TFMBMc1

-5.98%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

(Bloomberg) — European natural gas prices declined as temperatures are forecast to return to more normal levels within the next few days.

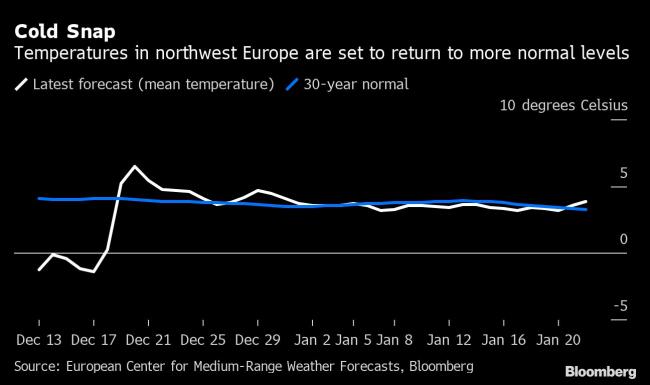

Benchmark futures fell as much as 4% on Wednesday after edging higher a day earlier. A cold blast that’s gripped northern Europe over the first half of December is forecast to snap by next week, with temperatures seen hovering near the 30-year norm over the next month.

Wind power generation is also expected to pick up next week, easing pressure on natural gas feedstock to produce electricity.

Near-record imports of liquefied natural gas into northwest Europe and the UK have helped limit the impact of higher consumption for heating. Gas storage facilities remain about 87% full, but have been falling more steeply than usual.

While gas costs have eased so far this week, prices remain almost four times higher than the average for this time of year.

European Union nations made another attempt on Tuesday at reaching a deal to cap prices as they look to curb high energy bills that have hammered the economy and boosted inflation. But they ultimately decided to postpone a decision after a group of nations led by Germany called for more scrutiny of the controversial measure.

“The indecision of the EU on the regulatory side does not help the market to clear its view,” EnergyScan, the market analysis platform of Engie SA, said in a note.

Dutch front-month futures were trading 2.8% lower at €133.7 per megawatt-hour at 10:17 a.m. Amsterdam time. Price volatility on the European benchmark has fallen over the past month. The UK equivalent fell 1.9%.

©2022 Bloomberg L.P.

Source: Investing.com