BTC/USD

+5.64%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IBIT

+5.71%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Bitcoin continued rallying and reached its highest level since November 2021.

Significant inflows into Bitcoin spot ETFs have set volume records and aided the rally.

Beyond ETF success, Bitcoin’s upward momentum is linked to the upcoming halving in April and favorable economic data.

In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Bitcoin surged for the third consecutive day, approaching the $64,000 mark in early market trading today, marking its highest level since November 2021 as bulls continue their march toward all-time highs near $68,900.

This recent surge can be attributed to familiar bullish factors that have supported the prices in previous weeks, including substantial inflows into Bitcoin ETF spot funds.

BlackRock’s iShares Bitcoin Trust (NASDAQ:IBIT) set a volume record for the third consecutive day, with shares worth around $3.3 billion changing hands in a single day.

This is over twice the previous record of $1.35 billion set on Tuesday, which itself surpassed the Monday record of $1.3 billion.

Ten BTC spot ETF funds recorded a total trading volume of $7.7 billion, surpassing the previous record of $4.7 billion set on January 11, the first day of trading.

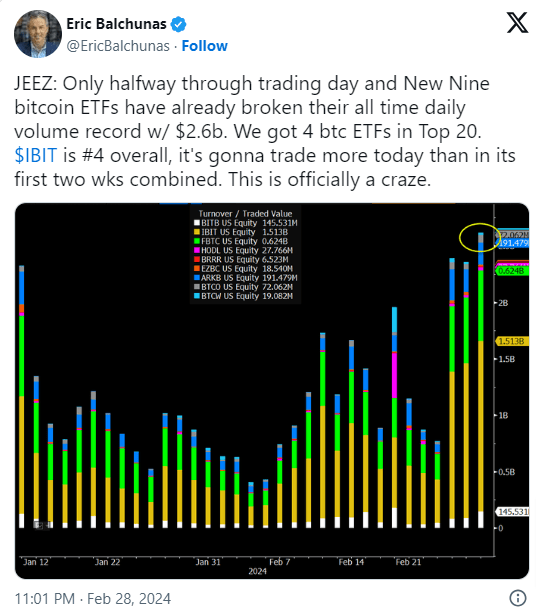

Eric Balchunas, an ETF fund specialist at Bloomberg, described these numbers as “absurd” and labeled them “madness” in a post on X.

Tweet

Tweet

Source: Eric Balchunas

Will the Fund Inflow Continue to Soar, Pushing Bitcoin Higher?

It appears that this success will likely grow even further as Wall Street giant Morgan Stanley also plans to add Bitcoin ETF products to its brokerage platform.

While billions of dollars have already been invested in these products, their availability through major registered investment advisor (RIA) networks and broker-dealer platforms, such as those associated with Merrill Lynch, Morgan Stanley, Wells Fargo, and others, may further amplify this success.

Halving to Fuel Bullish Sentiment as Well

Bitcoin’s price rally and the success of BTC ETF funds are also linked to the anticipation of the upcoming halving in April. This event, which occurs approximately every four years and involves a 50% reduction in mining revenues, has historically had a strong impact on Bitcoin, both in anticipation and aftermath.

In addition to ETFs and halving, it’s worth noting that Bitcoin benefited from slightly lower-than-expected U.S. GDP yesterday, which revived expectations for a Federal Reserve interest rate cut. In this context, Thursday’s expected PCE price index may have an even greater impact on these expectations.

Key Levels to Monitor for Dip-Buying

Finally, from a chart perspective, the initial crucial support for Bitcoin is the $60,000 threshold, but a correction could go much lower without questioning the bullish sentiment, given the recent surge. Therefore, any BTC declines can be considered buying opportunities, as long as the cryptocurrency does not drop below $55,000.

***

As a reader of our articles, you are eligible for a special offer for our InvestingPro stock market strategy and fundamental analysis platform at a discounted rate of 10%, thanks to the promo code “ACTUPRO”, valid for 1 and 2-year Pro+ and Pro subscriptions!

You’ll know which stocks to buy and which to sell to outperform the market and boost your investments, thanks to a host of exclusive tools.

These tools, which have already proved their worth with thousands of investors, will meet the expectations of those looking for turnkey solutions and advice, as well as those wishing to research and select stocks for their portfolios.

ProPicks: equity portfolios managed by a fusion of AI and human expertise, with proven performance.

ProTips: Digestible information to simplify masses of complex financial data into a few words.

Exclusive pro news: To understand what’s going on in the market before anyone else.

Fair Value and Health Score: 2 summary indicators based on financial data that instantly reveal the potential and risk of each stock.

Advanced stock screener: Search for the best stocks according to your expectations, taking into account hundreds of financial metrics and indicators available on InvestingPro.

Historical data for thousands of metrics on tens of thousands of global stocks: To enable fundamental analysis pros to dig into all the details themselves.

And many more services, not to mention those we plan to add soon!

Don’t face the market alone, and arm yourself with tools that will help you make the right stock market decisions and get your portfolio off the ground, whatever your level or expectations.

Subscribe Today!

Subscribe Today!

Click here to subscribe, and don’t forget the promo code “ACTUPRO”, valid for 1 and 2-year Pro and Pro+ subscriptions!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple perspectives and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.

Source: Investing.com