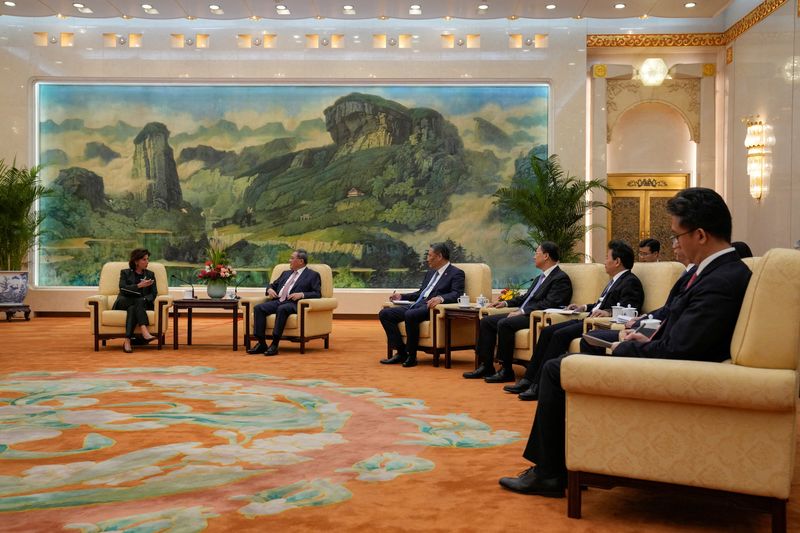

© Reuters. U.S. Commerce Secretary Gina Raimondo talks to Chinese Premier Li Qiang during a meeting at the Great Hall of the People in Beijing, China Tuesday, August 29, 2023. Andy Wong/Pool via REUTERS

BA

+0.09%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DIS

+0.27%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

MU

+2.10%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

By David Shepardson and Andrea Shalal

SHANGHAI/WASHINGTON (Reuters) -China has defended its business practices after U.S. Commerce Secretary Gina Raimondo said American firms had told her it had become “uninvestible,” highlighting a trend of global investors turning away from assets in the world’s second-largest economy.

The commerce secretary is the latest Biden administration official to visit China in a bid to strengthen communications, particularly on economics and defense, amid concern that friction between the two superpowers could spiral out of control.

She insists the United States does not want to decouple from China but her comment on the difficulties U.S. businesses face has shone a harsh light on trade and investment flows between the geopolitical rivals.

Asked to respond to the comments Raimondo made in China, the spokesperson for the Chinese embassy in Washington, Liu Pengyu said that most of the 70,000 U.S. firms doing business in China wanted to stay, that nearly 90% were profitable, and that Beijing was working to further ease market access for foreign companies.

“China is actively advancing its high-level opening-up and making efforts to provide a world-class, market-oriented business environment governed by a sound legal framework,” he said. “China will only open its doors even wider to the outside world.”

The Commerce Department declined to comment.

Global investors, who have been spooked by unpredictable crackdowns on sectors from e-commerce to education in recent years, have been streaming out of Chinese assets lately.

Foreign net selling of 82.9 billion yuan ($11.4 billion) in Chinese stocks this month is a record outflow. Corporate investment is also going missing, with foreign direct investment (FDI) at its lowest since records began 25 years ago.

Raimondo is in Shanghai on Wednesday for the last day of meetings before returning to the United States.

Asked what her message was to U.S. business in China, Raimondo said: “The message is to continue to do what you’re doing. We want you here investing, growing.”

But on Tuesday, she told reporters on a highspeed train from Beijing to Shanghai that U.S. companies had complained to her that China has become “uninvestible,” pointing to fines, raids and other actions that have made it risky to do business in the world’s second-largest economy.

She is pressing China to take actions to improve business conditions.

Michael Hart, president of the American Chamber of Commerce in China, said businesses had been “very clear” in making their concerns known to the Chinese government.

“Certain actions, including raids on companies and restricting data flows, are not conducive to attracting additional FDI,” Hart said.

‘QUITE COMPLICATED’

Raimondo said American firms are facing new challenges, among them “exorbitant fines without any explanation, revisions to the counterespionage law, which are unclear and sending shockwaves through the U.S. community; raids on businesses – a whole new level of challenge and we need that to be addressed.”

She said there was “no rationale given” for Chinese actions against chipmaker Micron Technology (NASDAQ:MU), whose products were restricted by Beijing this year, and rejected any comparisons to U.S. export controls.

Raimondo said this week she did not pull any punches in meeting with Chinese officials discussing the concerns of U.S. businesses, including raising the treatment of Micron.

Raimondo, in opening remarks at a meeting on Wednesday with Shanghai Party Secretary Chen Jining, struck a positive tone saying she wanted to discuss “concrete ways that we can work together to accomplish business goals and to bring about a more predictable business environment, a predictable regulatory environment and a level playing field for American businesses.”

Chen said a stable relationship between China and the United States was crucial for the world. He said Shanghai had the highest concentration of U.S. businesses.

“The business and trade ties serve the role as stabilizing ballast for bilateral ties. However, the world today is quite complicated. The economic rebound is a bit lackluster. So stable bilateral ties in terms of trade and business is in the interest of two countries” and also the world community.

She will visit New York University’s Shanghai campus as well as Shanghai Disneyland on Wednesday, a joint venture of Walt Disney (NYSE:DIS) and Chinese state-owned Shendi Group and hold a press conference at a Boeing (NYSE:BA) Shanghai facility before departing.

Raimondo, who has said China is blocking tens of billions of dollars in deliveries of Boeing airplanes to Chinese airlines, said she raised the airlines’ refusal to accept delivery of Boeing 737 MAX airplanes but won no commitments.

Source: Investing.com