The world’s biggest grower and exporter of rubber, Thailand, wants to get a little smaller.

The government plans to encourage farmers to chop down 350,000 rubber trees a year to stem a 60% slide in natural rubber prices over the past three years, and to use the land to produce palm oil instead.

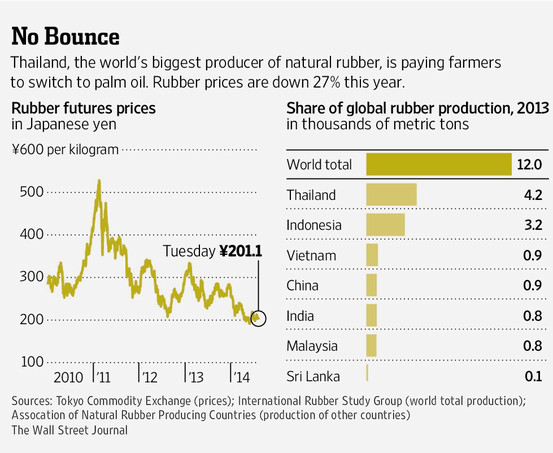

A global rubber glut, in part due to record-high output in Thailand in recent years, has sent prices plummeting from peaks reached in early 2011. Prices are down 27% this year.

The Thai government hopes farmers will cut 160,000 hectares of rubber trees—around 8% of the nation’s total rubber-growing area—to make room for oil palms, says Dumrong Jirasutas, director-general at the Department of Agriculture.

Thailand accounts for a third of the world’s supply of natural rubber, a market valued at around $25 billion a year. But as prices dove in recent years, the government bought rubber at above-market rates to support rural incomes. In a bid to reduce supply in the near term, it also compensated farmers for replacing old rubber trees with new ones, which usually need seven years before they can be tapped.

The plans failed to keep prices from falling as supply continued to surge. Domestic rubber production rose 10% last year. Now, Thailand’s agricultural authority says it will subsidize farmers’ planting of oil palm trees on some rubber plantations.

The government has regularly encouraged farmers to replace older rubber trees with new ones, but it has rarely urged farmers to switch to other crops. Its doing so underscores the urgency it faces in supporting the industry, which generated an average $9.3 billion a year in exports from 2010 through 2013.

The last time the Thai government advocated a change in crop was about a decade ago, said Pongsak Kerdvongbundit, managing director at Von Bundit Co., one of Thailand’s biggest rubber exporters.

“Many farmers have already stopped tapping rubber trees as the returns are poor. Palm oil will provide better returns,” he said.

An oil palm tree can be harvested within three or four years of planting, making for a quicker return than from a rubber tree. Palm oil is a key edible vegetable oil in many countries, and can also be used to produce biodiesel.

The Thai government this month unveiled a plan to offer farmers 21,000 baht ($655) for every 1,600 square meters of rubber trees they chopped down. That is an increase of more than 30% from the offer of 16,000 baht in place since 2011.

Analysts said the move will support global rubber prices to some degree, adding to an existing decline in Thailand’s domestic production this year.

“No single factor alone will push up prices,” said Gu Jiong, an analyst at Tokyo-based commodities brokerage Yutaka Shoji Co. 8747.TO -1.28% The government’s move shows it is “not willing to let prices fall any further,” which is a confidence booster, he said.

Commerzbank CBK.XE +2.40% said in a recent note that the Thai measures could bring the global rubber market “back into equilibrium.”

– WSJ