LCO

+1.20%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CL

+1.51%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Middle East conflict has escalated as Israel prepares for ground invasion of the Gaza strip

With rumors of Iran potentially getting involved, there is a concern that this conflict could escalate into a regional crisis like the one in 1970s

The risk of crude oil prices surging above $100 looms large

In recent weeks, the Middle East has plunged into its most significant conflict in decades. The catalyst for Israel’s military action was a series of brutal Hamas terrorist attacks and rocket fire, primarily affecting civilians.

Recently, Israel’s response has escalated, with discussions of a potential ground invasion of the Gaza Strip. While the impact on the oil market has been relatively restrained, there are concerns of further escalation if neighboring states like Iran get involved in the conflict.

On the economic front, the uptrend in oil prices resulting from this conflict present challenges to Western economies already grappling with inflation. OPEC+ members, notably Saudi Arabia and Russia, have decided to reduce oil production, and dwindling U.S. oil reserves are putting continued pressure on oil prices.

This has led to a rare alignment of interests between Western nations and Iran, temporarily allowing Iran to significantly increase its oil production from 0.5 million to 3 million barrels per day. However, a potential problem arises if Iran openly supports Hamas in its conflict with Israel. This could trigger a Western response, possibly reinstating stringent sanctions on Iran.

Additionally, it’s crucial to monitor the situation at the Strait of Hormuz, currently under Iranian control, as any disruption in its operation could be another factor that leads to a substantial spike in oil prices.

Could a 1970s-Esque Crisis Repeat?

The recent events may draw comparisons to the oil crisis of the 1970s when the Yom Kippur War saw Israel in conflict with Syria and Egypt. During that time, OPEC imposed an embargo on countries like the United States and the Netherlands for supporting Israel, leading to a surge in oil prices from $2.90 to over $11 per barrel.

However, the likelihood of a similar scenario unfolding today is greatly reduced. Statements from key players, including the United Arab Emirates, suggest that the Israel-Hamas conflict will not significantly impact OPEC’s decisions, as the cartel is primarily motivated by economic rather than political interests.

Nonetheless, it’s essential to remain cautious, as an escalation of the conflict involving other Middle Eastern countries could lead to an extended period of oil prices staying above $100 per barrel.

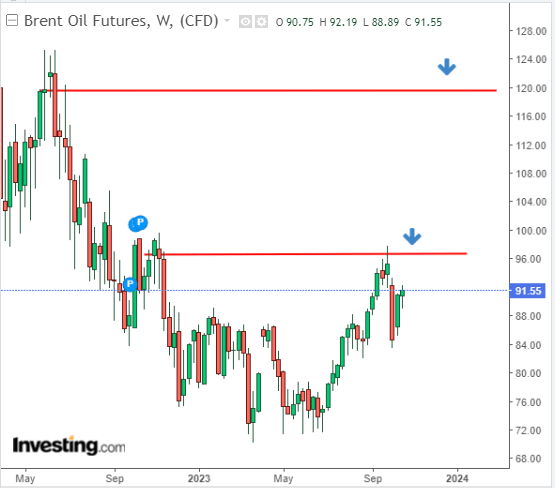

Technical View: Brent Oil Back Above $90

Brent crude oil prices continue their upward rebound, which was confirmed in the short term by the top breakout from the local flag formation.

Brent Oil Weekly Chart

Brent Oil Weekly Chart

The first target for buyers remains the previously tested supply zone located in the $97 per barrel price area. If the indicated resistance is knocked out, an attack on targets already above $100 will be the base scenario.

Brent Oil Hourly Chart

Brent Oil Hourly Chart

The negation of the uptrend should be a descent below the support in the area of $89.

***

Find All the Info You Need on InvestingPro!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered investment advice.

Source: Investing.com