PANW

+5.33%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DBX

+3.18%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Some stocks were punished by the market despite satisfactory results.

In hindsight, it looks like investors have overreacted to earnings that weren’t so bad.

Could this be a buying opportunity?

In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Some companies reported stronger-than-expected numbers this earnings season and rallied. Meanwhile, others fell short of expectations and faced selling pressure as markets went on to punish them.

However, that doesn’t necessarily imply that stocks that faced post-earnings selloffs are no longer fit for long-term performance. As matter of fact, oftentimes, some of the best gains will come from finding stocks that are being unfairly punished.

This article delves into such unique scenario – i.e., companies that exceeded consensus forecasts for their financial performance but still received negative reactions from the stock market.

We’ll delve deep into why the market responded negatively and evaluate whether the reaction was warranted. By doing so, we aim to determine if these stocks present promising buying opportunities.

Let’s dig in:

1. Palo Alto

Fall in the session following Q4 results: -28.5%

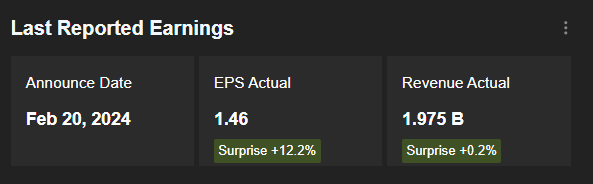

Cybersecurity company Palo Alto (NASDAQ:PANW) reported satisfactory financial results on February 20, beating analysts’ consensus on both EPS and sales.

Palo Alto Previous Earnings

Palo Alto Previous Earnings

Source : InvestingPro

However, the company also said it expected EPS of between $1.24 and $1.26 on sales of $1.95 to $1.98 billion for the next quarter, below analysts’ forecasts of $1.29 per share on sales of $2.04 billion.

Forecasts were therefore only marginally disappointing, which might make it seem like the market’s reaction was appropriate.

However, an analysis of the stock using InvestingPro data indicates that this isn’t the case.

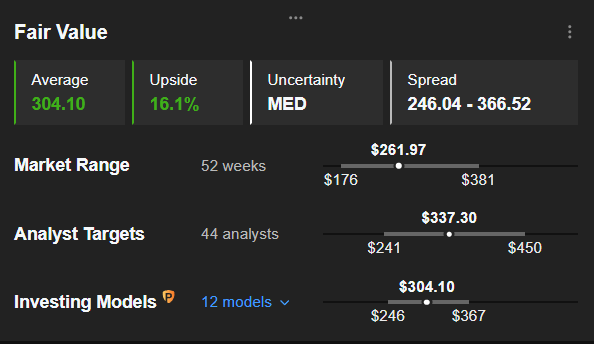

The Palo Alto Fair Share Value, which synthesizes 12 recognized financial models, values the stock at $304.1, more than 16% above Wednesday’s closing price.

Palo Alto Fair Value

Palo Alto Fair Value

Source : InvestingPro

In addition, the 44 professional analysts who follow the stock display an average target of $337.30, translating into a bullish potential of over 28%.

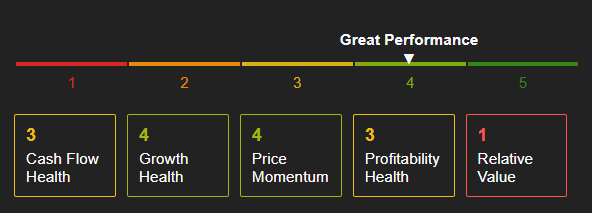

Score

Score

Source : InvestingPro

The stock’s InvestingPro health score, rated very good at 3.07, is another reason to be optimistic about the stock.

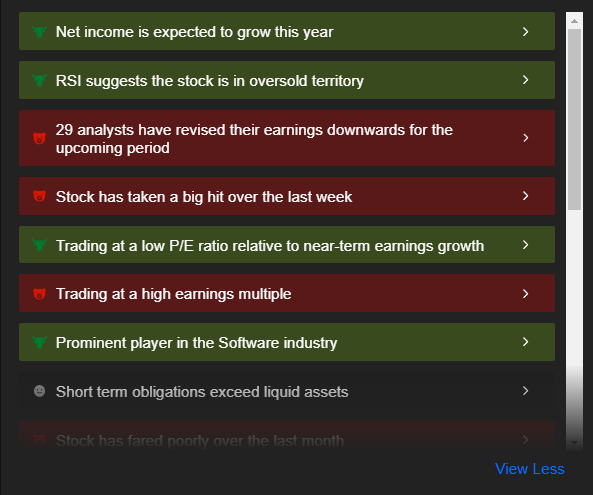

As are the InvestingPro ProTips, which highlight several major strengths (alongside a few weaknesses):

ProTips Palo Alto

ProTips Palo Alto

Source : InvestingPro

2. Dropbox

Fall in the session following Q4 earnings release: -22.62%

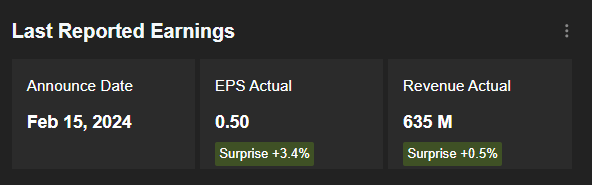

File-sharing and collaboration platform Dropbox’s (NASDAQ:DBX) stock was also hit hard by the market following better-than-expected results.

Dropbox Earnings

Dropbox Earnings

Source : InvestingPro

However, these satisfactory results were accompanied by forecasts that were below expectations.

CFO Tim Regan told analysts that the company expected full-year sales for 2024 to be between $2.535 billion and $2.55 billion, below the consensus figure of $2.57 billion.

The forecasts announced by the company therefore proved only marginally disappointing, suggesting that the market’s strongly bearish reaction was motivated more by profit-taking than any real disappointment.

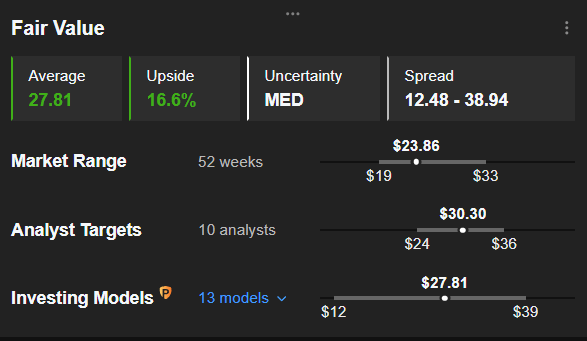

Against this backdrop, an opportunity could be just around the corner. Analysts seem to agree: they have set a target of $30.30 for Dropbox stock, i.e. 27% above the current price.

Dropbox Fair Value

Dropbox Fair Value

Source : InvestingPro

The InvestingPro models, though more conservative, also point to a solid upside potential of 16.6%, with a target of $27.81.

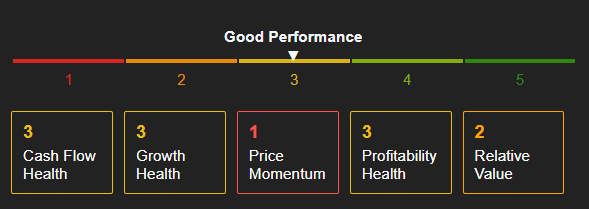

In contrast to Palo Alto, Dropbox’s financial health score is average.

Score

Score

Source : InvestingPro

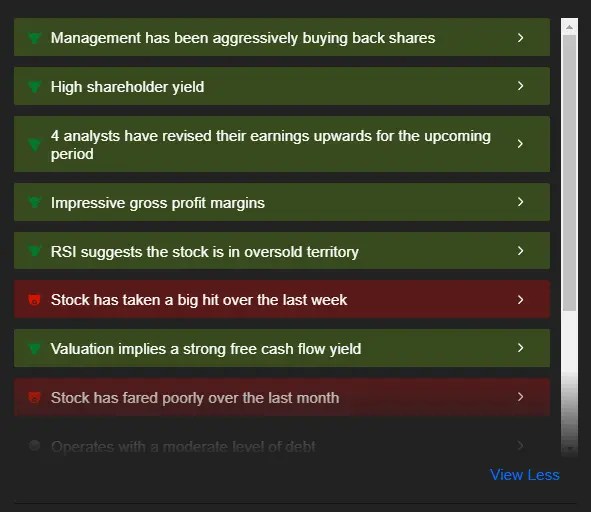

However, this does not prevent the stock from displaying several major strengths, as highlighted by the InvestingPro ProTips for the stock, which are almost unanimously positive:

ProTips Dropbox

ProTips Dropbox

Source : InvestingPro

Conclusion

Palo Alto and Dropbox are two stocks that seem to have been excessively punished by the market for forecasts that were marginally below expectations.

Current prices on these stocks are therefore good levels for those looking to accumulate. However, further technical analysis would paint a clearer picture for an entry point.

***

SPECIAL OFFER: As a reader of our articles, you are eligible for a special offer for our InvestingPro stock market strategy and fundamental analysis platform at a discounted rate of 10%, thanks to the promo code “ACTUPRO”, valid for 1 and 2-year Pro+ and Pro subscriptions!

You’ll know which stocks to buy and which to sell to outperform the market and boost your investments, thanks to a host of exclusive tools.

These tools, which have already proved their worth with thousands of investors, will meet the expectations of those looking for turnkey solutions and advice, as well as those wishing to research and select stocks for their portfolios.

ProPicks: equity portfolios managed by a fusion of AI and human expertise, with proven performance.

ProTips: Digestible information to simplify masses of complex financial data into a few words.

Exclusive pro news: To understand what’s going on in the market before anyone else.

Fair Value and Health Score: 2 summary indicators based on financial data that instantly reveal the potential and risk of each stock.

Advanced stock screener: Search for the best stocks according to your expectations, taking into account hundreds of financial metrics and indicators available on InvestingPro.

Historical data for thousands of metrics on tens of thousands of global stocks: To enable fundamental analysis pros to dig into all the details themselves.

And many more services, not to mention those we plan to add soon!

Don’t face the market alone, and arm yourself with tools that will help you make the right stock market decisions and get your portfolio off the ground, whatever your level or expectations.  Subscribe Today!

Subscribe Today!

Click here to subscribe, and don’t forget the promo code “ACTUPRO”, valid for 1 and 2-year Pro and Pro+ subscriptions!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple perspectives and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.

Source: Investing.com