The Pakistan Stock Exchange (PSX) extended losses for a fifth session on Tuesday as the KSE-100 index endured a topsy-turvy session and closed in loss despite resumption of the International Monetary Fund (IMF) programme.

Late on Monday, the global lender approved the revival of the Extended Fund Facility (EFF) for Pakistan, paving the way for an inflow of $1.17 billion.

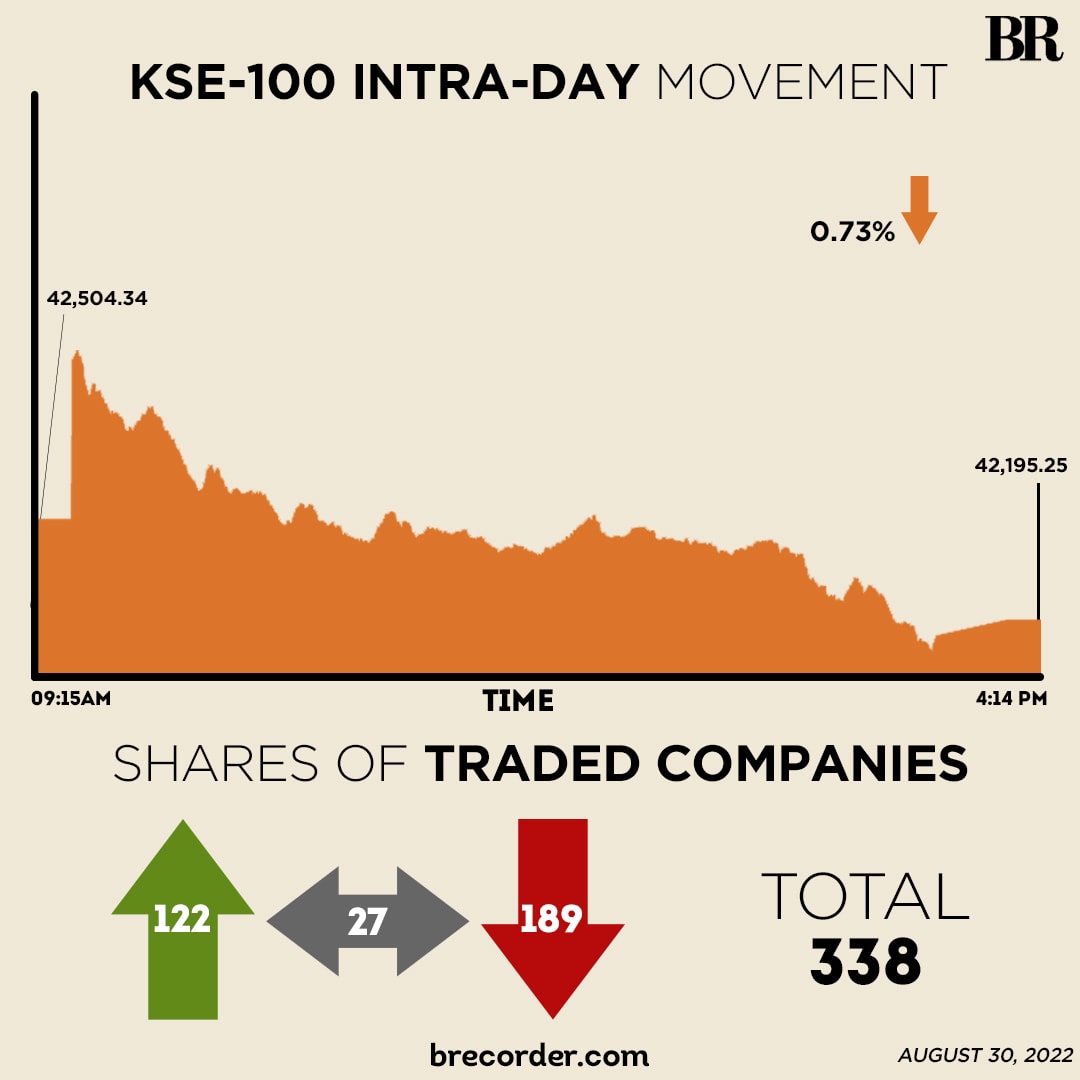

The market ended the day with a loss of 309.08 points or 0.73% at 42,195.26 level.

After over 700-point fall, KSE-100 recovers to end marginally negative

Investors weighed sentiment on nation-wide floods that are expected to cause a dent worth $10 billion to Pakistan’s economy, and resorted to offload their holdings.

‘Third’ of Pakistan under water as flood aid efforts gather pace

Buoyed by revival of IMF bailout programme, trading began on a positive note and the market posted an intra-day high of nearly 550 points in the initial hour. Selling pressure emerged at this point and the KSE-100 index began to decline. The sell-off erased all gains at the equity market and it ended on a negative note.

Heavyweight sectors automobile, cement, chemical, banks, fertiliser and oil closed with massive losses.

A report from Capital Stake cited that failing to sustain the gains made during the initial hours of the session, the PSX ended the day on Tuesday in red.

“Indices traded in red for most part of the day while volumes decreased from last close,” it said. “Rumours of an interest rate hike as well as the ongoing floods, dented investors’ confidence despite IMF’s approval of the release of a $1.1 billion loan tranche last night.”

A report from Topline Securities stated that Pakistan equities celebrated resumption of the EFF program by IMF as the KSE-100 index opened with a gain of 486 points.

“Buying interest was witnessed across the board in the market which assisted it to make an intraday high at 43,052 (+548 points; up 1.41%),” it said. “However, profit taking kicked in at the aforesaid level which pushed index towards intraday low at 42,106 (-398 points; down 0.94%) before eventually settled at 42,195 points for the day.

On the economic front, rupee appreciated Rs1.79 or 0.81% against the US Dollar on day-on-day basis ending to close at Rs220.12.

Rupee registers 0.82% gain following IMF programme revival

Sectors dragging the benchmark KSE-100 lower included banking (95.99 points), fertiliser (48.86 points) and cement (33.42 points).

Volume on the all-share index inched up to 237.7 million from 229.2 million on Monday. On the other hand, the value of shares traded ticked up to Rs7.32 billion from Rs7.28 billion recorded in the previous session.

K-Electric was the volume leader with 38.2 million shares, followed by WorldCall Telecom with 13.7 million shares and Unity Foods with 12.9 million shares.

Shares of 338 companies were traded on Tuesday, of which 122 registered an increase, 189 recorded a fall, and 27 remained unchanged.

Source: Brecorder

![[Geojit Comtrade] Daily report on Natural Rubber: December 4, 2012](https://img.globalrubbermarkets.com/2024/08/geojit-comtrade-daily-report-on-natural-rubber-december-4-2012.jpg?resize=120%2C86&ssl=1)