PTON

+4.08%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CAT

-4.02%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

SBUX

+0.19%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

SNAP

+2.85%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

GOOG

+0.93%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

XLK

+0.73%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

META

+0.71%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IXIC

+1.04%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

AMD

+2.65%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

UPS

+3.19%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

PFE

-0.21%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

XOM

+1.85%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US500

+0.69%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

AMZN

+2.59%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

AAPL

+0.17%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

QCOM

+1.52%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

GOOGL

+0.78%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

MRK

+0.34%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

MCD

-2.69%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

F

+3.53%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

GM

+7.81%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DJI

+0.26%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Fed rate decision, Mega-cap tech earnings, U.S. jobs report in focus.

Caterpillar shares are a buy amid strong profit and sales growth.

Peloton stock set to underperform amid sluggish results and weak outlook.

Stocks on Wall Street rose on Friday, with the major averages capping off another strong week as investors cheered signs that inflation may be peaking, raising hopes the Federal Reserve will be less aggressive on interest rate hikes.

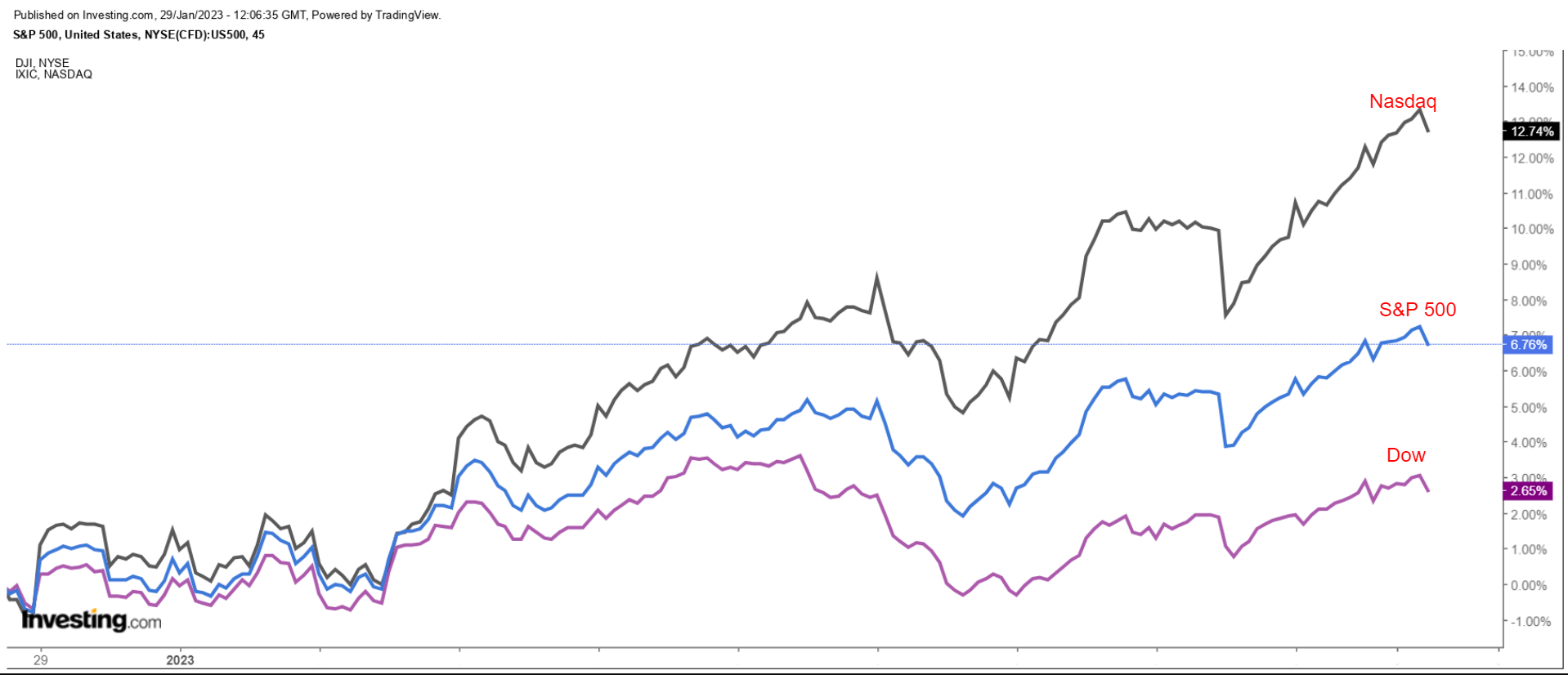

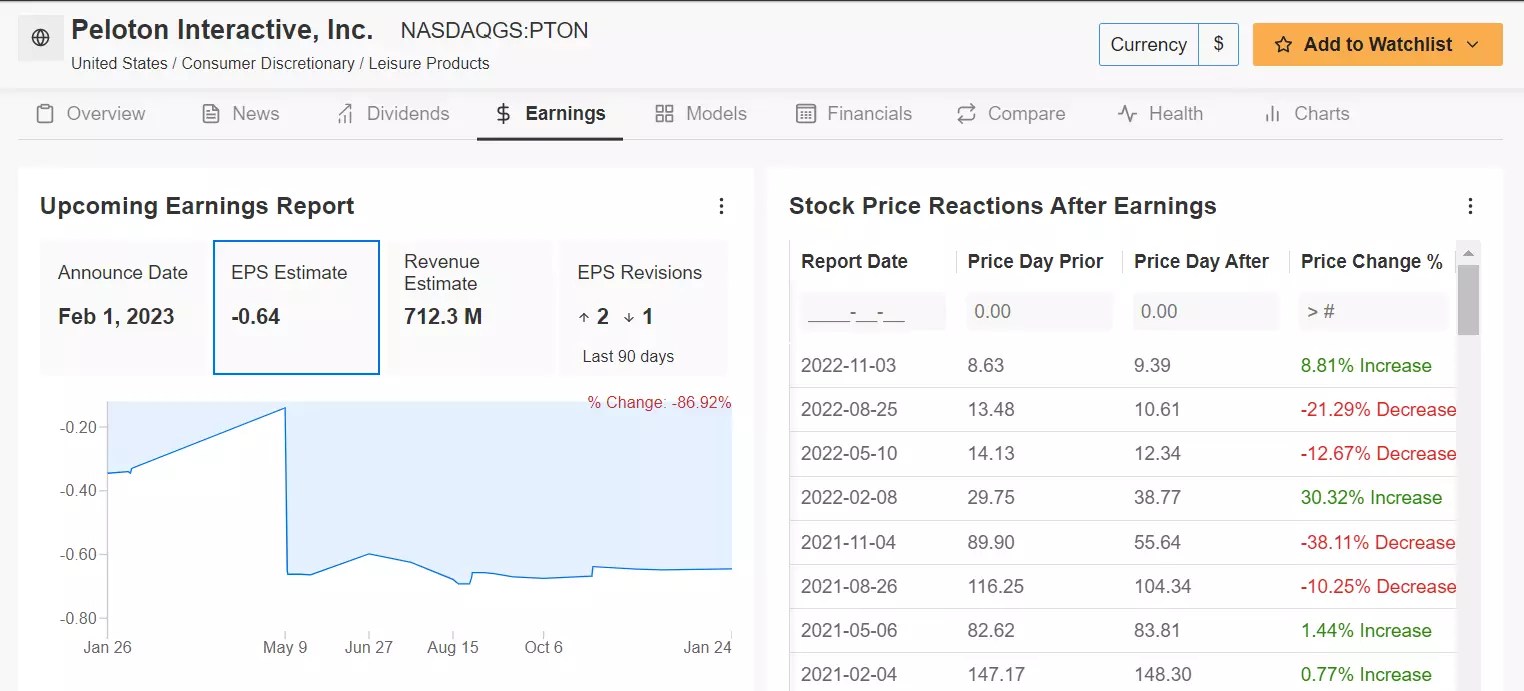

For the week, the blue-chip Dow Jones Industrial Average rose 1.8%, while the benchmark S&P 500 and technology-heavy Nasdaq Composite advanced 2.5% and 4.3% respectively to notch their fourth straight weekly advance.

So far in the early weeks of 2023, the Nasdaq has jumped 11%, while the S&P 500 and the Dow have gained 6% and 2.5%, respectively.

Source: Investing.com

The blockbuster week ahead is expected to be an eventful one filled with market-moving events, including a key Fed rate decision, as well as a flurry of heavyweight earnings reports and economic data.

The Fed is set to conclude its first policy meeting of the year on Wednesday, which Wall Street largely expects to result in a 25-basis point rate hike, a step down from the 50bps move in December. That would bring the fed funds target rate range to 4.50% to 4.75%.

Fed Chair Jerome Powell’s comments on the pace of future rate increases will be in focus as investors ramp up bets the U.S. central bank will pause its tightening cycle and even cut rates by the end of the year.

In addition, earnings season kicks into high gear, with reports expected from the mega-cap tech stocks, including Apple (NASDAQ:AAPL), Google-parent Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), and Meta Platforms (NASDAQ:META).

The earnings agenda also consists of other high-profile companies, such as Advanced Micro Devices (NASDAQ:AMD), Qualcomm (NASDAQ:QCOM), Snap (NYSE:SNAP), Exxon Mobil (NYSE:XOM), McDonald’s (NYSE:MCD), Starbucks (NASDAQ:SBUX), UPS (NYSE:UPS), Ford (NYSE:F), General Motors (NYSE:GM), Pfizer (NYSE:PFE), and Merck (NYSE:MRK).

Elsewhere, on the economic calendar, most important will be Friday’s U.S. employment report for January, which is forecast to show solid job gains but a slowing from December’s growth.

Regardless of which direction the market goes, below we highlight one stock likely to be in demand and another which could see further downside.

Remember though, our timeframe is just for the upcoming week.

Stock To Buy: Caterpillar

After closing at a new record high on Friday, I expect Caterpillar’s (NYSE:CAT) stock to extend its rally in the week ahead as the thriving construction and mining equipment company is forecast to deliver strong profit and sales growth when it reports its latest financial results thanks to an improving fundamental outlook.

The industrial giant, which is one of the 30 components of the Dow Jones Industrial Average, is up more than 10% so far in January thanks to optimism about the resilience of the global economy.

CAT stock, which has outperformed the Dow by a wide margin over the past year, ended at $264.54 on Friday, above the prior record high close of $262.12 from a day earlier. At current levels, the Deerfield, Illinois-based heavy machinery maker has a market cap of $137.8 billion.

Source: Investing.com

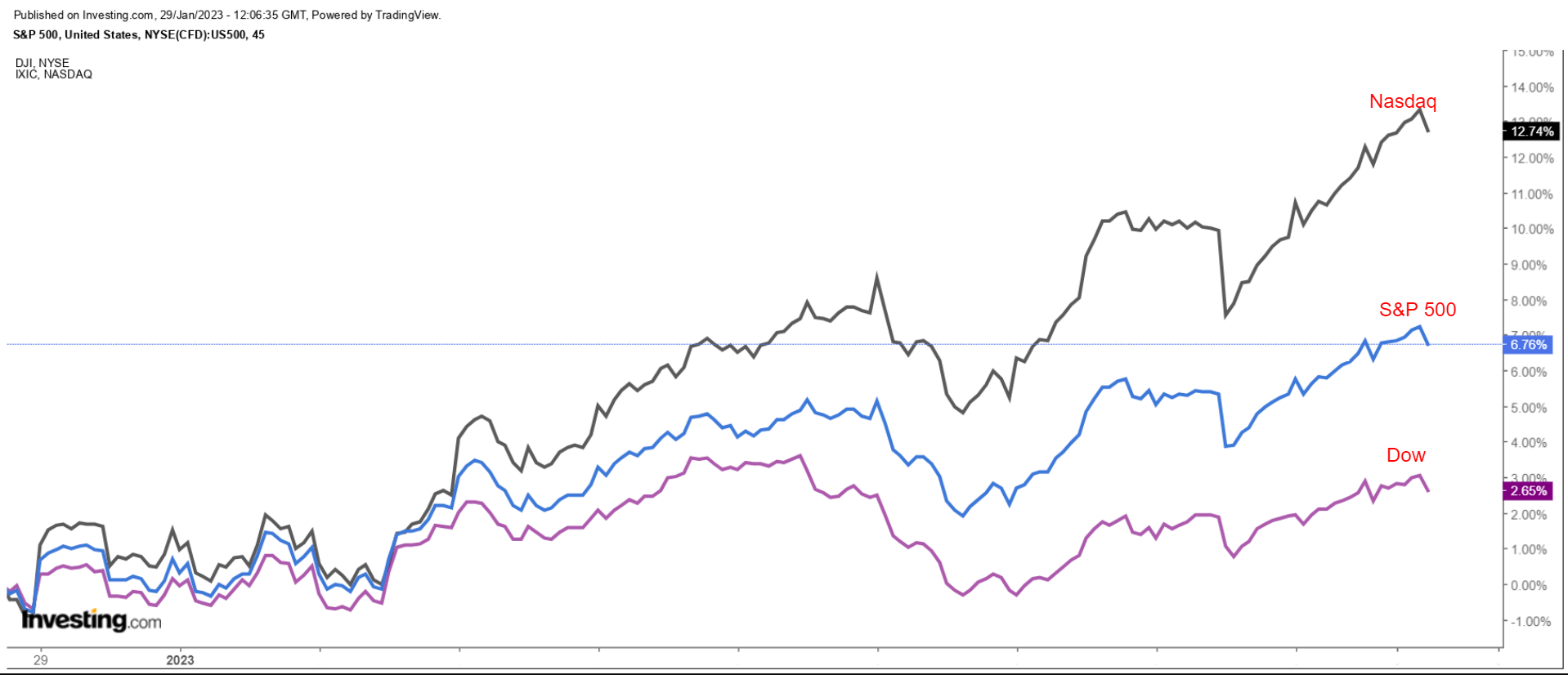

Caterpillar’s Q4 earnings are due before Tuesday’s opening bell and are once again likely to benefit from an improving global growth outlook as China’s economy reopens, as well as increased infrastructure spending in the U.S.

As per moves in the options market, traders are pricing in a swing of about 4% in either direction for CAT stock following the release.

Not surprisingly, profit forecasts have been revised upward 20 times in the 90 days prior to the earnings release, according to InvestingPro.

Consensus estimates call for earnings to accelerate for the sixth consecutive quarter to $4.03 per share, improving 49.8% from EPS of $2.69 in the year-ago period. Meanwhile, revenue is forecast to jump 14.7% year-over-year to $15.8 billion, reflecting robust demand for its wide array of construction, mining, and energy equipment.

Source: InvestingPro

If those figures are confirmed, it would mark the highest quarterly profit and sales total in Caterpillar’s history, demonstrating the strength and resilience of its operating business.

Looking ahead, I anticipate the industrial giant will provide upbeat guidance for the rest of the year as it continues to benefit from a potent combination of favorable industry demand trends and pricing strength given the promising outlook for construction and mining machinery sales.

Stock To Dump: Peloton

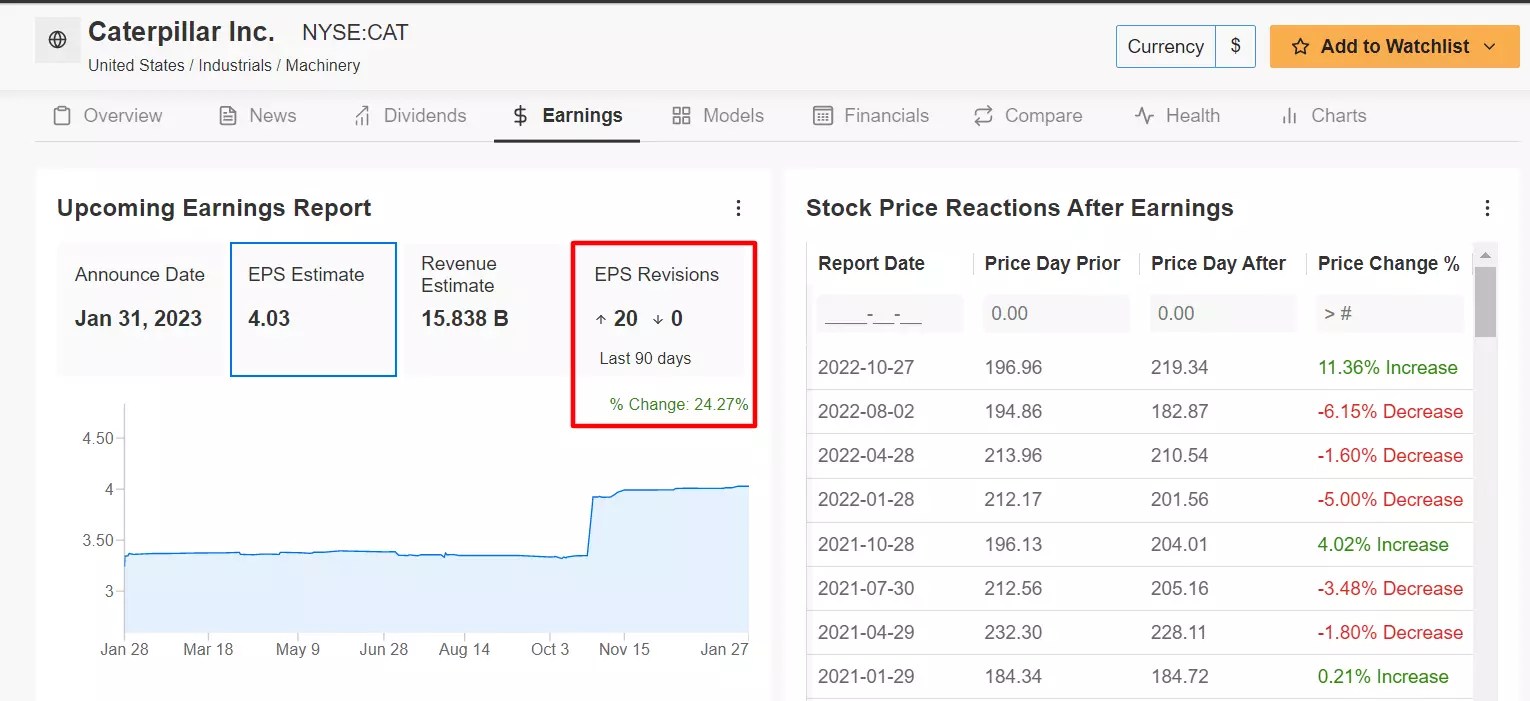

Despite its recent uptrend, I believe Peloton’s (NASDAQ:PTON) stock will underperform this week as its latest earnings report will likely reveal another sharp slowdown in revenue growth, adding to fears over the money-losing home exercise equipment maker’s long-term growth prospects.

Based on the options market, traders are pricing in a large move for PTON stock following the update, with a possible implied swing of 18.7% in either direction.

Results are due on Wednesday ahead of the U.S. market open.

Peloton has missed bottom line estimates for six quarters in a row, while trailing revenue expectations five times in that span, reflecting the negative impact of various headwinds on its business.

As could be expected, an InvestingPro survey of analyst earnings revisions points to mounting pessimism ahead of the report, with analysts slashing their EPS estimates by roughly 87% from their initial expectations over the last 90 days.

Source: InvestingPro

Consensus expectations call for the interactive fitness company – which sells stationary bicycles and treadmills that allow monthly subscribers to remotely participate in classes via streaming media – to report a loss of -$0.64 per share for its fiscal second quarter amid ongoing restructuring costs related to its massive turnaround efforts.

Revenue is forecast to sink 37% from a year earlier to $712.3 million, due to dwindling demand for its at-home fitness products amid the current economic climate and as more people head back to the gym.

As such, I expect Peloton’s management to strike a cautious tone in its guidance for the year ahead as it faces a challenging macro environment that is seeing it burn through high levels of cash amid higher cost pressures and declining operating margins.

With the company currently sitting on $939 million in liquidity, there is a legitimate fear that Peloton could run out of cash by the end of the year as it struggles to deliver on its turnaround plan and regain its footing in a post-pandemic world.

Source: Investing.com

PTON stock ended Friday’s session at $12.65, its highest close since Dec. 5, earning the New York City-based company a valuation of $4.3 billion.

Shares, which have roared back in the early part of 2023 along with the tech-heavy Nasdaq, are up a whopping 59.3% in the year’s first 27 days. Despite its recent turnaround, the stock – which suffered an annual decline of 77.8% in 2022 – remains about 93% away from the January 2021 record of $171.09.

Disclosure: At the time of writing, I am long on the S&P 500 and Nasdaq via the SPDR S&P 500 ETF (SPY) and Invesco QQQ ETF (QQQ). I am also long on XLK, the Technology Select Sector SPDR ETF. I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

***

The current market makes it harder than ever to make the right decisions. Think about the challenges:

Inflation

Geopolitical turmoil

Disruptive technologies

Interest rate hikes

To handle them, you need good data, effective tools to sort through the data, and insights into what it all means. You need to take emotion out of investing and focus on the fundamentals.

For that, there’s InvestingPro+, with all the professional data and tools you need to make better investing decisions. Learn More »

Source: Investing.com