(Bloomberg) — The oil market is broken, according to star hedge fund manager Pierre Andurand.

The commodities trader known for his bullish calls opined on Twitter that futures can now move $10 lower a day “for no apparent reason.” The comments echo those of several market participants in recent weeks, including the Saudi Arabian Energy Minister Prince Abdulaziz bin Salman, who said extreme volatility and lack of liquidity has led to the futures market being increasingly disconnected from fundamentals.

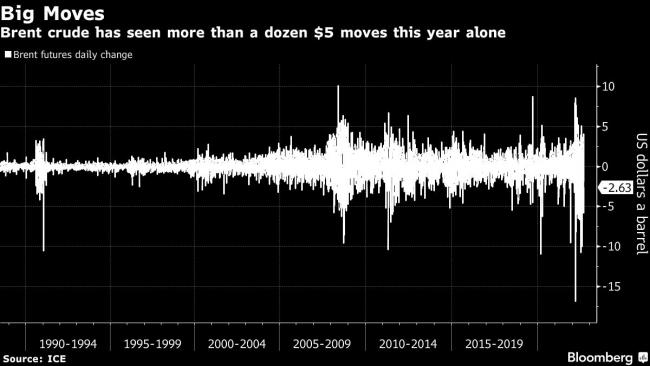

Oil prices have seen daily swings of more than $5 a barrel over a dozen times this year, particularly since Russia’s invasion of Ukraine. Such moves once would have been considered out of the ordinary. But open interest in oil futures is at a seven-year low, making bigger fluctuations more likely. Combined open interest on the four main Brent and WTI contracts fell below 4 billion barrels for the first time since June 2015 last week, Standard Chartered said in a note.

“The market has stopped even asking why we are down $5 in a session or why we are down $2.50 this morning,” said Scott Shelton, energy specialist at ICAP.

Andurand did not immediately respond to a request for further comment.

©2022 Bloomberg L.P.

Source: Investing.com