AKRON (Sept. 9, 2014) — The pecking order among the world’s largest tire makers changed very little last year — Bridgestone Corp. claimed top honors for the sixth straight year ahead of Group Michelin, Goodyear and Continental A.G.

The differentiating factor? Variances in the exchange rates of the major currencies vs. the U.S. dollar played a measurable role in the absolute numbers.

This was reflected, for instance, in the estimated value of the global market, which declined marginally from 2012 to $187 billion, and in the seeming incongruous swings in the dollar-denominated sales for various manufacturers.

For example, the translated sales value in dollars for the Japanese-based companies was less this year than in the 2013 rankings despite double-digit growth in Japanese yen for most of them.

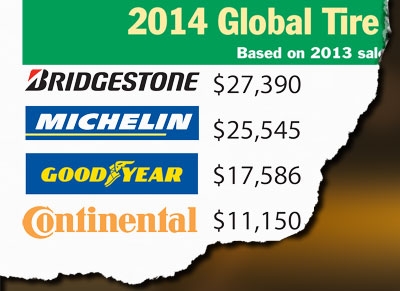

As for the ranking itself, Bridgestone maintained its spot at the top of the Global Top 75 with tire-related sales last year of $27.4 billion. Michelin was No. 2 again, with $25.5 billion, ahead of No. 3 Goodyear at $17.6 billion and No. 4 Continental A.G. at $11.2 billion.

Bridgestone’s position at the top is solidified by two minority holdings: a 43-percent ownership stake in Turkey’s BRISA/Bridgestone-Sabanci Tire Mfg. (No. 39 with 2013 sales of $784 million) and a 15-percent stake in Finland’s Nokian Tyres P.L.C. (No. 19 with $1.82 billion in sales).

Pirelli & C. S.p.A. regained the No. 5 spot ahead of Sumitomo Rubber Industries Ltd., with South Korea’s Hankook Tire Co. Ltd., Japan’s Yokohama Rubber Co. Ltd., Taiwan’s Maxxis International/Cheng Shin Rubber Industrial Co. Ltd. and China’s Zhongce Rubber Group Co. Ltd. making up the Top 10.

Collectively, the top 10 tire companies accounted for nearly 63 percent of the world’s tire sales last year, based on Tire Business’ numbers, down a couple of percentage points from a year ago, reflecting growth in the number of second-tier tire companies and their expanding revenues.

Tire Business subscribers can view the entire Top 75 list on pages 15-16 of the Sept. 1 issue.

Giti Tire Pte. Ltd., the predominantly Chinese tire maker based in Singapore, moved up to No. 11, based on the first-time incorporation of sales revenue from the company’s P.T. Gajah Tunggal Tbk. affiliate in Indonesia, which boosted Giti’s annual sales volume by about $1 billion to $3.76 billion.

Giti owns a 49.7-percent stake in Gajah Tunggal but has considerable sway over the Indonesian firm’s operations. Michelin also owns a 10-percent share of Gajah Tunggal and obtains tires from the firm in an off-take arrangement.

There were no significant mergers/acquisitions during the past year that affected the rankings, following the failure of Apollo Tyres Ltd. and Cooper Tire & Rubber Co. to complete their planned merger.

Transactions that could affect the rankings next year include:

- Sumitomo Rubber’s acquisition of the Dunlop-related assets in Africa/Middle East from Apollo Tyres; revenue related to this deal is estimated at $400 million a year.

- Titan International’s acquisition of Voltyre-Prom, the off-road tire maker in Volgograd, Russia, from J.S.C. Cordiant; annual sales are in the $200 million range.

- Double Coin Holdings recently acquired fellow Chinese tire maker Xinjiang Kunlun Tyre Co. Ltd., which reported 2013 sales of $244 million.

- In addition, Goodyear has shut its farm tire plant in Amiens, France, and has declared its intention to phase out of its farm tire business in Europea/Middle East.

Tire Business ranks tire makers based on their revenue from the sale of tires they’ve manufactured, excluding sales from non-tire products, such as auto-service-related revenue at company-owned retail stores, sales of steel cord, synthetic rubber or carbon black to third parties, etc.

Bridgestone, Michelin and Continental, for example, report hundreds of millions of dollars in revenue from their respective captive retail networks.

The U.S. dollar-denominated sales figures are based on average annual currency exchange figures, in order to avoid unusually high or low exchange rates at year-end.

New to the rankings this year are:

- Shandong Deruibo Tire Co. Ltd. of Guangrao, Shandong Province, China, No. 35 with sales of $991.5 million;

- Shandong Hengyu Technology Group of Dongying City, China, No. 43 with sales of $623 million;

- Shandong Taishan Tyre Co. Ltd. of Faicheng, China, No. 65 with sales of $211.3 million;

- Shandong Bayi Tyre Manufacture Co. Ltd. of Zaozhuang, China, No. 66 with sales of $200.9 million; and

- Magna Tyres Group of Waalijk, Netherlands, No. 73 with sales of $120 million.

Dropping out of the ranking were:

- Italy’s Marangoni S.p.A., which exited the new tire manufacturing business in mid-2013 and closed its sole factory in Italy;

- Maine Industrial Tire Tire L.L.C., which was acquired in late 2012 by Trelleborg Wheel Systems S.p.A.; and

- Thailand’s Inoue Rubber (Thailand) Co. Ltd., China’s Guangzhou Pearl River Rubber Tyre Ltd. and Pakistan’s General Tyre & Rubber Co. of Pakistan Ltd., all of which were displaced by new companies with larger sales volumes.

There are 29 Chinese companies in the 2014 ranking — including five among the top 20 — along with 10 from India, five each from the U.S. and Taiwan, four from Japan, three from South Korea, two each from Italy, Indonesia, Russia, Thailand and Turkey and one each from Argentina, Belarus, Czech Republic, Finland, France, Germany, Iran, Netherlands and Vietnam.

The average pre-tax operating profit for 20 leading publicly held companies jumped two percentage points from 2012 to 12.5 percent, the second straight year the average has increased by such a margin.

The average net income ratio for the group of 20 was 5 percent — on par with the 2012 average.

The most profitable companies in fiscal 2013, based on the operating ratio, were Nokian Tyres P.L.C. at 25.3 percent; Gajah Tunggal at 18.4 percent; Bridgestone’s Tire Division at 18.3 percent; and Maxxis International Inc. at 17.3 percent.

None of the 20 companies profiled in the financial results summary was in the red in fiscal 2013.

Nokian achieved the highest sales per employee at $484,388, ahead of Toyo’s 368,179, Hankook’s $365,121 and Nexen Tire’s $336,896.

– Tire Business