US500

-0.16%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

ROST

+1.93%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

COST

+0.43%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

WMT

-0.03%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

HD

+0.97%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

BBY

+0.15%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

KSS

-1.54%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

TGT

-0.55%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

TJX

+1.19%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

LOW

-0.02%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

PACW

-2.99%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

FL

+1.55%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

XRT

-0.65%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

ULTA

+0.35%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

KBWR

+0.52%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Retailers will be the last group to deliver financial results in the Q1 reporting season.

The retail sector has underperformed the broader market by a wide margin in 2023.

Despite the gloomy macroeconomic outlook, I used the InvestingPro stock screener to shortlist five bullish retail stocks.

Looking for more top-rated stock ideas to protect your portfolio amid the increasingly uncertain economic climate? Members of InvestingPro get exclusive access to our research tools and data. Learn More »

Upcoming earnings results from the major U.S. retailers will be the next major test for the stock market as investors await further insight into the health of consumer spending against a backdrop of persistently high inflation and worries over a looming recession.

Topping the lengthy list of retailers scheduled to report first-quarter results in the coming week are Walmart (NYSE:WMT), Home Depot (NYSE:HD), Target (NYSE:TGT), TJX Companies (NYSE:TJX), Ross Stores (NASDAQ:ROST), and Foot Locker (NYSE:FL).

Other high-profile companies, such as Lowe’s (NYSE:LOW), Kohl’s (NYSE:KSS), Best Buy (NYSE:BBY), Ulta Beauty (NASDAQ:ULTA), and Costco (NASDAQ:COST), are due to report March quarter results in the following week.

Most retailers – which are perhaps the most sensitive to shifting economic conditions and consumer spending – have struggled this year amid a gloomy macroeconomic outlook of elevated inflation and slowing economic growth.

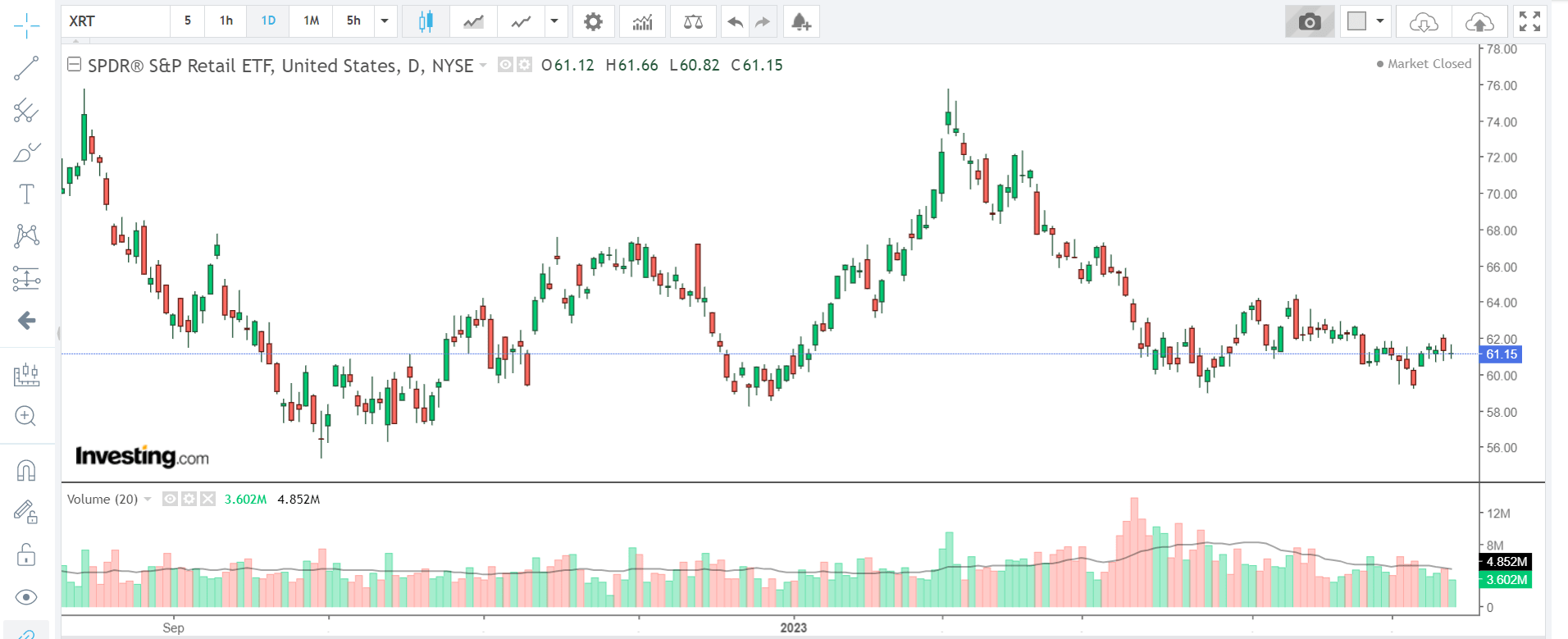

The retail industry’s main ETF – the SPDR® S&P Retail ETF (NYSE:XRT) – is up just 1.1% since the start of 2023, lagging the S&P 500’s near 8% gain over the same period.

XRT Daily Chart

XRT Daily Chart

Underscoring several near-term headwinds plaguing the sector, shares of Home Depot, which is the top U.S. home improvement chain, are down roughly 9% year-to-date as Americans cut back spending on discretionary items due to the uncertain economic climate.

There are some exceptions, of course. Take Walmart, for example, whose shares are up 8% so far this year as it benefits from changes in consumer behavior due to lingering inflationary pressures that are causing disposable income to shrink.

As such, next week’s earnings updates from the retail heavyweights will be a critical topic for investors amid growing fears the Federal Reserve’s aggressive rate hikes will tip the economy into recession.

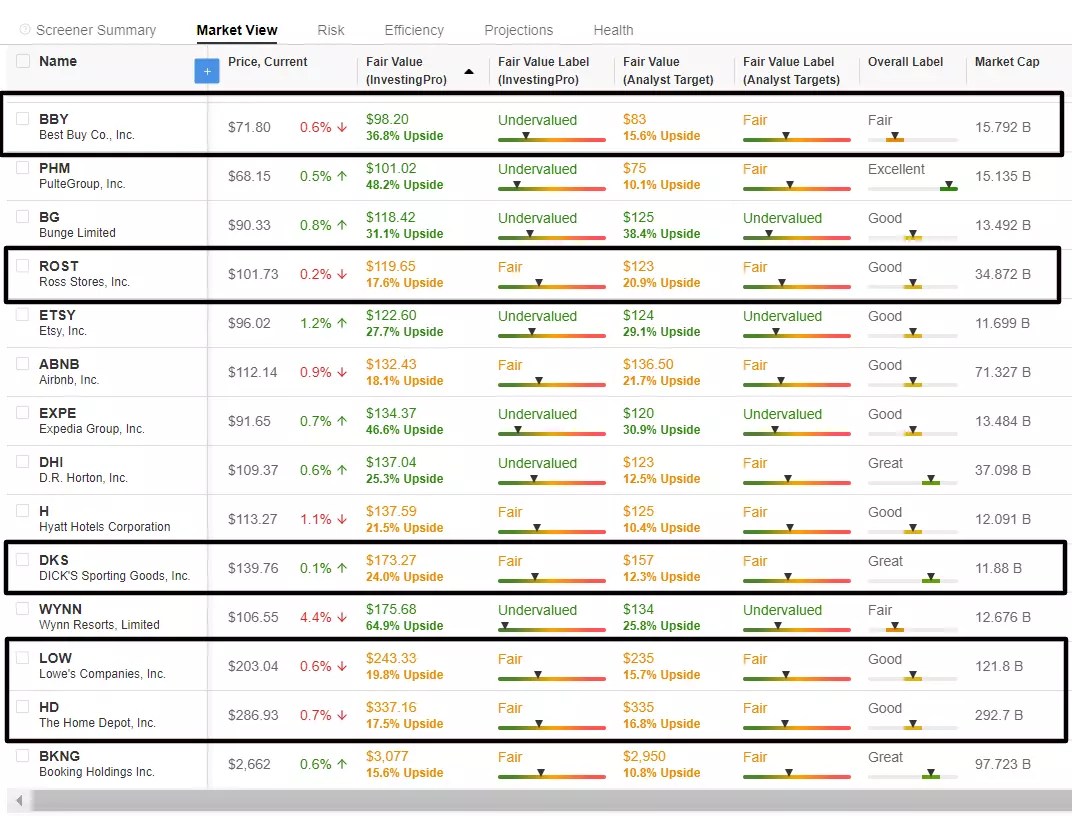

With that in mind, I used the InvestingPro stock screener to shortlist five retail stocks that Wall Street analysts are still bullish on heading into earnings.

Each name boasts a ‘Strong Buy’ rating recommendation and offers significant upside potential based on their InvestingPro ‘Fair Value’ price targets.

Best Buy (Fair Value Upside: +36.8%)

DICK’S Sporting Goods (Fair Value Upside: +24.0%)

Lowe’s (Fair Value Upside: +19.8%)

Ross Stores (Fair Value Upside: +17.6%)

Home Depot (Fair Value Upside: +17.5%)

InvestingPro Stock Screener

InvestingPro Stock Screener

Source: InvestingPro

Looking for more actionable trade ideas to navigate the current market volatility? The InvestingPro tool helps you easily identify winning stocks at any given time.

Start your 7-day free trial to unlock must-have insights and data!

Here is the link for those of you who would like to subscribe to InvestingPro and start analyzing stocks yourself.

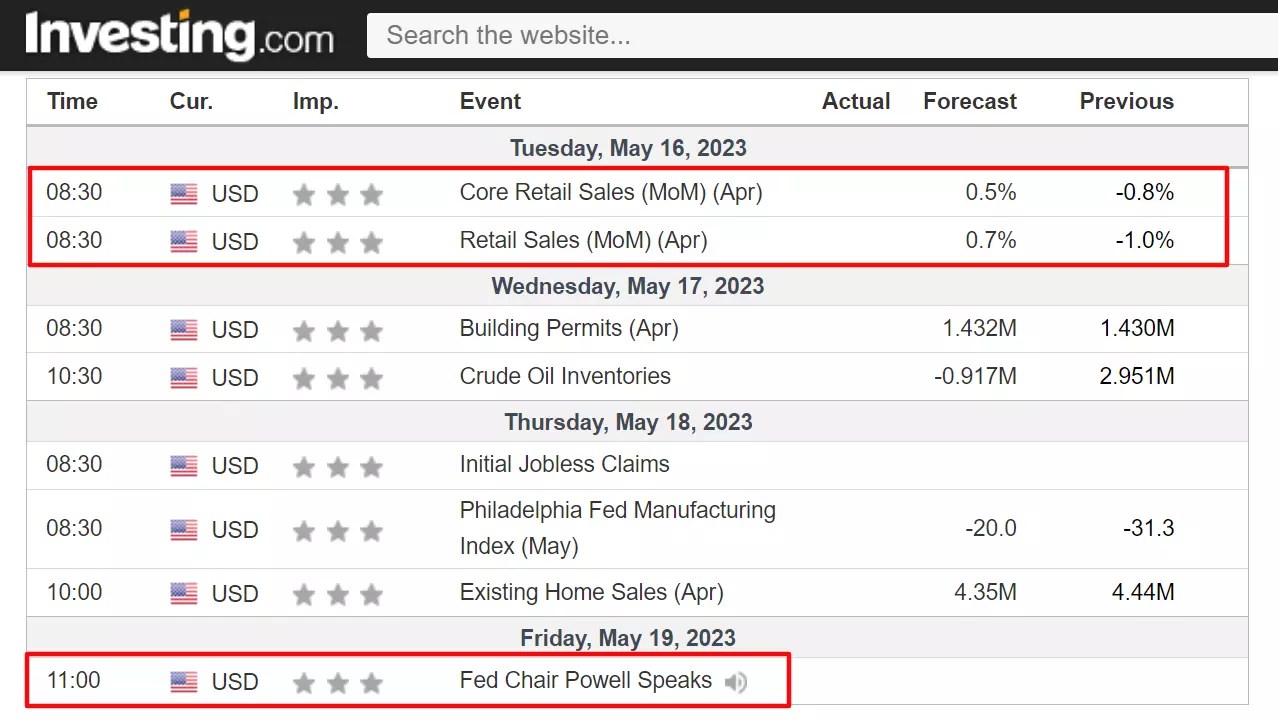

*Next Week: Retail Sales, Powell, Bank Turmoil & Debt Ceiling Crisis

In addition to the retailer earnings, the U.S. Commerce Department will publish its monthly retail sales report for April on Tuesday at 8:30 AM ET, with economists estimating a headline increase of +0.7% after spending fell -1.0% during the prior month.

Other economic reports on the agenda include the May NY Fed manufacturing index on Monday, as well as the May Philly Fed manufacturing index and April existing home sales figures, which are both set for release on Thursday, along with the latest jobless claims update.

Economic Calendar

Economic Calendar

The data will be accompanied by a heavy slate of Federal Reserve speakers. Most of the focus will be on Fed Chair Jay Powell, who is scheduled to participate in a panel discussion titled “Perspectives on Monetary Policy” at the Thomas Laubach Research Conference in Washington D.C. on Friday, at 11:00 AM ET.

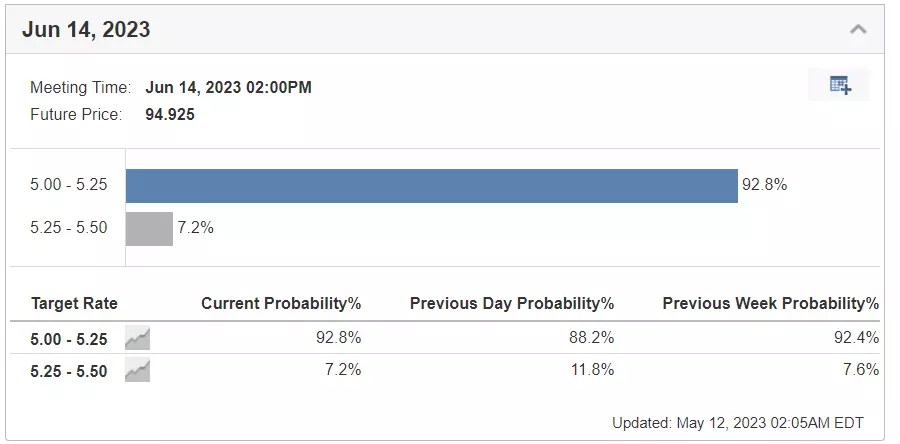

As of this morning, financial markets overwhelmingly expect the Fed to pause its interest rate hiking cycle at its next meeting in June, with odds for no action standing at 92.8%, according to Investing.com’s Fed Rate Monitor Tool.

Fed Rate Monitor Tool

Fed Rate Monitor Tool

Elsewhere, bank crisis developments will continue to be in focus amid ongoing concern over the health of the regional banking system.

Los Angeles-based PacWest Bancorp (NASDAQ:PACW) plunged 22% on Thursday after it reported a sharp drop in deposits last week, sparking another rout in shares of regional lenders.

Invesco KBW Regional Banking (NASDAQ:KBWR) is down 32% this year and has suffered a series of volatile sessions since March due to the banking crisis, which has led to the collapse of three regional lenders in the past two months.

KBWR Weekly Chart

KBWR Weekly Chart

Meanwhile, any updates on raising the United States’ $31.4 trillion debt ceiling will also be watched by investors as the country races to avert an unprecedented default.

The U.S. Treasury Department could run out of ways to pay its debt obligations in a matter of weeks if Congress fails to pass a bill to raise the debt limit. Lawmakers do not know precisely how much time they have left to act, but the “x-date” could come as soon as June 1.

Treasury Secretary Janet Yellen urged Congress to raise the federal debt limit and warned that a default could have severe repercussions on the global economy and risks undermining U.S. global economic leadership.

Find All the Info you Need on InvestingPro!

Disclosure: At the time of writing, I am short on the S&P 500 and Nasdaq 100 via the ProShares Short S&P 500 ETF (SH) and ProShares Short QQQ ETF (PSQ). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Source: Investing.com