Rubber industry in India has been growing with potency and significance, as a part of India’s increasing role in the global economy. The industry parents the genesis of a wide range of products such as adhesives, auto tyres, auto tubes, auto & cycle parts, footwear, belts, cables & wires, sports goods, surgical & pharmaceutical products etc. It is highly labour and energy intensive. The Indian Rubber Industry consists of about 450 / 500 large / medium scale units and nearly 5500 Small and Tiny units. Rubber is a handy product with multiple usages. It is grown in various countries worldwide and plays a vital role in the Indian economy too.

The use of rubber is extensive, ranging from household to industrial products, entering the production stream at the intermediate stage or as final products. Tyre and tubes are the largest consumers of rubber. India is the fourth largest producer of natural rubber in world and the third largest consumer of the polymer. India is considered to be one of the key players in the global rubber business. The whole requirement of rubber-based industries for natural rubber, synthetic rubber, rayon and nylon tyre cord, steel cord, carbon black and rubber chemicals, etc is being met from home-grown sources.

The products manufactured also cover hi-tech industrial items. The main areas which the industry caters to include all the three wings of defence, civil, aviation, aeronautics, railways, agriculture, transport as also textiles, engineering industries, pharmaceuticals, mines, steel plants, ports, family planning programmes, hospitals, sports, i.e. practically to every conceivable field.

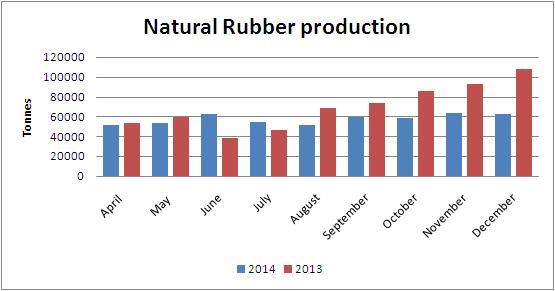

Declining production of Natural Rubber

Major Rubber Producing States in India are Kerala (92%), Tamilnadu (3.4%) & Karnataka (2.1%), while other producing states includes – Tripura, Assam, Meghalaya, Nagaland, Manipur, Goa And Union Territory Of Andaman & Nicobar Islands.

Production of natural rubber (NR) in India declined by 41.67 per cent to 63,000 tonnes during December 2014 from 108000 tonnes produced in the same period year ago. The total production during the current fiscal’s first nine months (April to December 2014) was down by 17.33 per cent to 517000 tonnes from same period of previous year. The production dropped mainly due to some farmers skipping tapping after rubber prices fell to their lowest level in five years.

Further, Indian natural rubber output is likely to decline over 10 per cent in current financial year as compared to previous financial year. The southern state of Kerala, which accounts for more than 90 per cent of the country’s natural rubber output, received 6 per cent more rainfall than normal, during the June-September monsoon season. The impact will be felt even in the January to March quarter as trees have lost large numbers of leaves on account of heavy showers. The slowdown in production has been widening the gap between local demand and supply, prompting tyre makers to import more.

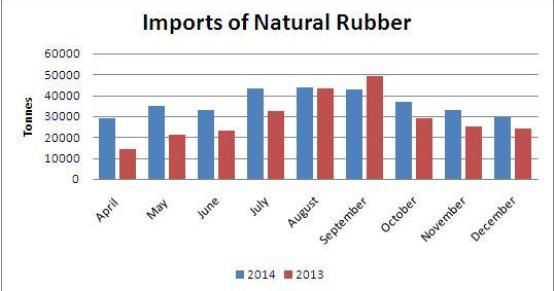

Rising imports of Natural Rubber

In the first nine months of financial year 2015, India’s natural rubber imports increased by 24.89 per cent to 326567 tonnes as compared to same period of last year. The imports increased mainly on account of drop in production in the country and lower prices in the world market which prompted tyremakers to increase overseas purchases to meet rising demand. Import of natural rubber in India in value terms is likely to touch $1,107 million by the end of the current fiscal year 2014-15. Further, in the month of December 2014 the imports increased by 8 per cent to 29,728 tonnes as compared to same month of previous year.

Rubber planters see a crisis-like situation looming, with international rubber prices falling in the Bangkok market to a seven-year low. This has resulted in a sharp rise in imports by Indian rubber consuming industries such as the tyre industry. In the face of a heavy inflow of imported rubber, domestic prices, too, fell to a five-year low of Rs 124 a kg for the benchmark variety, RSS-4.

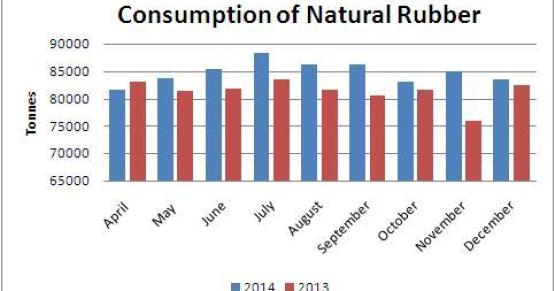

Consumption of Natural Rubber

India has consumed 83,500 tonnes of Natural Rubber (NR) during the month of December 2014 as compared to 82380 tonnes consumed same month of previous year. The total quantity consumed during the first nine month of the current fiscal was up 4.32 per cent at 763065 tonnes in comparison to same period of last year.

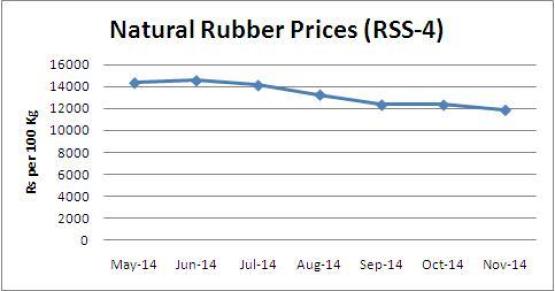

Decline in Natural Rubber price

Rubber price is under pressure both in the domestic as well as international markets on account of poor demand from countries like China and oversupply of the commodity. This sharp fall in price is due to the poor off take by China which is the world’s largest consumer, and by the European nations. The ongoing economic slow-down in China favours a sluggish demand.

The persistent fall in the price of natural rubber has caused concern among rubber farmers in Kerala. Rubber price, which ruled around Rs 220 per kg in January 2011, has now touched a low of Rs 123 per kg in the domestic market.

Government initiatives

In order to curb fall in rubber price and import, the government has increased the import duty by Rs 10 per kg. The government has constituted an expert committee to formulate a National Rubber Policy and examine issues relating to production, development and exports of rubber and related products. The Committee will recommend a broad based policy relating to all types of rubber such as synthetic, reclaimed rubber. It will submit its report including the draft of the National Rubber Policy within six months.

Challenges of Indian rubber industry

The scarcity of raw material has become the biggest issue for the industry. Polymer is a natural resource which the rubber products manufacturers require for making rubber related products. The industry is heavily relying on polymer imports. Kerala is the only region where polymer used to be grown. But over the past few years, the demand has gone up and the industry is relying on imports. Since the import duties are high, the cost of production is also more. The industry is struggling with this situation. Rubber growers have urged the Government to take some positive and quick actions in this direction to support the industry.

India Rubber Meet 2015

India Rubber Meet 2015 (IRM 2015) scheduled for March 4 – 6, 2015 in Kerala State. will have talks and panel discussions by internationally-renowned experts on wide range of topics such as:

-

Global economic outlook and the future of commodities.

-

Short and medium-term outlook for the global rubber industry.

-

Future of India in the global map of auto-tyre industry.

-

Short and medium-term outlook of China’s automobile industry, auto-tyre manufacturing sector and demand for rubber.

-

New legislations for auto-tyres and implications for rubber sector.

-

Innovations: The way forward for the global rubber industry.

Outlook

Indian Rubber Industry, currently is not in its best of health on account of low domestic production, high import duty and volatile prices along with slowdown in rubber industry and insufficient government support. At present, more than 90 per cent of Micro, small and medium enterprises (MSMEs) are facing operational issues in India.

The rubber industry is strongly correlated to macroeconomic trends. The current low rubber prices and declining demand for its products is a matter of concern but growth of rubber industry has always been cyclical and recovery is imminent.

The rubber industry has an essential role in the future of manufacturing industry, mainly automobile industry. Indian automobile industry is now going on path of revival, supported by improved consumer sentiment and measures taken by new government, and will consequently help in growth of the Indian rubber industry.

– money.livemint.com