US500

+0.70%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US2US…

+-2.65%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Financial conditions should remain relatively stable for the near future

Accordingly, the S&P 500 could trade in a tighter range than it did in the last few years

Such a scenario could generate interesting opportunities for traders looking to beat the market

With the prospect of a pause in most Central Banks’ rate hike cycles, 2023 will hardly experience the same volatility as 2022 did. Still, with no short-term solution to the current macroeconomic situation, betting on an immediate V-shaped rebound seems farfetched.

I emphasize the word “pause” because the current background simply does not allow Central Banks to start easing financial conditions anytime soon.

The labor market remains strained, supply chain issues have improved more from the demand than from the supply side, commodity prices have subsided but remain well above the historical average, and — despite last year’s global stock market selloff — valuations and P/E levels remain high, especially in the face of higher capital costs.

In such a scenario, even if headline inflation were to subside well below market expectations in the next few readings — which actually seems possible, given the latest batch of macroeconomic data — a pivot would almost instantly bring back all the drivers of the current crisis.

This leaves the Fed stuck between a rock and a hard place.

On the other side of the problem, a so-called 7% solution — as suggested by St. Louis Federal Reserve President James Bullard last week— also appears utterly out of the cards.

According to Bullard, the Fed would need to maintain the federal funds rate between 5% and 7% for quite some time before pivoting lower to ensure that the inflation monster is ultimately tamed from a structural perspective.

While he may have a valid point, his ‘medicine’— originally applied during the 1970s inflation crisis — is likely to kill the patient in the process as it does not consider the current highly-leveraged economy and the level of government debt.

Most likely, a liquidity dry-out of such magnitude would lead to a severe economic crisis which, in turn, would result in financial issues that run much deeper than the stock market itself — i.e., a widespread housing crisis, famine, and political and social unrest.

Even as Powell states that “restoring price stability when inflation is high can require measures that are not popular in the short term as we raise interest rates to slow the economy,” we know that a more profound economic crisis would push the Fed towards a pivot very quickly.

Also, the inverted yield curve needs to flatten soon; otherwise, the U.S. banking system will begin to show cracks. We must keep in mind that U.S. banks have a great influence on the Fed’s decision-making, both from the political and financial sides.

The slowing economic situation will also soon start reflecting on earnings, pushing P/E levels even higher — unless we witness a further selloff.

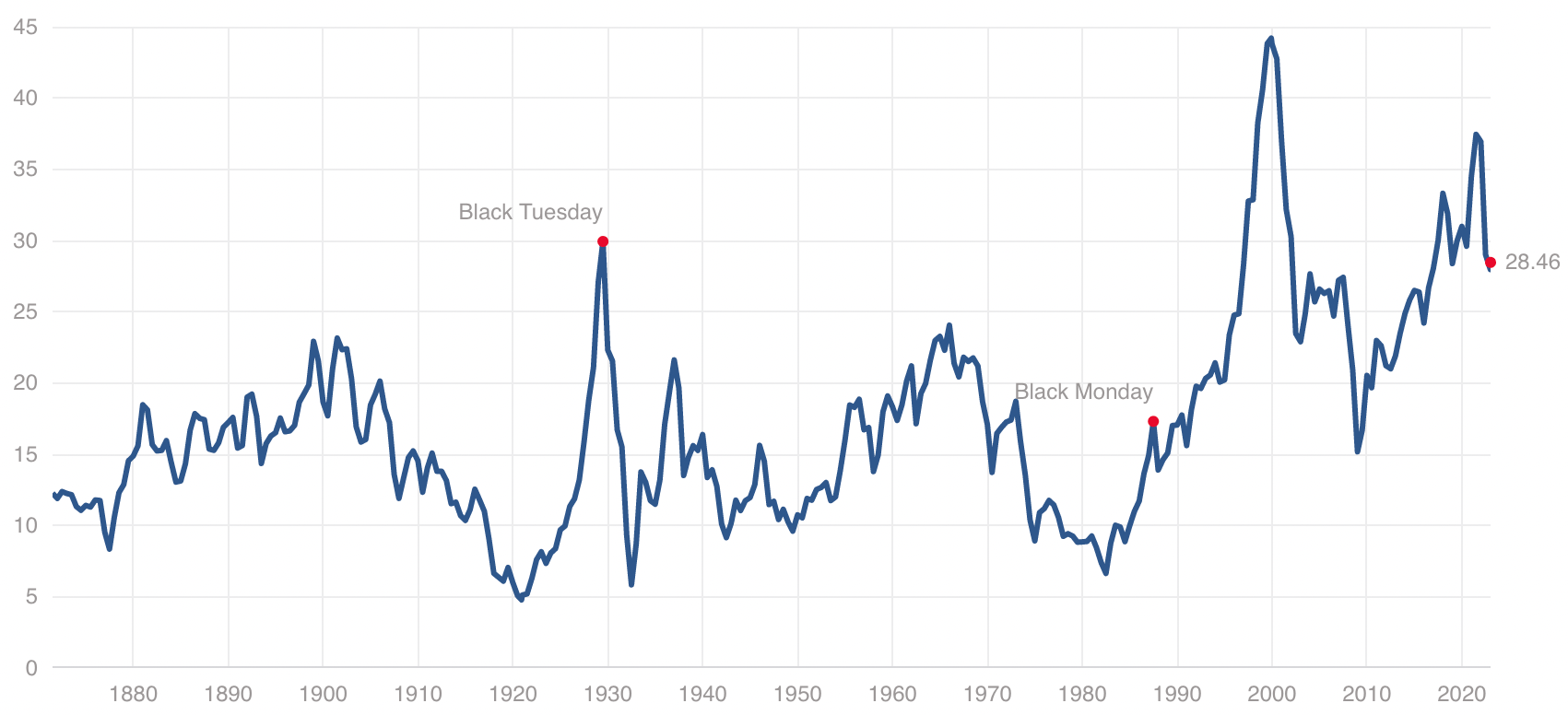

As we can see in the chart below, Schiller’s P/E average has dropped significantly last year but remains high from a historical perspective.

Shiller PE Ratio

Shiller PE Ratio

This background makes it all the more difficult for investors to find companies to go long on. Thus, researching and understanding what data to look at will become ever more important. That is where InvestingPro can help you with investment ideas based on numbers rather than personal opinions.

Check out a few interesting picks here.

S&P 500 Range

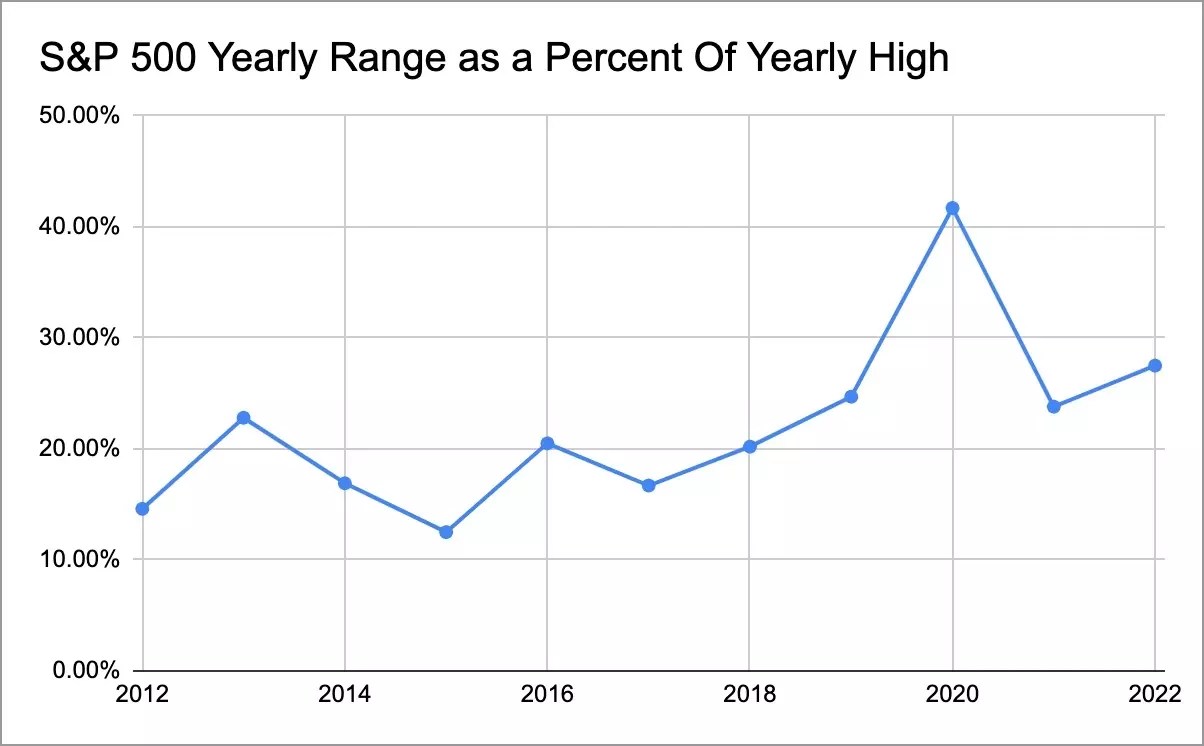

With a yearly bottom at roughly 3,500 and a top at around 4,800, 2022’s range for the S&P 500 was more than 1,300 points, approximately 35% of the index at current levels and 27.5% in relation to the yearly high, making it a challenging year for both traders and investors.

The only year in which the S&P 500 experienced a broader range in the last decade was 2020, when the U.S. benchmark gapped 1,600 points — or 41.7% from its yearly high — between its low and its high.

The chart below shows last decade’s yearly S&P 500 ranges normalized by their respective annual high.

S&P 500 Yearly Range

S&P 500 Yearly Range

Chart by the author. Data source: Investing.com

Here’s the list of ranges, yearly highs, and percentages:

2012 – 215.65 – 1,474.51 (14.6%)

2013 – 423.25 – 1,849.44 (22.8%)

2014 – 355.63 – 2,093.55 (16.9%)

2015 – 267.71 – 2,134.72 (12.5%)

2016 – 467.43 – 2,277.53 (20.5%)

2017 – 449.84 – 2,694.97 (16.7%)

2018 – 594.33 – 2,940.91 (20.2%)

2019 – 803.97 – 3,247.93 (24.7%)

2020 – 1,568.34 – 3,760.20 (41.7%)

2021 – 1,146.22 – 4,808.93 (23.8%)

2022 – 1,327.04 – 4,818.62 (27.5%)

As we can see, 2020 and 2022 were outlier years because the economy faced shifting conditions in both years.

Now, with the Fed stuck between supporting the economy and controlling inflationary conditions, the stock market could have a hard time breaking out of its current sideways trend ranging from 3,600 to 4,300 for quite a while yet.

S&P 500 Daily Chart

S&P 500 Daily Chart

The market maintaining this range would mark a significantly tighter range than we’ve seen in the post-pandemic period. This, in turn, will likely create several interesting trading ranges as resistances, supports, and DMAs become key for savvy traders looking to beat the market.

On the other hand, valuations remain elevated, and thus, long investing could prove a challenging road for the near term — unless you can find the right companies to put your money in. Even so, investors must remain active, lowering risks and understanding the macroeconomic conditions.

Bottom Line

Obviously, no one can forecast the market behavior in the weeks ahead — even more so for a full year. However, betting on probabilities and basing your strategy on real-world conditions will always beat excessive risk-taking in the long run (both bullish and bearish).

With markets returning to earth after a season on the moon (pun intended), indexes will likely trade closer to actual macroeconomic conditions than at any time in the aftermath of the pandemic.

Disclosure: I hold a diversified long-term portfolio with both stocks and ETFs, which I regularly rebalance based on a risk assessment of the macro environment and companies’ financials.

Source: Investing.com