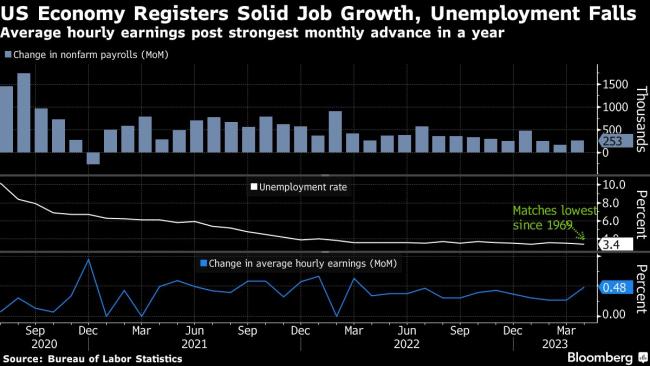

(Bloomberg) — The unexpected pickups in US hiring and wages last month increase chances the Federal Reserve will hold interest rates high for longer and potentially keep the door open to an 11th straight hike in June.

Nonfarm payrolls rose 253,000 last month, a Bureau of Labor Statistics report showed Friday. Economists had expected an increase of 185,000. The unemployment rate fell back to a multi-decade low of 3.4%.

Fed Chair Jerome Powell, speaking in a press conference Wednesday after officials wrapped up their May 2-3 meeting, said the labor market remains “extremely” tight and is one of the data points he and his colleagues will be carefully assessing as they determine whether more hikes are needed to cool the economy.

“It reduces the odds of cuts and reinforces higher for longer,” Neil Dutta, head of economics at Renaissance Macro Research LLC, said of the jobs report.

The Fed has raised rates aggressively over the past 14 months, bringing interest rates to a range of 5% to 5.25%, but has indicated it may pause and hold them high from now.

Financial-market estimates, which see a rate cut as early as September, continue to be out of line with forecasts from the Fed, where none of the 18 policymakers see a reduction this year.

©2023 Bloomberg L.P.

Source: Investing.com