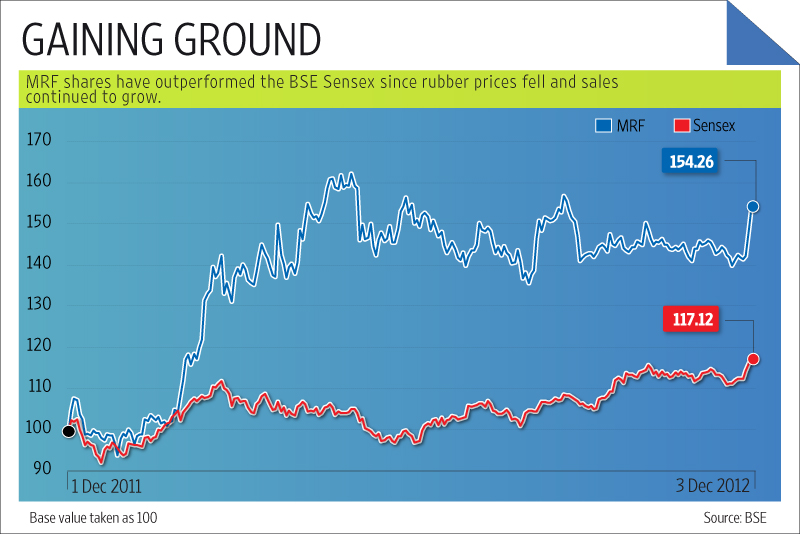

It’s not surprising then that MRF’s stock price has been northward bound since rubber prices started softening. It has outperformed the Sensex significantly, returning 60% since January. Despite the surge, the stock discounts one-year forward earnings by only seven times. If rubber prices remain subdued, the stock can continue to get re-rated; but the low valuations are also testimony to the fact that the company’s performance largely depends on the vagaries of rubber prices.

Source: livemint.com