After a 31.4% slump year to date and a 33.1% slide from its Nov. 4, 2021 record close, is Tesla (NASDAQ:TSLA) a bargain?

Tesla does have a lot going for it. The company showed resilience to challenges in the second quarter and has the potential for a record-breaking second half, as it remains the leader in its space. Furthermore, Constellation Research Principal Analyst & Founder, Ray Wang argues that Tesla and others should replace Meta Platforms (NASDAQ:META) and Netflix (NASDAQ:NFLX) in big-tech leadership.

But according to my interpretation of the forces of supply and demand, it is not yet the time to buy Tesla, and it might even be a good idea to short the stock.

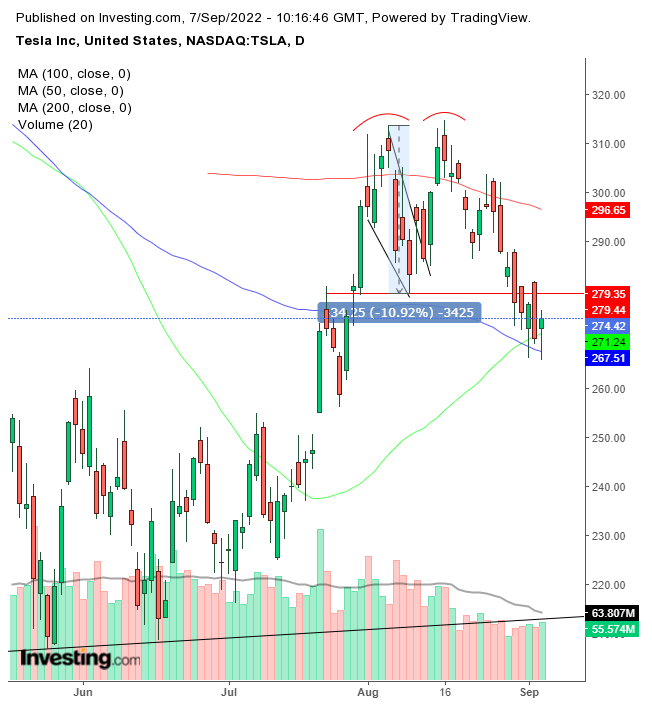

In August I outlined conflicting trends in the share price and predicted the short-term trend would continue before the long-term falling trend resumes. I was wrong. The bullish flag blew out. The tell-tale sign lacked volume support upon the flag’s breakout so the potential bullish pattern’s failure turned bearish.

Tesla Daily

Tesla Daily

The stock completed a small double top, reinforced by the 200 daily moving average (DMA). After a near 5%, 3-day penetration, presumed short-covering triggered a return move that confirmed the neckline’s resistance.

Note: I would prefer heavier volume on the breakout, and the 50 and 100 DMAs have been supporting the price for the past three sessions. Based on its $34.25 height, the pattern’s implied target is $245.10

Tesla Weekly

Tesla Weekly

Tesla has been ranging since December 2020. A downside breakout below its lows will complete a massive H&S top, implying a $200 downside breakout. Conversely, an upside breakout from the falling trendline since then could suggest a continued uptrend line. It is important to underscore that the range is presumed to disrupt an uptrend as long as there is no downside breakout.

Trading Strategies

Conservative traders should wait for investors to resolve the long-term trend.

Moderate traders would wait for the price to fall below the 50 and 100 DMAs before considering a short.

Aggressive traders could short at will.

Trading Sample – Aggressive Short

Entry: $280

Stop-Loss: $285

Risk: $5

Target: $250

Reward: $30

Risk-Reward Ratio: 1:6

Source: Investing.com