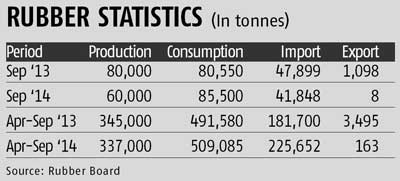

A fall in monthly rubber output since June is causing concern to observers. Production in September fell 25 per cent to 60,000 tonnes, compared to 80,000 tonnes in the same month last year. Total stock at September-end was 200,000 tonnes, against 223,000 tonnes earlier.

Experts say the negative output trend indicates a shift in attitude from growers, owing to a continuously sliding price, The local price is Rs 120 a kg, a level at which a majority of small and medium farmers have stopped tapping rubber trees, as this isn’t viable enough to nurse the plantations.

“This is a serious situation,” says N Radhakrishnan, former president, Cochin Rubber Merchants Association. Since industries have to use rubber, it would mean a further rise in imports. “The price should be at least Rs 170/kg. Only then can we continue with tapping,” says Binu John, a Kottayam-based grower.

He said the high cost of labour is a serious issue. And, with the fall in prices, aging trees are not being replaced with fresh plants in recent years.

The Rubber Board says consumption in September was 85,500 tonnes, compared to 80,550 tonnes in the same month of last week. With production dipping and consumption rising, the gap is being met through imports — prices are even lower in global markets than here.

During April–September, the first six months of the current financial year, 225,652 tonnes were brought in as against 181,700 tonnes in the same period of 2013-14, a rise of 24 per cent. More import is likely. The SMR grade is available at Rs 88/kg abroad, against Rs 120/kg in India. So, even after paying a 20 per cent import duty, it is still much cheaper than buying at home, a further loss of markets for home growers.

– business-standard.com