Not all of the world’s tire makers are just spinning their wheels.

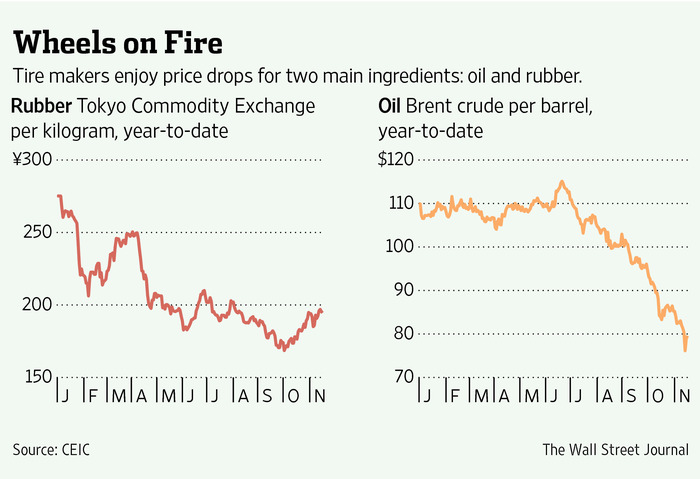

The global tire industry is getting a push from the rapid fall in the international prices of its two key raw materials. Rubber has plunged roughly 30% this year, mostly as the product from too many rubber trees planted years ago now enters the market. Traders may also fear that key producer Thailand will sell down the massive stockpile it earlier built up.

The second big input into tires is crude oil, used to make an ingredient called carbon black and other synthetic materials. Brent fell 29% this year, too, on the back of roaring supply and tepid demand.

The problem is that is cold solace to tire multinationals such as Bridgestone , Michelin and Goodyear. The low commodity prices also partly reflect weak demand outlook for autos in China, Japan and Europe.

Yet there is a place where tire makers have something to sell: India. After two years of slowdown, India’s industries are reviving and using more trucks to transport goods. Sales of medium and heavy trucks jumped 20% year-over-year between August and October. These matter more than cars, since 70% of all tires in India are sold to trucks, says Credit Suisse ’s Jatin Chawla.

The confluence of falling costs and potentially rising sales is a bonanza for Apollo Tyres , the largest Mumbai-listed tire maker by sales. It generates about 70% of its sales in India, the rest in Europe and South Africa.

Cheaper rubber and crude already helped Apollo’s operating profit margin inch up 2.4 percentage points in the September quarter from the year before. And more help is coming as these materials keep weakening. Every 1% fall in rubber boosts net profit by 1.8%, and crude by more than 2%, says Mr. Chawla. It also helps there are only a few tire makers in India, meaning margins won’t be easily competed away.

Investors may remember Apollo as the firm that botched its bid for New York-listedCooper Tire and Rubber last year. That misjudgment appears to be in the past and with India’s economy stabilizing, the company has reason to focus at home.

Apollo’s shares have more than doubled this year alongside enthusiasm for India. Though at 10.1 times forward earnings, they are more expensive than global makers like Bridgestone, they remain cheaper than domestic rival MRF’s 12.6 times and in line with smaller peer CEAT. At that valuation, Apollo has an open road ahead.

Source: WSJ