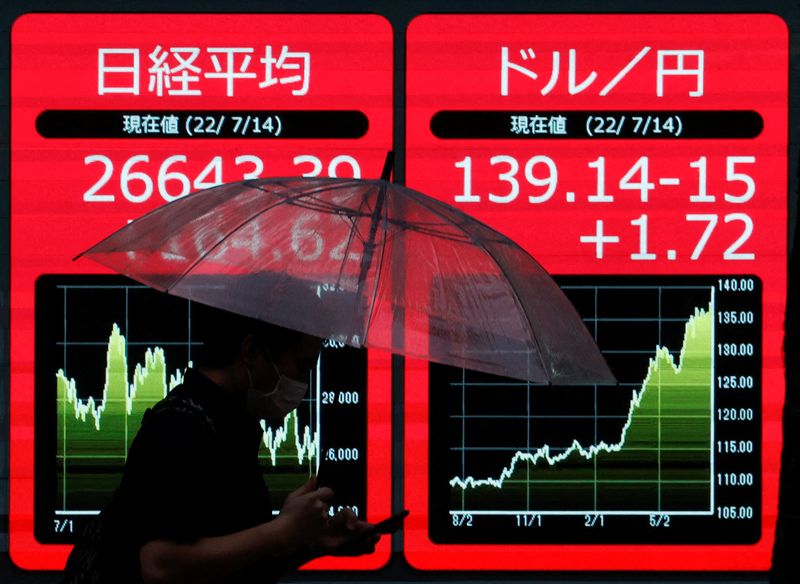

© Reuters. FILE PHOTO: A man holding an umbrella is silhouetted as he walks in front of an electric monitor displaying the Japanese yen exchange rate against the U.S. dollar and Nikkei share average in Tokyo, Japan July 14, 2022 REUTERS/Issei Kato

NDX

-1.48%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US500

-0.41%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

SSE

+1.41%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

LCO

-0.27%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US10Y…

-0.73%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

STOXX

+0.14%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

By Ankur Banerjee and Naomi Rovnick

SINGAPORE, LONDON (Reuters) -Global equities traded sideways on Wednesday after China took further steps towards reopening its COVID-battered economy, with hopes for an economic rebound tempered by near-term worries over rising cases.

MSCI’s broadest index of global stocks was was flat as investors stayed on the sidelines at the end of a brutal year for equities. The global gauge is on course to end 2022 19.5% down, in its worse performance since the financial crisis of 2008, having buckled under the pressure of red-hot inflation in Western economies, major central banks hiking intrest rates, and China’s stringent zero-COVID policies.

European stocks, which are strongly influenced by developments in China, were steady, with the broad STOXX 600 now on course for its worst year since 2018.

Chinese stocks were mixed, with the mainland’s SSE (LON:SSE) Composite ending the session 0.4% lower while the Hong Kong stock market rose 1.6%. China’s government announced on Monday it would stop requiring inbound travellers to go into quarantine starting from Jan. 8.

A faster-than-anticipated peak of infections in mainland China has stoked expectations that a quick economic recovery is on the cards. But a surge in cases that is straining resources and putting hospitals under pressure has curbed investor enthusiasm.

Iris Pang, ING’s chief economist for Greater China, said the relaxation of travel rules could “reduce the level of worries [about] Covid among the general public,” in turn increasing “mobility within the country” and consumer spending.

Strategists at JP Morgan warned, in a research note, of a “likely infection peak” during China’s Lunar New Year holiday in January, meaning “limited holiday consumption upside.” But this, they argued, could be followed by a “cyclical upturn after nearly three years of on and off restrictions.”

In fixed income, euro zone debt markets remained under pressure following hawkish rhetoric from the European Central Bank at its December monetary policy meeting.

The two-year German government bond yield, which tracks interest rate expectations, hovered just below a 14 year high reached in the previous session, at 2.66%.

The 10-year German yield, a benchmark for euro zone borrowing costs, inched 3 basis points lower to 2.481%, trading around levels last seen regularly during the European debt crisis of 2011.

The yield on 10-year U.S. Treasury notes was down 2 basis points to 3.837%, hovering around the five-week high of 3.862% it touched in the previous session.

The two-year U.S. Treasury yield was down 3 basis points at 4.429%.

Investors have been trying to gauge how high the Federal Reserve will need to raise rates as it tightens policy in its continuing battle against inflation, while also trying to avoid tilting the economy into recession.

Futures that wager on the direction of Wall Street’s S&P 500 share index gained 0.3% in European morning trading. Contracts trading the tech-heavy Nasdaq 100 rose by the same amount.

In foreign exchange markets, the yen weakened 0.4% to 134.00 per dollar, in a partial reversal of strong gains for the Japanese currency after the nation’s central bank made a hawkish tweak to its controversial “yield curve control” policy that suppresses domestic borrowing costs.

The index, which measures the safe-haven dollar against six major currencies, rose 0.038%.

Brent crude, the global oil benchmark, dropped 0.9% to $83.55.

Source: Investing.com