NVDA

+3.66%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

INTC

+2.25%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

MU

+3.73%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

SSNLF

0.00%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Nvidia’s stock has staged a powerful rebound over the past month on hopes that the worst is over for chipmakers

NVDA stock is also benefiting from the company’s release of two AI-powered gaming chips

Despite some bullish comments from some analysts, I recommend playing this trade with caution due to earnings vulnerability

A string of warnings on semiconductor demand from some of the industry’s biggest players, like Micron Technology Inc (NASDAQ:MU). and Samsung Electronics (OTC:SSNLF), doesn’t make a compelling case to buy chip stocks.

In fact, analysts are slashing earnings forecasts for these tech darlings at the fastest pace since 2008 amid the increasing risk of a recession and a clear sign that demand from these chips is falling fast.

Investors may see further evidence of this trend when Nvidia (NASDAQ:NVDA) reports its third-quarter earnings on Wednesday after the market close. Given the industry trend, I expect it will be another weak report from the chipmaker.

Intel Corp (NASDAQ:INTC) and other companies that depend on PC sales have reported sharp declines in demand for their products, and it is highly unlikely that NVDA will escape this weakness.

Nvidia’s graphics chips are a staple of high-end PCs and are used to produce a realistic gaming experience. Most of the major gaming companies have reported falling sales or weaker outlooks this year.

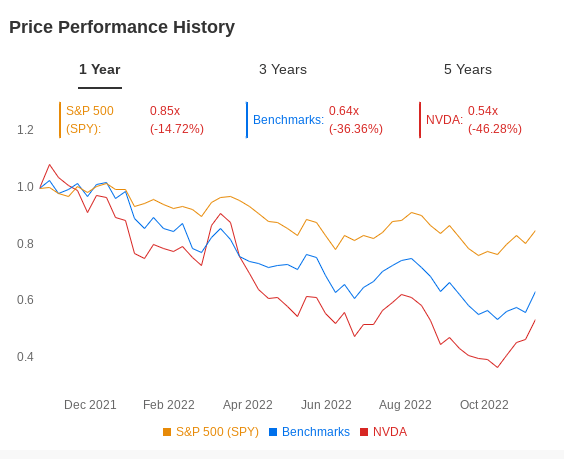

NVDA Price Performance per InvestingPro+

NVDA Price Performance per InvestingPro+

Source: InvestingPro+

Drastic Cut in EPS Forecast

Another hit that Nvidia is likely to sustain is from the plunging demand for its add-in cards, which are a key part of systems used by currency miners. With the crypto industry in a crisis mode, this stream of revenue makes the company’s earnings more vulnerable.

Due to these vulnerabilities, analysts have drastically reduced forecasts for Nvidia’s earnings per share. According to InvestingPro+ data, the company has reduced this quarter’s expectations by 41.7% for EPS – from $1.21 per share to $0.71 per share – over the last 12 months.

NVDA Earnings Expectations per InvestingPro+

NVDA Earnings Expectations per InvestingPro+

Source: InvestingPro+

Despite this tough operating environment, when costs are rising across the board and demand is falling, NVDA’s stock has staged a powerful rebound over the past month. It’s up more than 40%, cutting its losses for the year. The stock closed on Friday at $163.27, showing a 44% decline for 2022.

That upside momentum is partly a reflection of the improving sentiment in the market. Signs are emerging that the U.S. Federal Reserve interest-rate hikes, which have badly damaged the appeal of investing in such growth stocks as Nvidia, are near peaking.

Another reason some analysts favor NVDA again is the company’s recent introduction of new gaming products, which they say will fuel strong demand from gamers, overcoming overall weakness in the PC sector.

Nvidia in September unveiled new flagship gaming chips that use artificial intelligence to enhance graphics. Its data-center business, which sells chips used in AI, has also boomed in recent years.

JPMorgan in a recent note said Nvidia’s new gaming products were set to be strong demand catalysts into 2023. The note adds:

“NVIDIA is well-positioned to continue to benefit from major secular trends in AI, high-performance computing, gaming, and autonomous vehicles, in our view.

“Bottom line: NVIDIA continues to be 1-2 steps ahead of its competitors from silicon/systems, software, and ecosystem adoption.”

Despite these bullish sentiments from some top industry analysts, I still recommend playing this trade with caution.

Recessionary cycles are particularly harsh on chipmakers, and it’s hard to predict when they will end. Furthermore, these producers tend to quickly build up inventories during such periods and then they take years to clear them out, thus further pressuring their earnings.

The global PC market saw its steepest decline on record in the third quarter, according to Gartner, as economic uncertainty and a glut of unsold inventory dented shipments for the fourth straight quarter.

Beyond the cyclical downturn, the U.S.-China political rivalry is making things more unpredictable for chipmakers. Washington has recently unveiled new restrictions on sales to Chinese tech companies that could hurt companies like Nvidia.

Bottom Line

There is no doubt that Nvidia is one of the best-positioned chip companies to capture demand from high-growth areas of the market, like gaming and AI, due to its strong product portfolio. But the environment for chipmakers is likely to get worse before it gets better, in my view. NVDA’s earnings report will likely prove that point.

Disclosure: At the time of writing, the author did not own stocks mentioned in this article. The views expressed in this article are solely the author’s opinion and should not be taken as investment advice.

***

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest-growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »

Source: Investing.com