XAU/USD

-0.51%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

XAG/USD

-1.47%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Gold

-0.70%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Silver

-1.21%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

2023 is set to be a positive year for gold and silver

Weakening U.S. dollar, global economic slowdown, and the Fed easing the pace of rate hikes are all tailwinds for the precious metals

Gold could rally to all-time highs this year

The turn of the year has been a walk in the park as far as the gold and silver markets are concerned. For the last two months, the precious metals have gained 7.5% and 12.1%, respectively.

Fundamentally, the rise in prices can be attributed to cooling inflation, which is grounds for the Fed to slow the pace of interest rate hikes, thus weakening the US dollar.

A strong dollar and rising bond yields have been the primary factors limiting the upside potential for gold and silver in recent years and keeping them in a consolidation phase. If this trend continues in the coming months, gold and silver could rally to all-time highs.

A global economic slowdown and the release of pent-up demand from China after the easing of pandemic restrictions should be tailwinds for gold and silver.

Analysts’ Consensus Favors Higher Gold Prices

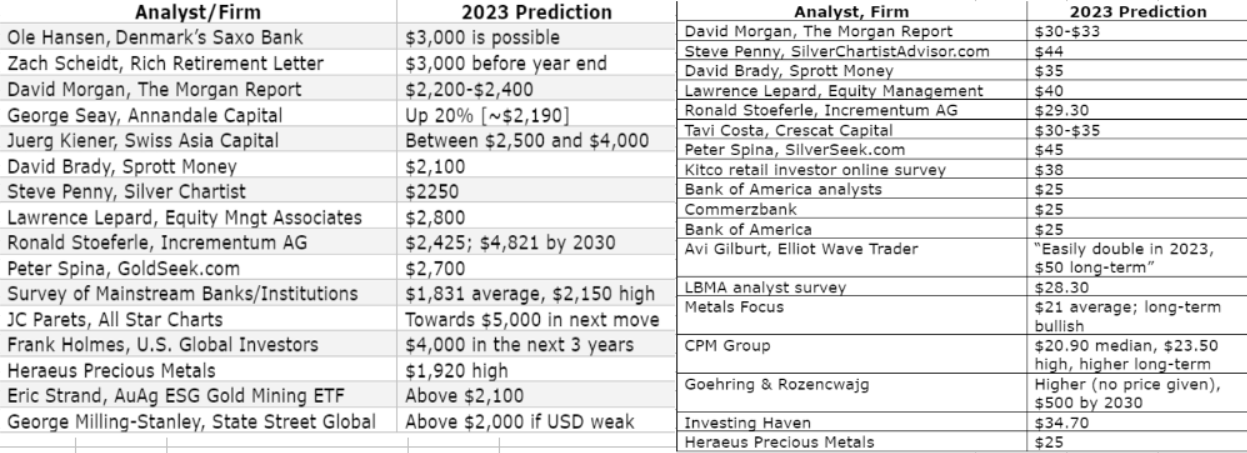

At the beginning of the year, forecasts of many different financial instruments are published. According to forecasts compiled by Goldsilver.com, the vast majority of gold and silver forecasts call for strong increases in 2023.

Analysts’ Forecasts for Gold and Silver Prices in 2023

Analysts’ Forecasts for Gold and Silver Prices in 2023

Source: GoldSilver.com

Such forecasts should be taken with a grain of salt, as we have seen similar predictions in previous years that were not ultimately realized.

This year, however, many factors indicate that the metals are likely to break out of the consolidation range. In this context, the main thing to watch out for is what the Fed will do at its upcoming meeting on Feb. 1.

The tone of the statement and Chairman Jerome Powell’s consequent press conference would be key. In recent months we have witnessed relatively hawkish announcements, and therefore a possible change in tone will be a strong impetus for buyers.

Silver Is Irreplaceable in Photovoltaics

Silver, compared to gold, has far more industrial applications. The metal is one of the best conductors of electricity and has a wide range of applications in electronics or photovoltaic panels, among others.

As the world transitions to renewable energy, the demand for solar energy is set to accelerate.

This means that demand for silver could also increase. And, with limited reserves estimated to be depleted by 2050, this will put upward pressure on prices.

While efforts have already begun to try to replace silver with copper elements and increase recycling, the work is at a very early stage. Many years or even decades are needed to put these solutions into practice.

In addition to its industrial use, silver is also an investment alternative to gold but on a smaller scale. Hence, the same factors that can drive the yellow metal’s price increases apply to silver.

In the short term, the first target for buyers appears to be a strong demand zone located in the $26 per ounce price region. Its breakthrough opens the way for the metal to reach the psychological resistance of $30 per ounce.

Gold Knocks Out $1,900

Since mid-October last year, gold has been in a dynamic uptrend. The yellow metal could break above the critical resistance at $1900 per ounce.

Gold Weekly Chart

Gold Weekly Chart

If gold continues to rally, which looks likely, the next target for the bulls is the resistance area at $2,000 per ounce. After that, the key area is the all-time high of $2075, which was successfully defended in early March last year.

Disclosure: The author does not own any of the securities mentioned in this article.

Source: Investing.com