Ceat Ltd posted disappointing results for the June quarter. The shocker was the weak operating performance in spite of stable sales growth and lower rubber prices when compared with a year back.

The tyre maker’s performance took a beating as exports did not measure up to expected levels and costs rose. Although consolidated net revenue atRs.1,462.1 crore was 10% higher than a year back, exports dropped by three percentage points to 18% of total revenue. While the company sold a higher number of tyres, average realization fell by Rs.2 per kg on sales.

Softer rubber prices did not rev up profitability as costs rose on other fronts. Stiff competition led to higher advertising expenditure. Besides, the management said that other expenses also included higher provisioning for an outsourced manufacturing contract where negotiations are pending. Employee costs rose significantly too because of higher incentives. Not surprisingly, operating profit fell by about 15.5% to Rs.137.3 crore on a year-on-year comparison. Operating margin was 250 basis points lower at 9.4% while analysts expected it to be a tad higher than 10%.

The key positive in the quarterly results was a Rs.2 crore saving on interest costs from the year-ago period, as the company repaid debt. That said, consolidated net profit plummeted by 21% to Rs.51.6 crore, failing investor expectations.

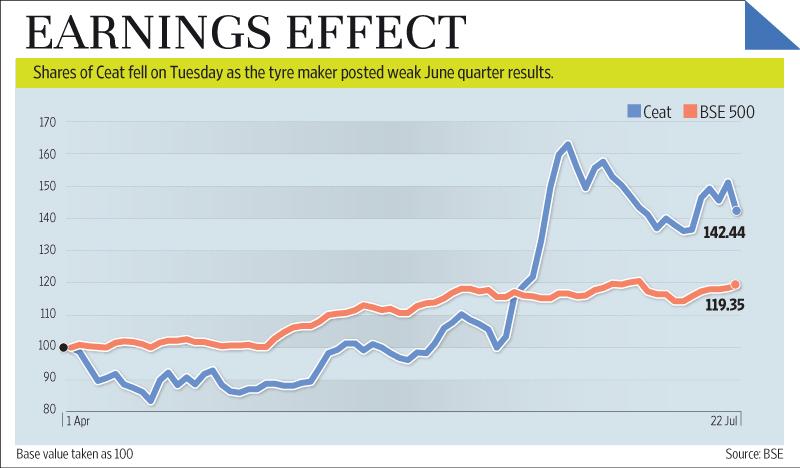

Given the poor June quarter performance and the fact that the stock has doubled in the last six months,Ceat is unlikely to reward investors from these levels. AMark-to-Marketarticle (Tyre firms’ valuations unlikely to improve further) about a month ago had highlighted that in the near term, given Ceat’s expansion plans, free cash flows could move into negative territory. The June quarter results have echoed the analysis on higher advertising expenses and peaking-out of growth rates in profit and valuation.

According to Surjit Arora, analyst at Prabhudas Lilladher Pvt. Ltd, “a 10% downgrade in earnings per share for fiscal 2015 is likely. Also, a meagre 5% compounded growth rate in earnings per share over the next two years leaves little hope for further rise in the stock price from current levels.”

Ceat’s shares trade at Rs.626.5 apiece discounting the one-year forward earnings per share by about 8 times. The stock fell 5.8% after the results were announced on Tuesday and could fall further.

– livemint.com