Wednesday, 19 August 2015 23:54

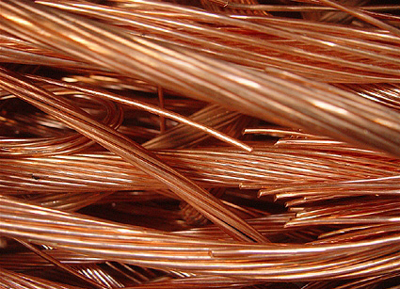

LONDON: Copper slid to a six-year low below $ 5,000 a tonne on Wednesday as a plunge in oil prices added to persistent concerns about slowing growth in China, where authorities intervened for a second day to calm volatile stock markets.

LONDON: Copper slid to a six-year low below $ 5,000 a tonne on Wednesday as a plunge in oil prices added to persistent concerns about slowing growth in China, where authorities intervened for a second day to calm volatile stock markets.

Three-month copper on the London Metal Exchange ended down 1 percent at $ 4,985 a tonne, having earlier hit its lowest since mid-2009 at $ 4,976. It fell 1.5 percent on Tuesday, breaking below $ 5,000 for the first time in six years.

Chinese stocks reversed sharp declines to end higher after the central bank injected more funds into the financial system, though worries about China persisted in global equity markets.

In metals, investors remained unnerved in particular by stuttering factory growth in China and falls in power generation and property prices. China consumes around 45 percent of the world’s copper.

Oil prices fell to six year lows, putting a lid on global equities and deterring investors from buying into commodity basket funds that include both oil and copper.

“Sentiment is extremely bearish at the moment … (but) we disagree that the situation in China is as dire as prices imply. Most metals in China are trading in backwardation and the price difference between Shanghai and London makes imports viable,” said Commerzbank analyst Eugen Weinberg.

Cash copper traded at its highest premium to the three-month price since May. Also, the total net “short” or sell position of LME money managers trading copper fell on Friday.

The dollar was lower with investors cautious ahead of minutes from the Federal Reserve which could signal if it will raise interest rates next month. A weaker dollar makes dollar-priced metals cheaper for non-U.S. investors.

Miner and commodities firm Glencore earlier cut its forecast for earnings from trading on a weak metals outlook, but said it was pursuing growth opportunities in copper and zinc production.

Tin ended up 1.4 percent at $ 15,350 a tonne, supported by a drop in available LME stocks that sent cash tin to its highest premium in six years against the benchmark contract on Tuesday.

“Tin is attracting buying today but it’s more for technical reasons. I suspect Indonesia are still digging for material and there’ll be a flood of supply at some point,” said a trader.

Aluminium ended up 0.2 percent at $ 1,557 a tonne, having earlier sunk to Tuesday’s six-year low of $ 1,549.50.

Nickel ended up 0.5 percent at $ 10,410 a tonne, lead closed flat at $ 1,691 and zinc ended up 1.25 percent at $ 1,784.