RCL

-2.96%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

UBER

-1.59%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CRWD

+0.79%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US500

-0.80%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Wall Street’s Q3 earnings season kicks into high gear this week.

Despite the bleak forecast, there is a select group of companies poised to deliver explosive profit growth.

Investors should consider buying Uber Technologies, CrowdStrike, and Royal Caribbean Cruises.

Looking for more actionable trade ideas to navigate the current market volatility? Members of InvestingPro get exclusive ideas and guidance to navigate any climate. Learn More »

Wall Street’s third quarter earnings season kicks into high gear this week, with some of the biggest names in the market set to report their latest results.

Analysts expect Q3 S&P 500 earnings to fall 0.3% year-over-year, which, if confirmed, would mark the fourth consecutive quarter of annual earnings declines reported by the index.

While most of the focus will be on the mega-cap technology stocks, like Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), Tesla (NASDAQ:TSLA), and Nvidia (NASDAQ:NVDA), there are several fast-growing names set to enjoy explosive earnings growth thanks to surging demand for their products and services.

Here are three names worth owning ahead of their quarterly reports in the weeks ahead.

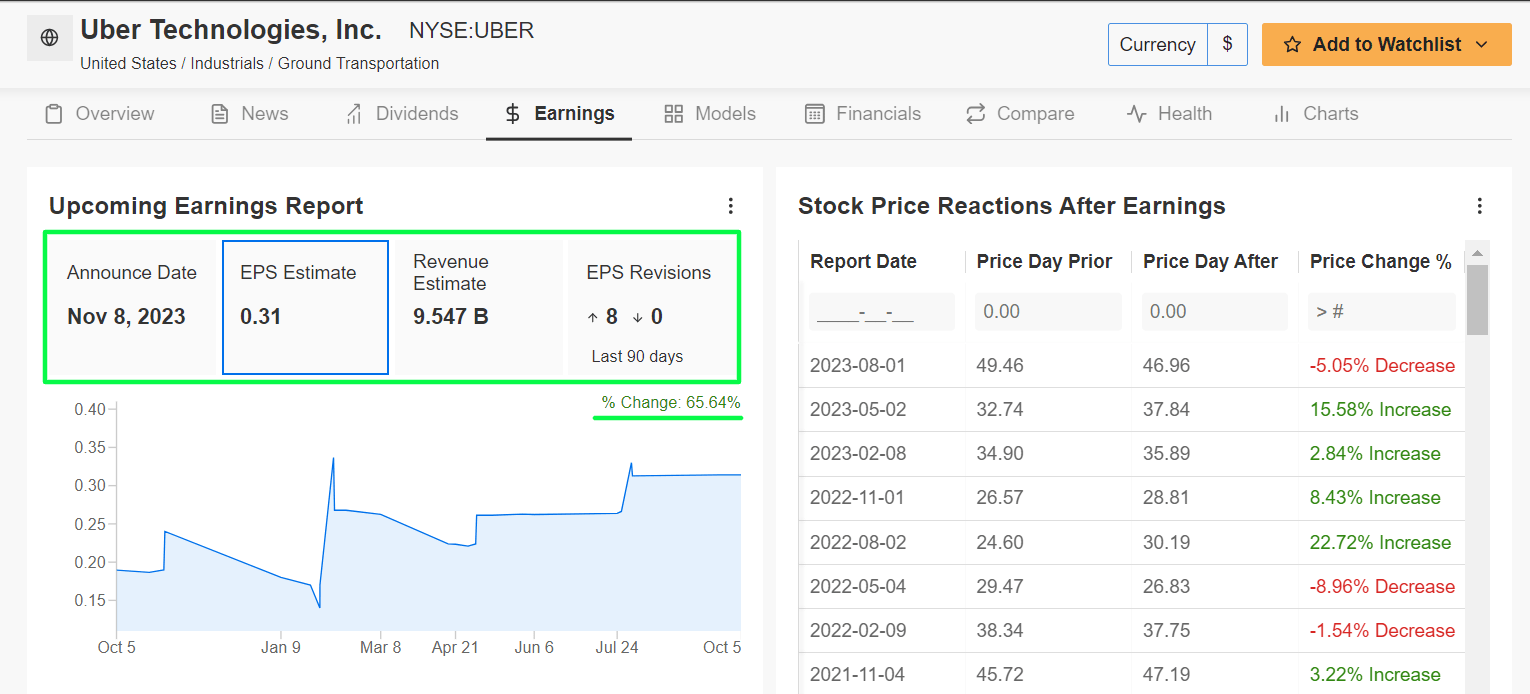

1. Uber Technologies

Year-To-Date Performance: +79.5%

Market Cap: $90.7 Billion

Uber Technologies (NYSE:UBER) has experienced a strong and sustained rally this year as the ride-hailing giant has proved that it can thrive in a challenging environment. In contrast with many other high-growth companies, Uber is generating solid profits and cash flow as more people use its transportation and food delivery services.

The next major catalyst is expected to arrive when Uber reports third-quarter earnings on Wednesday, November 8 and it is expected to shatter its sales record once again despite the existing inflationary and recessionary economic climate.

Wall Street is extremely optimistic ahead of the Q3 update, as per an InvestingPro survey, with analysts increasing their EPS estimates eight times in the past three months to reflect a gain of 65% from their initial expectations.

Uber EarningsSource: InvestingPro

Uber EarningsSource: InvestingPro

The ridesharing and delivery specialist is forecast to earn $0.31 per share, improving significantly from a loss of $0.61 per share in the year-ago period, thanks to ongoing cost-cutting measures and improving mobility trends.

Meanwhile, revenue is seen increasing 15% year-over-year to $9.55 billion. If that is in fact the reality, it would mark Uber’s highest quarterly sales total in its history thanks to strong demand from customers who continued to hail rides and order takeout food despite the current macro environment.

Shares of the San Francisco, California-based mobility-as-a-service company have run about 80% higher so far in 2023, far outpacing the comparable returns of major industry peer, Lyft (NASDAQ:LYFT), whose stock is down 2% over the same timeframe.

Even with the recent upswing, UBER stock, which closed last night’s session at $44.38, could see an increase of roughly 19%, according to InvestingPro, bringing shares closer to their ‘Fair Value’ of $52.71.

Uber Fair ValueSource: InvestingPro

Uber Fair ValueSource: InvestingPro

Additionally, more than three quarters of analysts surveyed by Investing.com rate UBER at the equivalent of a ‘buy’ rating, with an average price target of around $58, implying upside of 30.5% from recent trading levels.

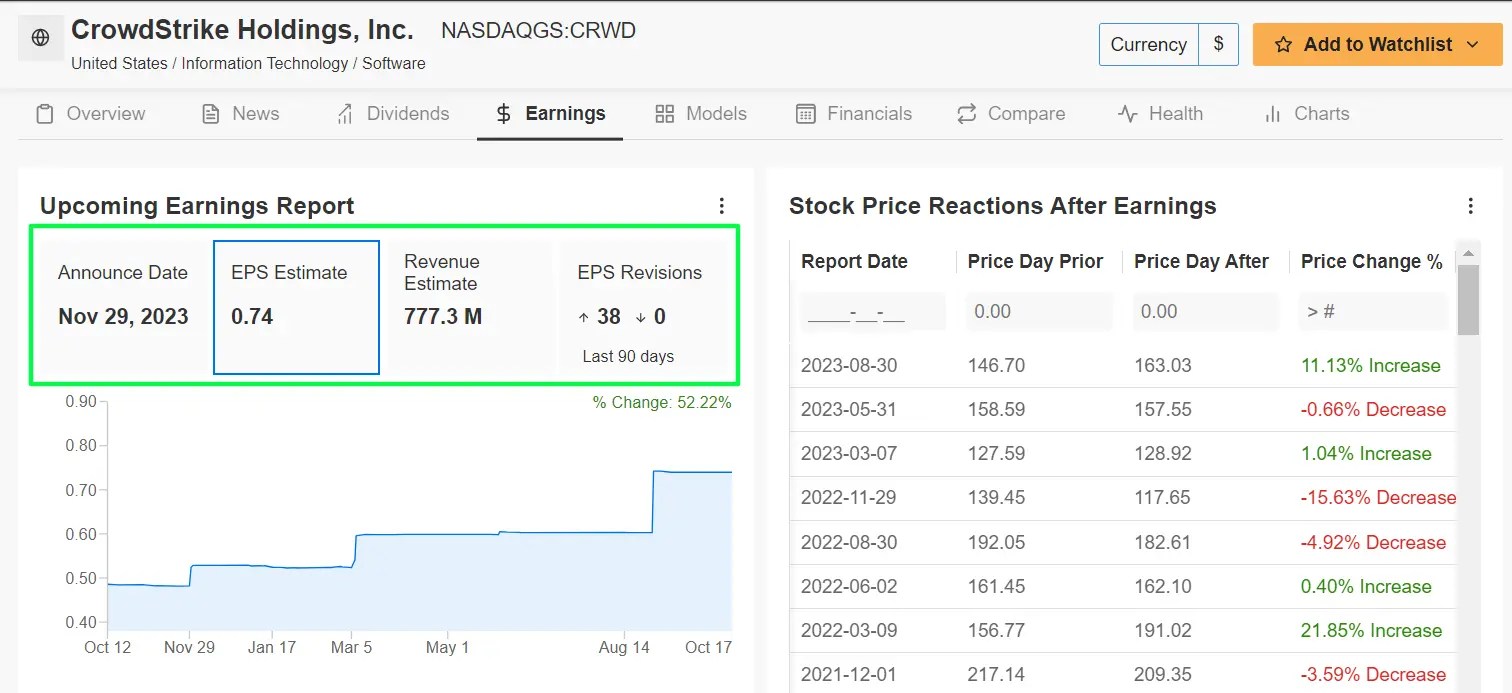

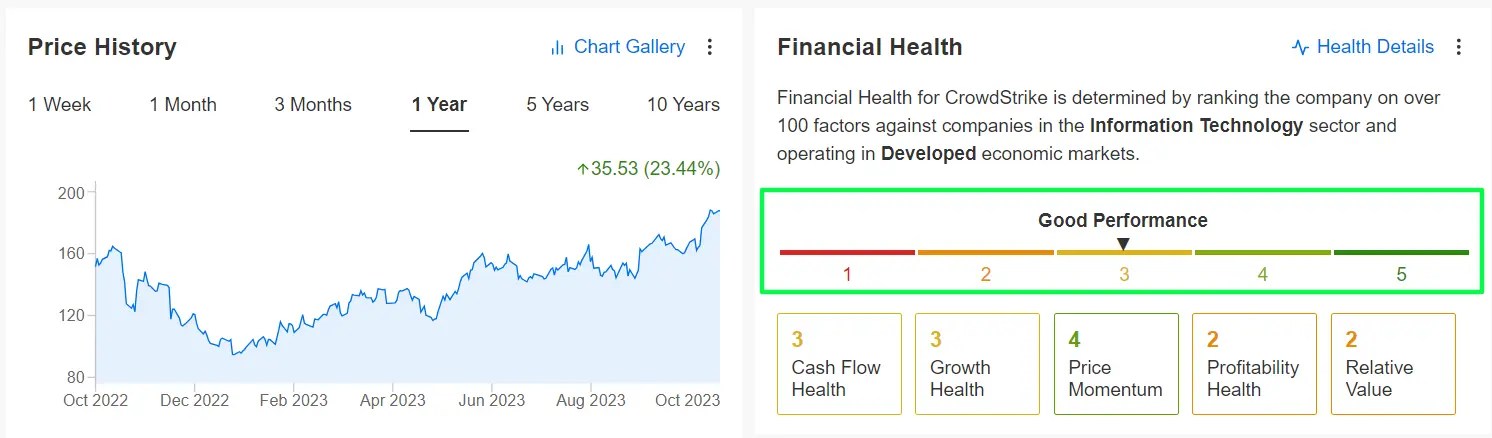

2. CrowdStrike

Year-To-Date Performance: +77.7%

Market Cap: $44.7 Billion

Widely viewed as one of the leading names in the cloud-based cybersecurity industry, I believe CrowdStrike’s stock is well worth buying amid the current market backdrop.

CrowdStrike (NASDAQ:CRWD) is anticipated to deliver explosive profit and sales growth when it reports third quarter financial results on Wednesday, November 29, as it benefits from favorable cybersecurity demand trends.

Earnings estimates have been revised upward 38 times in the past 90 days, according to an InvestingPro survey, compared to zero downward revisions, as Wall Street grows increasingly bullish on the cybersecurity company.

CrowdStrike EarningsSource: InvestingPro

CrowdStrike EarningsSource: InvestingPro

Consensus calls for earnings of $0.74 per share, improving 85% from EPS of $0.40 in the year-ago period. Revenue is forecast to increase 34.8% to a record $777.3 million thanks to growing demand for its cloud-based cybersecurity platform, which is used to detect and prevent security breaches.

The Austin, Texas-based information security specialist has topped Wall Street’s expectations for earnings and revenue in every quarter since it went public in June 2019, underlining the strength of its underlying business.

CrowdStrike – which provides cloud workload and endpoint security, advanced threat intelligence, and sophisticated cyberattack response services – has been one of the main beneficiaries of the surge in cyber spending from corporations and governments around the world as they respond to growing digital security threats.

src=Source: InvestingPro

src=Source: InvestingPro

CRWD stock has been on a tear in 2023, with shares up nearly 78% year-to-date, as high-growth tech shares have come back in favor following last year’s brutal selloff. The endpoint security leader has a market cap of $45 billion as of Tuesday’s closing price of $187.14.

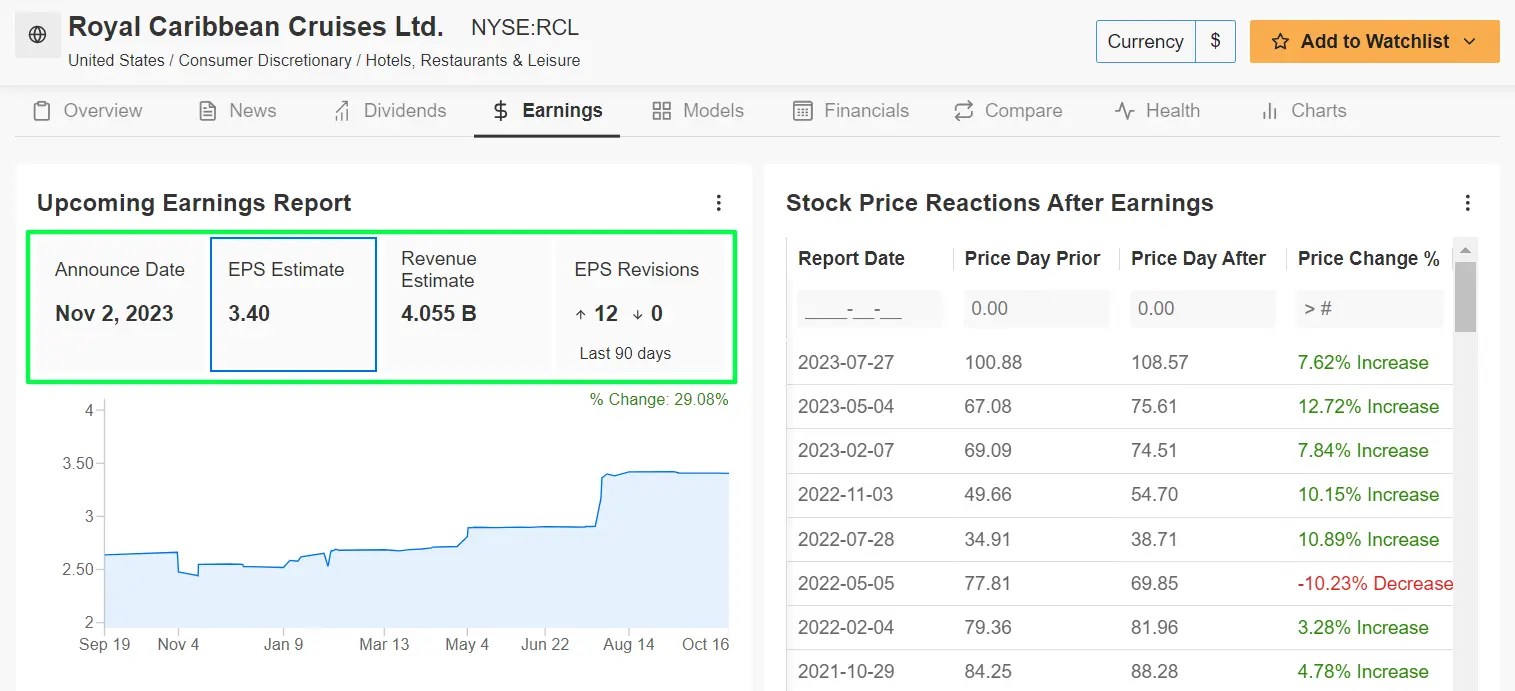

3. Royal Caribbean Cruises

Year-To-Date Performance: +75%

Market Cap: $22.2 Billion

Royal Caribbean (NYSE:RCL) Cruises has also had excellent momentum this year and should continue appreciating as it grows earnings, making the cruise operator a buy ahead of its third quarter earnings report.

The Miami, Florida-based company, which is the world’s largest cruise liner, is forecast to report a more than 1,000% increase in profit growth for its July-September quarter.

Not surprisingly, an Investing Pro survey of analyst earnings revisions points to mounting optimism ahead of the print – which is due on Thursday, November 2 – with Wall Street growing increasingly bullish on the cruise giant.

The last 12 EPS revisions from analysts have all been to the upward side and 15 analysts have a Buy-equivalent rating on the stock vs. seven Hold-equivalent ratings and zero Sell-equivalent ratings.

Royal Caribbean Cruises EarningsSource: InvestingPro

Royal Caribbean Cruises EarningsSource: InvestingPro

Wall Street sees the cruise giant earning $3.40 a share, soaring 1,200% from EPS of $0.26 in the year-ago period. If confirmed, it would mark Royal Caribbean’s most profitable quarter in four years as profitability trends continue to recover from the Covid-19 pandemic amid the ongoing improvement in travel demand.

The travel company is also expected to deliver record for quarterly revenue of $4.05 billion, up 35.2% annually, as travelers flock to its cruises amid the current macro environment.

Cruise line stocks have surged this year as they benefit from pent-up demand for international travel delayed by pandemic lockdowns. Royal Caribbean’s shares have gained 75% year-to-date, Carnival (NYSE:CCL) has risen 55%, and Norwegian Cruise Line (NYSE:NCLH) Holdings is up around 24%.

Royal Caribbean Cruises Fair ValueSource: InvestingPro

Royal Caribbean Cruises Fair ValueSource: InvestingPro

With that being noted, RCL stock is still cheap according to a number of valuation models on InvestingPro, with the average ‘Fair Value’ price target pointing to a potential upside of 16.4% from the current market value of $86.50.

***

With InvestingPro, you can conveniently access a single-page view of complete and comprehensive information about different companies all in one place, eliminating the need to gather data from multiple sources and saving you time and effort.Sign Up for a Free Week Now!

Disclosure: At the time of writing, I am long on the Dow Jones Industrial Average, the S&P 500, and the Nasdaq 100 via the SPDR Dow ETF (DIA), the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). Additionally, I have a long position on the Energy Select Sector SPDR ETF (NYSE:XLE) and the Health Care Select Sector SPDR ETF (NYSE:XLV).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Source: Investing.com