Forecast to 2020, the global SBR market transaction value will reach $ 23 billion (141.5 billion yuan). SBR (styrene butadiene rubber- SBR) increasing demand for tires in the manufacture of automobile demand remained strong under the circumstances, is expected to grow to support the SBR will be synchronized global industry growth.

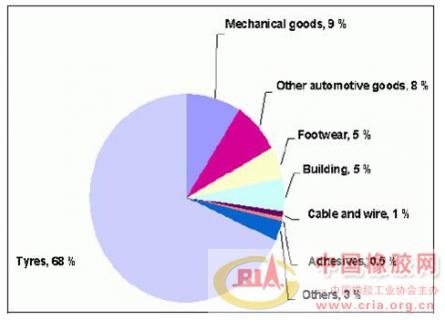

SBR Tire is the largest single application segment market share reached 73.5% in 2013 (2010 was 68%), the share of global consumption of footwear in about 5%, but is expected to gradually witness the SBR a significant increase. Furthermore, changing the price of natural rubber synthetic rubber such as to create an opportunity cross SBR.

Realization tire labeling regulations in the EU, Japan and South Korea implemented, manufacturing high-end tires prerequisites “green tire”, is expected to continue to increase S-SBR demand.

EU regulations mandatory for all producers on the label tire wet grip and rolling resistance. According to the agency study, some SBR manufacturers, such as Lanxess, tire manufacturers have to meet the growing demand, the conversion from the E-SBR plant for S-SBR production.

Global SBR market in 2013 was 5,122,400 tons, from 2014 to 2020 is expected at 6.1% CAGR.

Asia-Pacific region is the largest consumer of SBR, 2013, more than 46 percent of global demand. Especially in China’s growing auto industry, India and Japan are expected to boost the market which is expected to drive greater demand for styrene-butadiene rubber tires forecast period in. In addition, China and India are expected to implement the provisions of the EU tire labeling legislation and regulations, to 2015, is expected to be in the near future, S-SBR in sales will have a more positive impact.

Europe is the second largest consumer of SBR, 2013 as the consumer more than 10 million tons. EU labeling regulations came into effect from the beginning of 2012, is expected to increase demand for S-SBR in the forecast period. Germany, Italy and France are expected to tire production increased.

The global market is relatively fragmented, former 10 companies account for less than 65% market share, the major company has focused on the integration of resources to offset the impact of rising raw material prices variable. Some companies Lanxess chemicals, Sinopec and PetroChina is the E-SBR and S-SBR market players.

Translated by Google Translator from http://news.cria.org.cn/4/22840.html