All eyes are on the US inflation data ahead of its release tomorrow

After a steady decline, the CPI is expected to increase slightly due to the base effect

US indexes, currently trading near resistance, face a make-or-break moment

The US will release its inflation data tomorrow, marking the most important day of the week for the market. Investors will closely watch the data as it directly impacts the Fed’s interest rate decisions going forward.

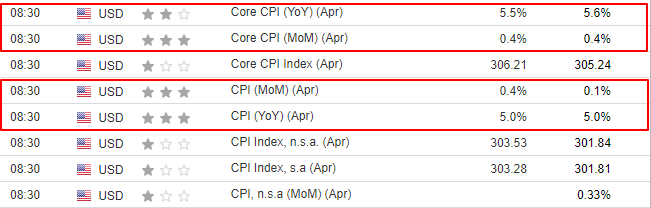

The primary focus will be on the CPI index and the core CPI index, both highlighted in red. The core CPI index excludes volatile components like energy and will provide valuable insights alongside the overall CPI index.

U.S. Inflation Report Date and Time

U.S. Inflation Report Date and Time

This survey, unlike the previous ones, will be different. Let’s see why.

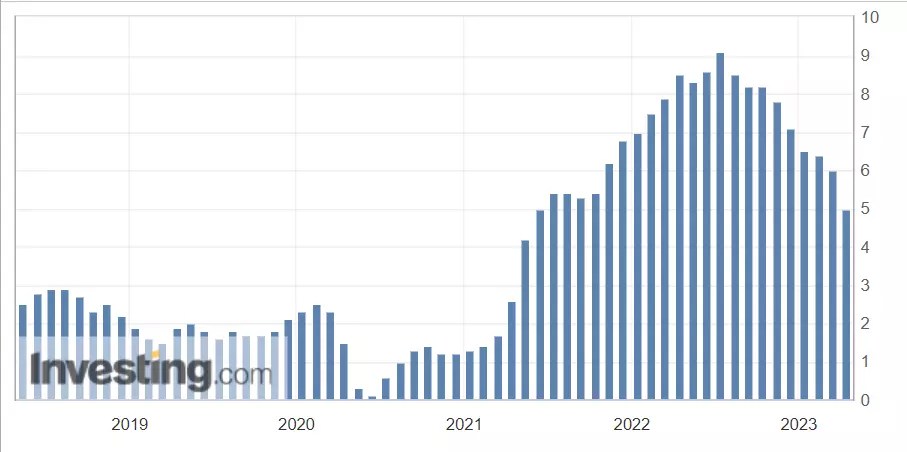

U.S. CPI Trend

U.S. CPI Trend

As we can see from the graph above, after peaking at just over 9%, it began a steady decline to 5% from July 2022 onwards. Over the past few months, there has been a lot of talk about the famous ‘base effect’ and its impact on the current readings.

The math we need to do for the annual CPI change is simple: Expected value = current value + monthly change – base effect previous year.

Therefore: Expected value = 5% (latest available data) + 0.4% – 0.3% = +5.1%.

So the surprise from this point of view could be a slightly higher CPI than last month, as the base effect of the same period in 2022 is minimal (so we take little out of the equation).

But the same effect in June and July will instead be much bigger (1% and then 1.3%).

In other words, if we continue to have a monthly change in the CPI of, say, 0.4%, we would find ourselves with a CPI of around 3.6% in July. That is unbelievable but true: 5.1% + 0.4% (June MoM change) + 0.4% (July MoM change) – 1% (June 2022 base effect) – 1.3% (July 2022 base effect).

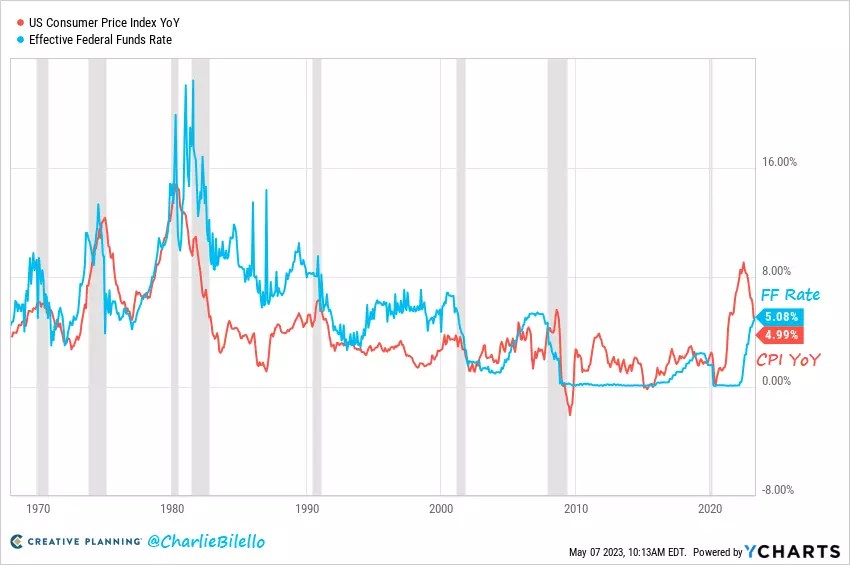

Assuming a final Fed hike in June of 0.25% followed by a pause, with rates at 5.25%-5.50%, and considering the core component or PCE, there is a possibility that the Fed could outpace inflation. This occurred for the first time this month since 2010.

CPI YoY Vs. Fed Funds Rate

CPI YoY Vs. Fed Funds Rate

US indexes are trading near their respective resistances, and the ball is in their court. The question arises: Will we witness a “sell in May and come back in June” scenario?

Time will tell.

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or investment recommendation. As such, it is not intended to incentivize the purchase of assets in any way. I want to remind you that any type of asset is evaluated from multiple points of view and is highly risky; therefore, any investment decision and the associated risk remain with the investor.

Source: Investing.com