Tuesday, 10 November 2015 13:34

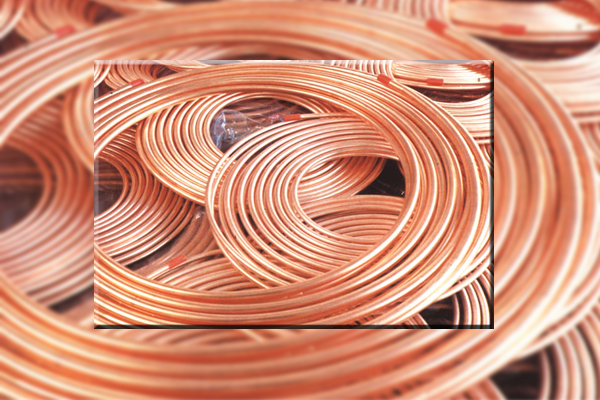

MANILA: London copper futures fell to their weakest since August on Tuesday, moving closer to a six-year low amid a firmer dollar and prolonged economic weakness in top metals consumer China.

MANILA: London copper futures fell to their weakest since August on Tuesday, moving closer to a six-year low amid a firmer dollar and prolonged economic weakness in top metals consumer China.

Copper has dropped more than 21 percent this year and is on track for a third annual decline, with industrial commodities falling out of favour as China’s economy slows.

Three-month copper on the London Metal Exchange fell as far as $ 4,915 a tonne, its weakest since Aug. 26. It was near this year’s low of $ 4,855 also reached in August, which was copper’s cheapest price since 2009. The metal was down 0.4 percent at $ 4,946 at 0706 GMT.

“The market’s pricing in a worst-case scenario (on China’s economic slowdown) and that’s why we don’t really see any significant upside to copper prices,” said Daniel Hynes, senior commodity strategist at ANZ Bank.

“While further supply cuts will be supportive, it only does so much to provide some impetus for recovery. You really need demand to show signs of stabilising and picking up before the market will get comfortable.”

Glencore said last week it expected to cut 455,000 tonnes of copper output by the end of 2017. In September, it suspended copper production at two mines in Africa, removing 400,000 tonnes of cathode from the market.

The most-traded January copper contract on the Shanghai Futures Exchange on Tuesday dropped 0.7 percent to end at 37,570 yuan ($ 5,908) a tonne.

China is making 6.5 percent a floor or minimum level for annual economic growth in 2016 through 2020, a senior Chinese policymaker said on Monday, adding that the figure would be a base for setting a target for the five-year period.

A stronger US dollar is also weighing on copper and other dollar-priced commodities after robust US employment data on Friday nearly cemented expectations that the Federal Reserve will raise interest rates next month.

That would be the first hike in almost a decade and the dollar hovered close to a seven-month peak against a basket of major currencies.

Other metals also fell, with LME aluminium down 0.8 percent at $ 1,497.50 a tonne and zinc off 1.6 percent to $ 1,618. Zinc fell to as low as $ 1,606.50, within sight of a five-year trough of $ 1,601.50 touched in September.

Shanghai aluminium slid nearly 3 percent to 10,270 yuan a tonne and zinc lost 2.2 percent to 13,1225 yuan.