BLK

-0.14%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

BX

+1.35%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

ABNB

+2.03%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

The cost of housing remains a hot-button topic with both Millennials and Gen-Z. Plenty of articles and commentaries address the concern of supply and affordability, with the younger generations getting hit the hardest. Such was the subject of this recent CNET article:

“The housing affordability crisis means it’s taking longer for people to become homeowners — and that’s especially impacting millennials and Gen Zers, economically disadvantaged families, and minority groups. There’s not one single driver of the crisis, but several colliding elements that put homeownership out of reach: rising home prices, high mortgage interest rates and limited housing supply. That’s on top of myriad financial challenges, including sluggish wage growth and increasing student loan and credit card debt among middle-income and low-income Americans.”

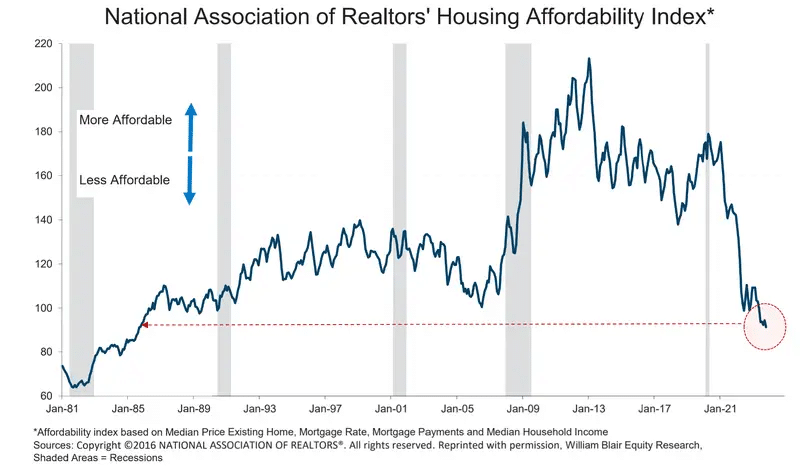

The chart below of the housing affordability index certainly supports those claims.

Housing Affordability Index

Housing Affordability Index

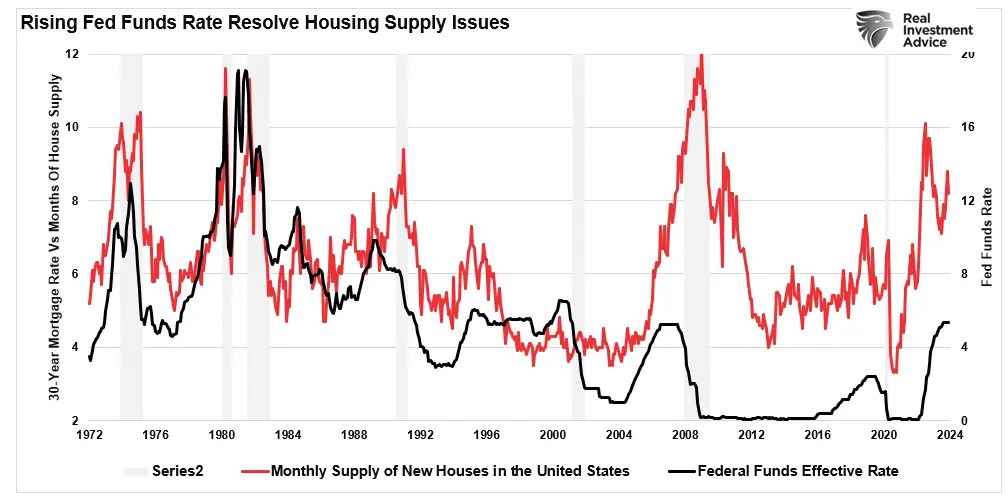

As noted by CNET, there are many apparent reasons causing housing to be unaffordable, from a lack of supply to increased mortgage rates and rising prices. Over the last couple of years, as the Fed aggressively hiked interest rates, the supply of homes on the market has grown.

Such is because higher interest rates lead to higher mortgage rates and higher monthly payments for homes. It is also worth noting that previously when the supply of homes exceeded eight months, the economy was in a recession.

Rising Fed Funds vs Housing Supply

Rising Fed Funds vs Housing Supply

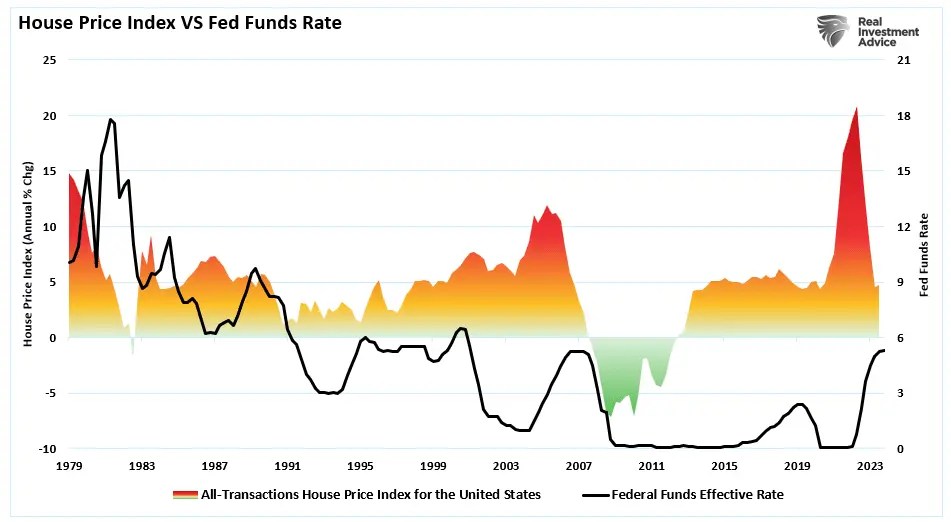

At the same time, higher interest rates and increased supply should equate to lower home prices and, therefore, create more “affordability.” As shown, such was the case in prior periods, but post-pandemic housing prices skyrocketed as “stimulus checks” fueled a rash of buyers.

Housing Prices vs Fed Funds Rate

Housing Prices vs Fed Funds Rate

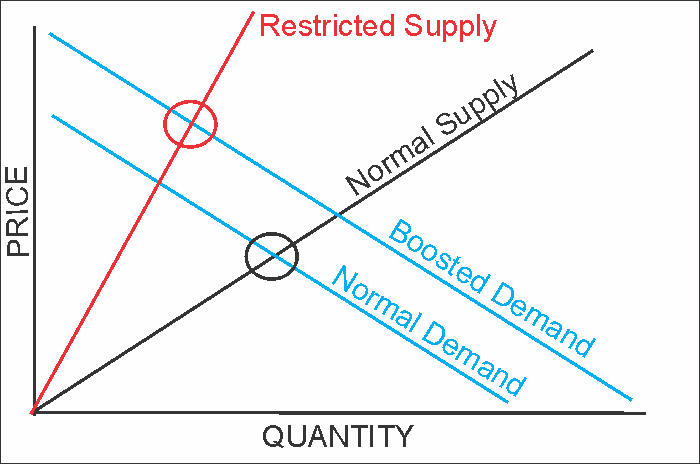

As is always the case with everything in economics, price is ALWAYS a function of supply versus demand.

A Host Of Bad Decisions Created This Problem

The following economic illustration is taught in every “Econ 101” class. Unsurprisingly, inflation is the consequence if supply is restricted and demand increases.

Supply/Demand Chart

Supply/Demand Chart

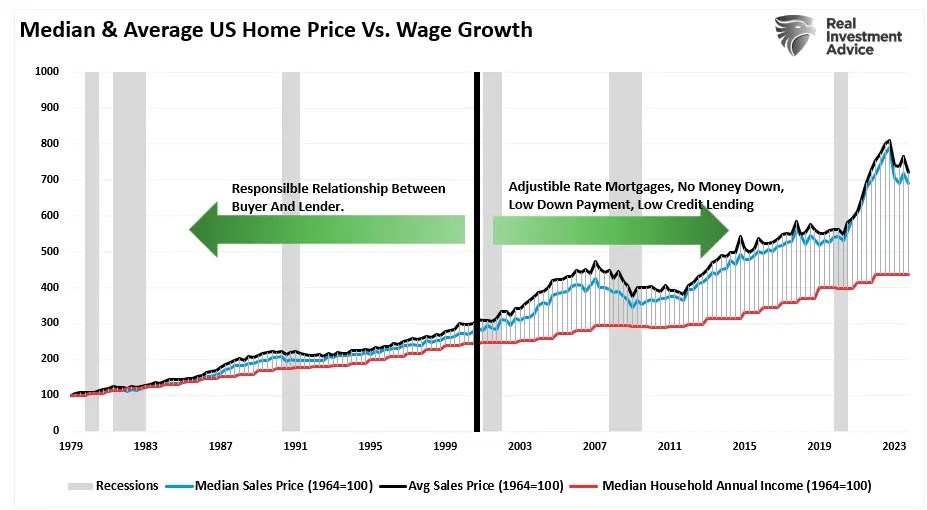

While such was the case following the economic shutdown in 2020, the current housing affordability problem is a function of bad decisions made at the turn of the century. Before 2000, the average home buyer needed good credit and a 20% down payment. Those constraints kept demand and supply in balance to some degree. While housing increased with inflation, median household incomes could keep pace.

However, in the late 90s, banks and realtors lobbied Congress heavily to change the laws to allow more people to buy homes. Alan Greenspan, then Fed Chairman, pushed adjustable-rate mortgages, mortgage companies began using split mortgages to bypass the need for mortgage insurance, and credit requirements were eased for borrowers. By 2007, mortgages were being given to subprime borrowers with no credit and no verifiable sources of income. These actions inevitably led to increased demand that outpaced available supply, pushing home prices well above what incomes could afford.

Median & Avg Home Price vs Incomes

Median & Avg Home Price vs Incomes

This episode in the housing market resulted from zero-interest policies by the Federal Reserve. That policy and massive liquidity injections into the financial markets brought hoards of speculators, from individuals to institutions.

Institutional players like Blackstone (NYSE:BX), Blackrock (NYSE:BLK), and many others purchased 44% of all single-family homes in 2023 to turn them into rentals. As prices rose, advances like AirBnB (NASDAQ:ABNB) brought more demand from individuals for rentals, further reducing the available housing pool. Those influences lead to even higher prices for available inventory.

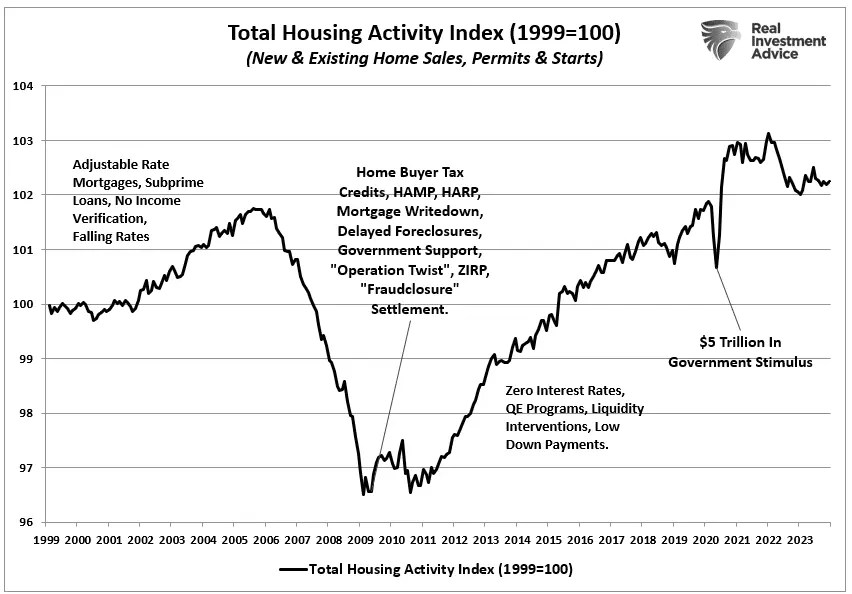

Notably, it isn’t a lack of housing construction. The Total Housing Activity Index is not far from its all-time highs following the 2020 pandemic “housing rush.” The issue is the removal of too many homes by “non-home buyers” from the available inventory.

Total Housing Activity Index

Total Housing Activity Index

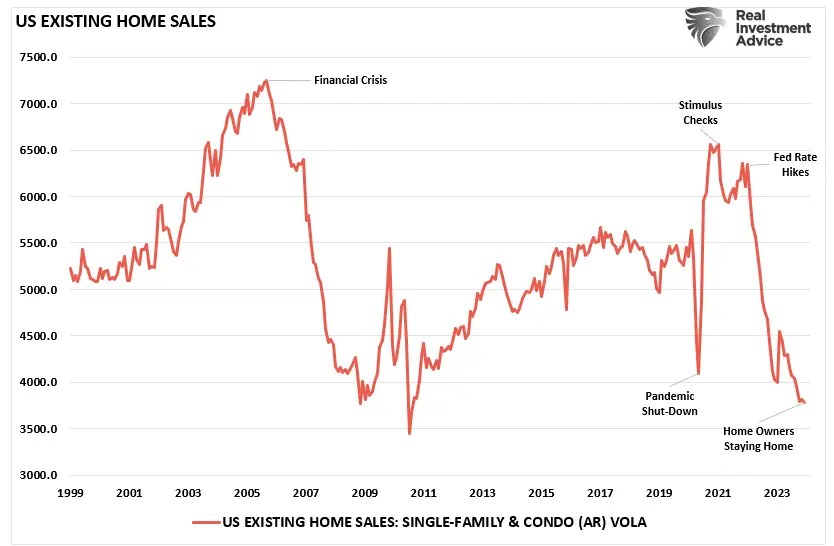

Furthermore, existing home sales are absent. Current homeowners are unwilling to sell homes with a 4% mortgage rate to buy a home with a 7% mortgage. As shown, existing home sales remain remarkably absent.

US Existing Home Sales

US Existing Home Sales

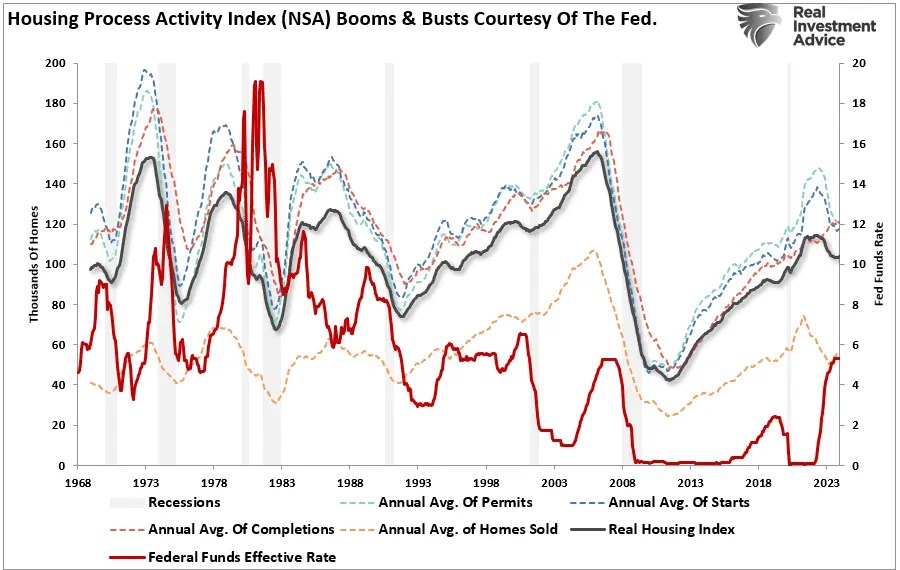

All of these actions have exacerbated the problem. At the root of it all is the Federal Reserve, keeping interest rates too low for too long. Oversupplying liquidity and creating repeated surges in home prices. It is not a far stretch to realize the bulk of the housing problem directly results from Governmental forces.

Housing Process Activity Index vs Fed Funds

Housing Process Activity Index vs Fed Funds

What’s the Solution?

Sen. Elizabeth Warren and three other lawmakers are pushing Jerome Powell to lower interest rates at the upcoming Fed meeting to make housing more affordable.

“As the Fed weighs its next steps in the new year, we urge you to consider the effects of your interest rate decisions on the housing market. The direct effect of these astronomical rates has been a significant increase in the overall home purchasing cost to the average consumer.” – Letter To Jerome Powell

As discussed above, lowering interest rates is not the solution to lowering housing prices. Lower interest rates would bring more buyers into a market already short inventory, thereby increasing home prices.

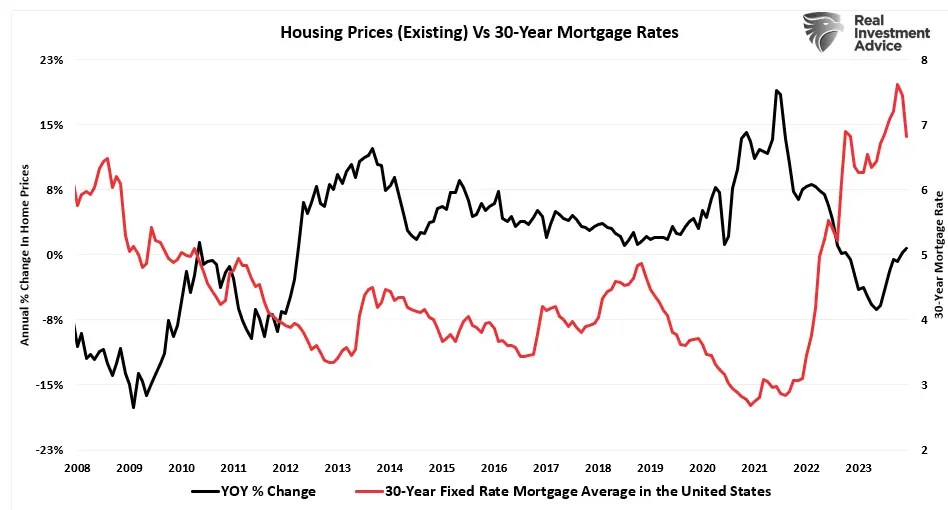

We can already see the impact of lower mortgage rates on home prices just since October. Prices rose as yields fell on hopes the Federal Reserve would cut rates in 2024. If mortgage rates revert to 4%, where they were during most of the last decade, home prices will significantly increase.

Housing Prices vs 30-Year Mortgage Rates

Housing Prices vs 30-Year Mortgage Rates

There is only one solution to return home prices to affordability for most of the population. That is to reduce the existing demand. Here are a few measures that could help solve the problem:

Restrict corporate and institutional interests from buying individual homes.

Increase the lending standards to require a minimum 15% down payment and a good credit score. (such would also increase the stability of banks against another housing crisis.)

Increase the debt-to-income ratios for home buyers.

Return the mortgage market to straight fixed-rate mortgages. (No adjustable rate, split, etc.)

Require all banks that extend mortgages to hold 25% of the mortgage on their books.

Yes, those are very tough standards to meet and initially would exclude many from home ownership. But, home ownership should be a demanding standard to meet, as the cost of home ownership is high.

For the individual, such standards would ensure that home ownership is feasible and that such ownership, along with the subsequent fees, taxes, maintenance costs, etc., would still allow for financial stability. For the lenders, it would reduce the liability of another financial crisis to almost zero, as the housing market’s stability would be inevitable.

But most importantly, such strict standards would immediately cause an evaporation of housing demand. With a complete lack of demand, housing prices would fall and reverse the vast appreciation caused by a decade of fiscal and monetary largesse. Yes, it would be a very tough market until those excesses reverse, but such is the consequence of allowing banks and institutions to run amok in the housing market.

Source: Investing.com