A rise in the prices of natural rubber has prompted tyre manufacturers to consider replacing the commodity with synthetic products.

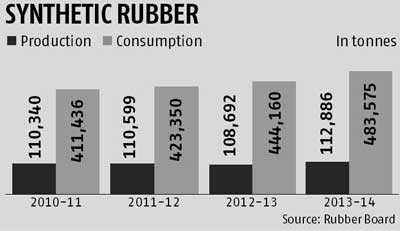

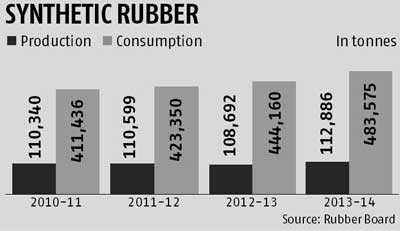

“Until last week, prices of both synthetic rubber and natural rubber were moving hand-in-hand. It was only last week that natural rubber prices started moving up without a proportionate increase in synthetic rubber prices. If the trend continues, we might think of replacing natural rubber with synthetic rubber,” said a senior official at one of the largest tyre manufacturing companies in the country. In India, the ratio between the consumption of natural rubber and that of its synthetic counterpart stands at 73:27, against the global ratio of 44:56, showing over-dependence on natural rubber in the country. With a proposed change in the consumption pattern, the ratio might shift in favour of synthetic rubber.

“Yes, replacement of natural rubber with synthetic rubber is possible up to a point, as it adds to the cost advantage. Therefore, the tyre sector might think of using more synthetic rubber if natural rubber prices continue their upward move,” said M F Vohra, chairman and managing director of Zenith Industrial Rubber Products.

“The use of synthetic rubber can be capped with the quality of products. If you want more tensile and strength in tyre, synthetic rubber can be a better choice,” he added.

Subba Rao Amarthaluru, chief financial officer of CEAT and RPG Group, said, “Some countries are looking at controlling the supply of natural rubber in the hope of a rise in prices. Indonesia and Thailand are among them. Indian rubber prices are hovering at about Rs 125/kg. We are expecting the price to rise because the supply has been cut 10 per cent.”

Currently, styrene butadiene rubber is being traded at $1,850 a tonne, against $1,650 a tonne in the case of ribbed smoked sheet, a raw material for rubber. Prices of these commodities have moved in tandem with the price of crude oil. According to a recent study, raw material costs account for 65-70 of the tyre sector’s turnover. As raw materials, tyre manufacturers primarily use natural rubber, synthetic rubber, carbon black and rubber chemical.

In 2012-13, the tyre sector accounted for Rs 35,000 crore of the rubber sector’s overall turnover of Rs 60,000 crore. B K Bansal, senior vice-president (finance) of Balkrishna Tyres, however, says he doesn’t favour replacing natural rubber with synthetic rubber. “The replacement comes at the cost of quality, which most reputed companies will not like,” he said.

Data compiled by the Rubber Board showed India’s natural rubber production stood at 60,000 tonnes in September this year, against 80,000 tonnes a year earlier. Meanwhile, consumption of natural rubber increased 0.6 per cent to 85,500 tonnes from 85,000 tonnes in September 2013.

Sources said in September, the shortage of natural rubber stood at 25,500 tonnes, with India importing 41,848 tonnes. During the April-September 2014, imports have risen 24 per cent to 225,625 tonnes compared to the year-ago period.

A rise in the prices of natural rubber has prompted tyre manufacturers to consider replacing the commodity with synthetic products.

“Until last week, prices of both synthetic rubber and natural rubber were moving hand-in-hand. It was only last week that natural rubber prices started moving up without a proportionate increase in synthetic rubber prices. If the trend continues, we might think of replacing natural rubber with synthetic rubber,” said a senior official at one of the largest tyre manufacturing companies in the country. In India, the ratio between the consumption of natural rubber and that of its synthetic counterpart stands at 73:27, against the global ratio of 44:56, showing over-dependence on natural rubber in the country. With a proposed change in the consumption pattern, the ratio might shift in favour of synthetic rubber.

“Yes, replacement of natural rubber with synthetic rubber is possible up to a point, as it adds to the cost advantage. Therefore, the tyre sector might think of using more synthetic rubber if natural rubber prices continue their upward move,” said M F Vohra, chairman and managing director of Zenith Industrial Rubber Products.

“The use of synthetic rubber can be capped with the quality of products. If you want more tensile and strength in tyre, synthetic rubber can be a better choice,” he added.

Subba Rao Amarthaluru, chief financial officer of CEAT and RPG Group, said, “Some countries are looking at controlling the supply of natural rubber in the hope of a rise in prices. Indonesia and Thailand are among them. Indian rubber prices are hovering at about Rs 125/kg. We are expecting the price to rise because the supply has been cut 10 per cent.”

Currently, styrene butadiene rubber is being traded at $1,850 a tonne, against $1,650 a tonne in the case of ribbed smoked sheet, a raw material for rubber. Prices of these commodities have moved in tandem with the price of crude oil. According to a recent study, raw material costs account for 65-70 of the tyre sector’s turnover. As raw materials, tyre manufacturers primarily use natural rubber, synthetic rubber, carbon black and rubber chemical.

In 2012-13, the tyre sector accounted for Rs 35,000 crore of the rubber sector’s overall turnover of Rs 60,000 crore. B K Bansal, senior vice-president (finance) of Balkrishna Tyres, however, says he doesn’t favour replacing natural rubber with synthetic rubber. “The replacement comes at the cost of quality, which most reputed companies will not like,” he said.

Data compiled by the Rubber Board showed India’s natural rubber production stood at 60,000 tonnes in September this year, against 80,000 tonnes a year earlier. Meanwhile, consumption of natural rubber increased 0.6 per cent to 85,500 tonnes from 85,000 tonnes in September 2013.

Sources said in September, the shortage of natural rubber stood at 25,500 tonnes, with India importing 41,848 tonnes. During the April-September 2014, imports have risen 24 per cent to 225,625 tonnes compared to the year-ago period.