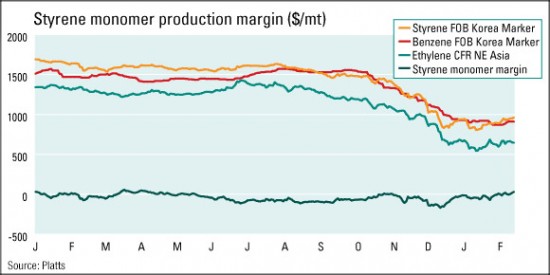

Margins for non-integrated styrene monomer producers hit an almost 10-month high Thursday, February 12, on the back of tightening supply ahead of a busy turnaround season in March and a weaker feedstock benzene market.

The margin was calculated at $29.80/mt FOB Korea above the breakeven level Thursday, based on the day’s benzene and ethylene assessments, up $13.40/mt from the day before.

It was last higher on April 4, 2014, at $35.80/mt, Platts data showed.

The breakeven is calculated using feedstock benzene and ethylene prices and a production cost of $150/mt.

The improving SM margin was attributed to supply tightness ahead of a flurry of turnarounds in South Korea in March.

Up to six of the eight SM plants in South Korea are scheduled to shut for maintenance over March-June, equating to 76% of the country’s total production capacity, Platts reported earlier.

The estimated loss of production in March is calculated at around 194,550 mt.

This is much greater than the volume of arbitrage cargoes from the US and Europe seen heading to Asia in March, at around 25,000-40,000 mt, and the injection of new supply from plant startups in the first quarter, which is estimated at 31,000 mt/month.

China’s Shandong Yuhuang Chemical Ltd. is starting up its new 240,000 mt/year SM plant in Shandong province over February-March and China National Offshore Oil Corp. its new 120,000 mt/year SM plant in Hainan in February.

SM DEMAND TO RISE FURTHER IN SPRING

Demand for SM is seen likely to improve further as the weather turns warmer in spring, boosting the currently sluggish downstream expandable polystyrene market as construction activity resumes after winter, market sources said.

Demand from EPS makers accounts for around 30% of China’s total SM demand, market sources said.

Another source said: “An EPS producer [in China] is operating [its plants] very well compared to last year.”

Chinese EPS plant operating rates were estimated at around 40% of capacity in January, almost double from the year before, she added.

Relatively low SM inventory levels in East China also point to an uptick in demand for SM in the near term, with Chinese SM end-users typically stockpiling ahead and after the Lunar New Year holiday.

Inventory in East China was heard at around 112,500 mt last Friday, 7% below the average level of 120,940 mt since 2011, according to Platts data.

A weaker main feedstock benzene market was also widening SM margins, with healthy ethylene and paraxylene margins adding to the glut of benzene supply, a Chinese market source said.

The PX production margin for a TDP unit was calculated at $29/mt Thursday, and has been positive since November 12, 2014.

Healthy ethylene margins have kept run rates at naphtha-fed steam crackers high in 2015, generating more byproduct benzene.

The ethylene margin was calculated at $132.98/mt FOB Korea Thursday and has been consistently positive since mid-2014.

Market participants expect it to remain positive into the second quarter.

As Asia-US benzene arbitrage window shut recently and healthy PX and ethylene margins are likely increasing benzene output in Asia, indicating the benzene market may remain bearish on oversupply for some time, a market source in Shanghai said.

– Platts.com