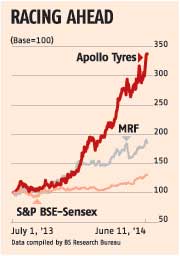

With rubber prices at five-year lows, stocks of tyre companies have been gainers over the past week. These gained on expectations that lower prices would boost margins and strong demand from replacement segment, which accounts for 60 per cent of sales, will make up for the lack of original equipment maker (OEM) demand and ensure volumes. After hitting a high of Rs 254 a kg a year ago, natural rubber prices have fallen 43 per cent to Rs 145 a kg. Also, no price cuts over two years despite a fall in demand and raw material prices have aided sector profits.

ICICI Securities analysts say with strong rubber production estimated in major producer countries and relatively sluggish global offtake, expect rubber prices to not increase significantly from current levels. All this is good news for tyre stocks that should see some of the gains flow through in the June quarter. Even for the automobile sector, except for steel prices, all other key raw materials, be it aluminium, lead or rubber, have seen a sequential decline in prices in the March quarter, with rubber prices touching a multi-year low. While replacement demand continues to be strong, analysts say a recovery in the OEM segment could come through in the second half of the current financial year, further boosting the fortunes of tyre companies.

Apollo Tyres

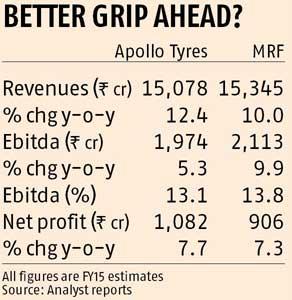

The company’s March quarter consolidated results were driven by the European business both on revenues (up 6.3 per cent year-on-year) and margin (up 256 basis points) fronts. While Indian operations, which account for 68 per cent of revenues, saw volume growth of six per cent, the European subsidiary registered growth of 13 per cent. In addition to the volume growth, a favourable exchange rate helped European revenues grow 45 per cent year-on-year. The strong margin show of Europe business more than compensated for the decline in domestic margins. Given the strong volume growth in Europe, the company is planning to set up a new facility in Eastern Europe at a cost of euro 500 million.

Analysts believe a pickup in OEM volumes in the domestic market is likely to happen in the second half of FY15, specially in truck tyres, two-thirds of Apollo’s revenues. Analysts at India Infoline Research say margins for the company are expected to expand, with stable raw material prices, coupled with increase in share of high-margin replacement market. Share of replacement market has increased by 200 basis points year-on-year to 76 per cent for March quarter. Of 26 analysts tracking the stock, most (77 per cent) are bullish on Apollo, with a consensus target of Rs 195. While there is little upside from the current levels of Rs 203, where the stock is trading at 9.6 times FY15 consolidated estimated earnings, any revival in auto fortunes could see a re-rating.

MRF

Despite slowing automobile sales, MRF managed to post a 13.5 per cent year-on-year increase in revenues for the March quarter largely driven by growth in the replacement market. This segment accounts for 70 per cent of revenues. While declining demand for tyres by auto makers is likely to put pressure in the near term, analysts expect the company to report revenue growth in the six-eight per cent range in the coming quarters largely driven by the replacement segment. The advantage for the company is it has a presence across the product chain from two-wheelers to commercial vehicles, with a market share of 25 per cent each. The key worry for MRF is the operating margins, down 278 basis points to 12.5 per cent, impacted by a rise in raw material (carbon black and tyre cord), employee and other expenses. Despite low rubber costs, higher expenses are likely to keep margins subdued over the next few quarters, believe analysts. At the current price, the stock is trading at 13 times its one-year forward earnings estimates. Of eight analysts tracking the stock, six have a buy and two a hold. Given consensus target price of Rs 24,443, there is little upside from current levels and investors are better off buying on dips.

– Business Standard