US2YT=X

+0.65%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US2US…

3.52%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

The markets are once again testing the Fed

The Fed’s forward guidance doesn’t seem to be working anymore

It may result in the Fed discussing further balance sheet reduction to tighten financial conditions.

The recent CPI data has encouraged investors to challenge the Fed’s plans to raise the overnight rate above 5%. But the market doesn’t seem to care, and rates are dropping across the yield curve following the inline CPI report. The 2-Year Treasury fell to its lowest rate since October and is in danger of dropping significantly.

If the Fed is determined to raise rates as much as they say and keep financial conditions tight, then the market isn’t listening and doesn’t seem to care what the Fed wants.

This can only make one think that forward guidance from the Fed is no longer working. The Fed may have to dig into its toolbox to convince the market it is serious and potentially talk about increasing the size of the balance sheet runoff or the outright sale of its Treasury and MBS holdings.

The market knows the Fed is getting to the end of its rate hiking cycle and is fully convinced the Fed will be forced to cut rates in 2023. However, the Fed has consistently noted it planned to get rates to 5% and keep rates high and financial conditions tight for a long time.

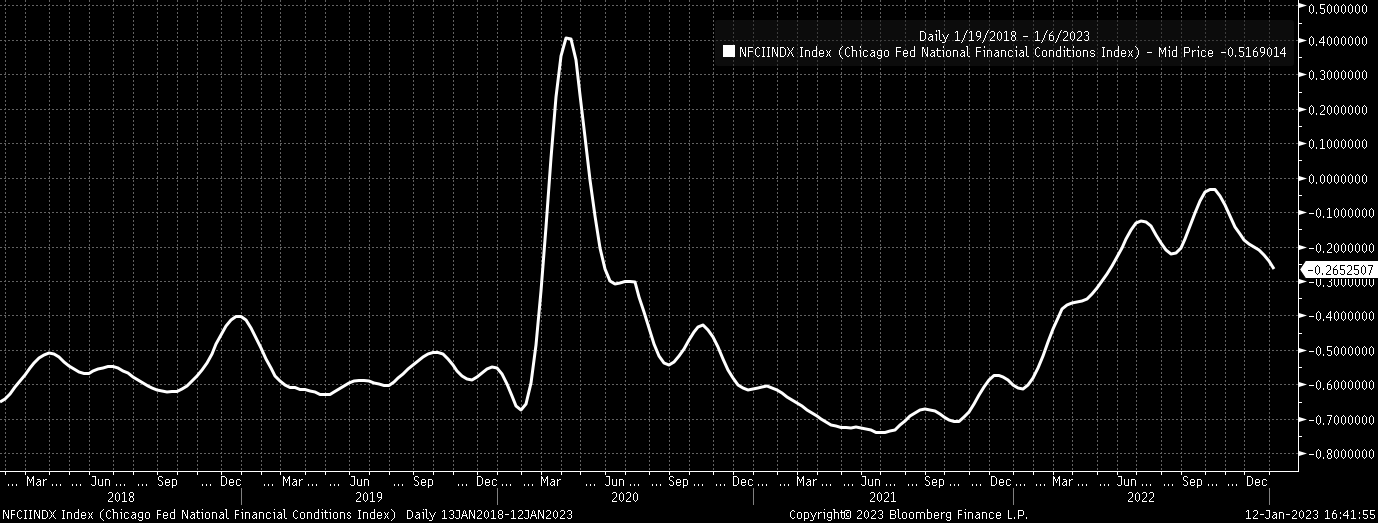

However, despite its best effort and hawkish commentary, the market doesn’t care. Financial conditions continue to ease, as the Chicago Fed’s Financial Conditions Index has fallen back to a level not seen since May 2022. Chicago Fed Financial Conditions Index

Chicago Fed Financial Conditions Index

The market’s latest move to go against the Fed was a sharp decline in the 2-Year Treasury, which fell to its lowest rate since the beginning of October. It is the first show of weakness the 2-year rate has shown in months; in what could be a sign, the market is now starting to price in rate cuts beyond the Fed Funds Futures market.

It will only leave the Fed to talk about its balance sheet as the last option for the Fed to keep rates elevated and the dollar strong enough to keep financial conditions from easing more than the Fed desires.

U.S. 2-Year Yield

U.S. 2-Year Yield

The market’s latest test is to see how far it can push the Fed to keep financial conditions tight. If the Fed is serious, they will need to push back very hard at some point soon, or they will risk losing control of the narrative and where they want the markets to go.

Talking about higher overnight rates has lost its effect, leaving the balance sheet as the next option if the Fed wants to regain market control.

Otherwise, it will indicate that the Fed is OK with financial conditions easing, giving the market the green light to rally more.

***

Disclosure: This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Past performance of an index is not an indication or guarantee of future results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index may be available through investable instruments based on that index. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment. Michael Kramer and Mott Capital received compensation for this article.

Source: Investing.com