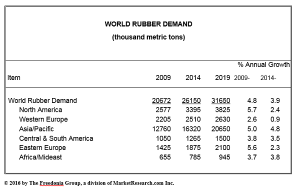

Cleveland, Ohio – World demand for rubber is to rise 3.9 percent per year to 31.7 million tonnes by 2019, according to a recent report by US-based industry market research firm Freedonia Group.

According to the report, gains will be driven by increased tire manufacturing, which represents the largest application for rubber.

Rising income levels in developing regions, particularly in the Asia/Pacific region, will support gains in motor vehicle manufacturing and usage, fueling demand for tires and, in turn, rubber.

“Growth in manufacturing activity will also support increased demand for rubber in non-tire applications such as automotive components, industrial rubber products, medical products, and footwear,” said analyst Elliott Woo.

The report projects that Asia/Pacific will post the fastest growth in rubber consumption through 2019 and will account for nearly two-thirds of global demand in that year.

The report projects that Asia/Pacific will post the fastest growth in rubber consumption through 2019 and will account for nearly two-thirds of global demand in that year.

“Through 2019, six of the seven fastest growing national rubber markets worldwide – with Iran as the seventh – will be located in the Asia/Pacific region,” said the report.

Indonesia, India, and Thailand are expected to show the fastest growth, while demand for rubber in China, Malaysia, and Vietnam will also advance rapidly, benefiting from gains in manufacturing activity.

China, the report suggested, will remain “by far” the world’s largest rubber market, representing over half of the Asia/Pacific total in 2019.

Demand for rubber in Central and South America and the Africa/Mideast region are also expected to rise at solid rates, benefiting from growth in their tire industries.

In North America and Europe, however, demand for rubber will be below average rates through 2019, as the maturity of economies throughout these regions will constrain growth in the manufacture of rubber consuming products.

Western Europe is forecast to post the slowest growth in rubber demand through 2019.

The region’s tire industries have suffered from producers shifting operations elsewhere in the world, and the permanent closure of tire manufacturing facilities will limit the ability of Western Europe’s rubber market to recover from recent economic weakness.