Friday, 13 March 2015 01:34

KAMPALA: Uganda’s shilling could remain under pressure next week after falling to a series of record lows as banks and factories bought dollars, while other currencies are likely to trade rangebound.

KAMPALA: Uganda’s shilling could remain under pressure next week after falling to a series of record lows as banks and factories bought dollars, while other currencies are likely to trade rangebound.

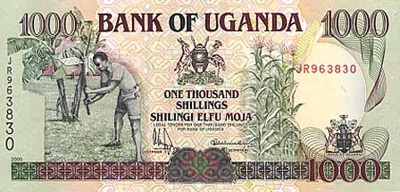

UGANDA

The Ugandan shilling could lose more ground as foreign investors cut their debt positions, worried by the state’s plans for increased spending in the current 2014/15 fiscal year, traders said. Dollar demand from manufacturers could also add to the local currency’s losses.

The shilling closed at near all-time lows of 2,940/2,950 unchanged from a week ago, but had fallen to a new record low of 3,116/3,126 before the central bank sold an unspecified amount of dollars to support the unit.

“The shilling will remain on the back foot,” said Ahmed Kalule, trader at Bank of Africa. “Clients in energy and manufacturing will be coming in after realising the shilling won’t recover soon.”

So far this year, the currency has lost nearly 10 percent of its value against the greenback, under relentless pressure from commercial banks building positions to hedge against further weakening of the shilling.

Uganda’s central bank said it would use interest rates to keep inflation from rising, reassuring investors worried by a planned hike in state spending. The bank has sold dollars eight times this year to support the local currency.

KENYA

Kenya’s shilling is expected to strengthen slightly on companies selling dollars to pay their taxes and dollar inflows from foreign investors seeking to buy a government bond.

The shilling closed weaker at 91.65/75 to the dollar on Thursday, compared with 91.05/15 last week.

Traders said the local currency was receiving support from central bank liquidity mop ups and dollar inflows from investors planning to buy a 12-year infrastructure bond worth up to 25 billion shillings ($ 272.93 million) on March 25.

TANZANIA

Tanzania’s shilling will trade in a range, with scope for slight gains as companies sell dollars to meet domestic tax and salary commitments.

The shilling traded at 1,840/1,850 to the dollar on Thursday, slightly weaker than 1,835/1,845 a week ago.

“Companies usually offload dollars at end of the quarter to get shillings for tax obligations and payment of salaries, so this will ease pressure on the local currency,” said Theopistar Mnale, a trader at TIB Development Bank.

The Bank of Tanzania said it had traded $ 64.45 million on the interbank foreign exchange market over the past week.

NIGERIA

The naira traded around 198.46 to the dollar, little changed from last week, with interbank trade subdued due to tight central bank controls. The bank has since been dictating the spread within which lenders can buy and sell dollars.

The bank last month said it would sell dollars only at 198 naira through the interbank, after scrapping twice-weekly foreign exchange auctions.

“There is still a lot of demand for the dollar in the market, which the central bank is not meeting, with many banks now depending on sale by some oil companies to satisfy their customers’ requests,” one dealer said.

Several large sales were carried out on Thursday at 197 naira for a total of $ 212.20 million, just before the interbank market closed, Thomson Reuters data showed, with dealers attributing trades to a central bank dollar sale.

“No real trading is going on in the market … and most banks are not willing to give quotes for lack of adequate dollar flows from oil companies,” another dealer said.

GHANA

Ghana’s cedi is seen under pressure as dollar demand continues to surge while hard currency inflows dwindle.

The local unit, which has fallen 8.5 percent to the dollar since January, traded between 3.6-3.7 against the dollar on Thursday, from 3.55 a week ago.

“We have seen demand surging day-by-day in recent days. It appears people are just panicking so they are buying in anticipation of a (dollar) shortfall as inflows have almost dried up,” Stanbic Ghana analyst Kofi Pianim said.

Ghana’s central bank has been supporting the interbank market with weekly dollar sales but traders say the amounts sold were inadequate to meet the high demand.

Ghana’s agreement with the International Monetary Fund last month for a three-year $ 940 million aid package to help fix its economy, dogged by high deficit, widening public debt and inflation, could eventually unlock donor and investor inflows of hard currency which could in turn support of the local currency.

Copyright Reuters, 2015