July 13, 2016 Updated 7/13/2016

Email Print

Bill Wood

Fiat Chrysler Fiat Chrysler workers at the company’s Jefferson North assembly plant in Detroit in May mark the 6 millionth vehicle to roll off its lines.

Two of the most relevant statistical series for the plastics industry — and the whole American economy — are the data that measure light vehicle sales and motor vehicle assemblies.

These series are crucial indicators of future demand for plastics parts, molds and tooling, and plastics machinery. They also are important indicators of the state of North American manufacturing and the spending behavior of American consumers.

Through June, the number of light vehicles sold in the United States (domestic plus imports) totaled just over 8.6 million units. This is 1.5 percent higher than the total in first six months of last year. You may recall that the annual sales total for 2015 set the all-time record, so a year-to-date increase of 1.5 percent coming off of a record-breaking year should feel pretty good.

But while nobody is actually complaining, I heard a lot more buzz about the auto industry in 2014 and 2015 than I have heard this year. It seems that auto industry analysts and suppliers get more excited about the rate of growth than they do about the actual sales totals, even when those totals are at or near cyclical high points.

In 2015, sales grew by more than 5 percent, and the data were building momentum in the second half of the year. So far this year, the growth rate is below 2 percent, and the monthly data are losing momentum. The annual total for 2016 could turn out to be the second-highest total ever, but that will likely generate little enthusiasm. It will be just another case of, “What have you done for me lately?”

In my opinion, this is the kind of thinking that creates booms and busts — more is better than less, and sooner is better than later. But alas, all I can do is bear witness. Arguing with the market is rarely profitable.

After taking a close look at the data from the first half of 2016, I am sticking with my forecast for total sales of more than 16.5 million units. This is a decrease of 5 percent from 2015, and it will be very close to the annual total from 2014. I should mention here that all of the analysts and suppliers I heard from were quite pleased with this total in 2014, so it should not be too disappointing if that’s the number we hit this year.

Breaking down the data, I expect total passenger car sales will be very close to 7 million units this year. This will represent a drop of more than 9 percent from 2015. Through the first six months of 2016, passenger car sales are down 7.5 percent compared to the same period in 2015.

Total sales of light trucks in 2016 (this category includes pick-ups, SUVs, and mini-vans) are forecast at 9.5 million units. This is down 2 percent from the annual total in 2015. Light truck sales surged during the second half of last year. Sales in the second half of this year will be solid, but they will not keep pace with the levels from 2015. For the year-to-date, light truck sales are running 9 percent higher than were during the same period a year earlier.

The value of the dollar has remained pretty strong this year, but the data suggest that manufacturers of imported cars are losing market share. Sales of imports are up by more than 1 percent so far this year compared with a 1.5 percent gain for the domestic manufacturers.

After a huge increase in sales in 2015, Fiat Chrysler is still registering the fastest growth rate of the traditional Big 3. Through June, total sales for Fiat Chrysler products are up a respectable 6.5 percent over last year. It is interesting to note that sales of passenger cars made by Chrysler are down a whopping 33 percent so far this year, but sales of light trucks are up by 21 percent. So it is another good year to be the purveyor of Jeep Cherokees.

Ford Motor Co. also is having a good year, posting a year-to-date sales total that is up by 4.4 percent from last year. Sales of passenger cars are down 9 percent, but Ford’s light truck sales are up 11 percent. That leaves General Motors in third place with a sales total that is down 4.4 percent through June. GM’s passenger car sales are off 9 percent, and their sales of light trucks have slipped 2 percent.

For North American plastics processors that supply the auto industry, the trend in the sales data indicates that the demand for parts will remain high, but the rate of growth will moderate. That is also my forecast for the motor vehicle assemblies data. The trend in the assemblies data is a good proxy for demand of domestically supplied plastics parts.

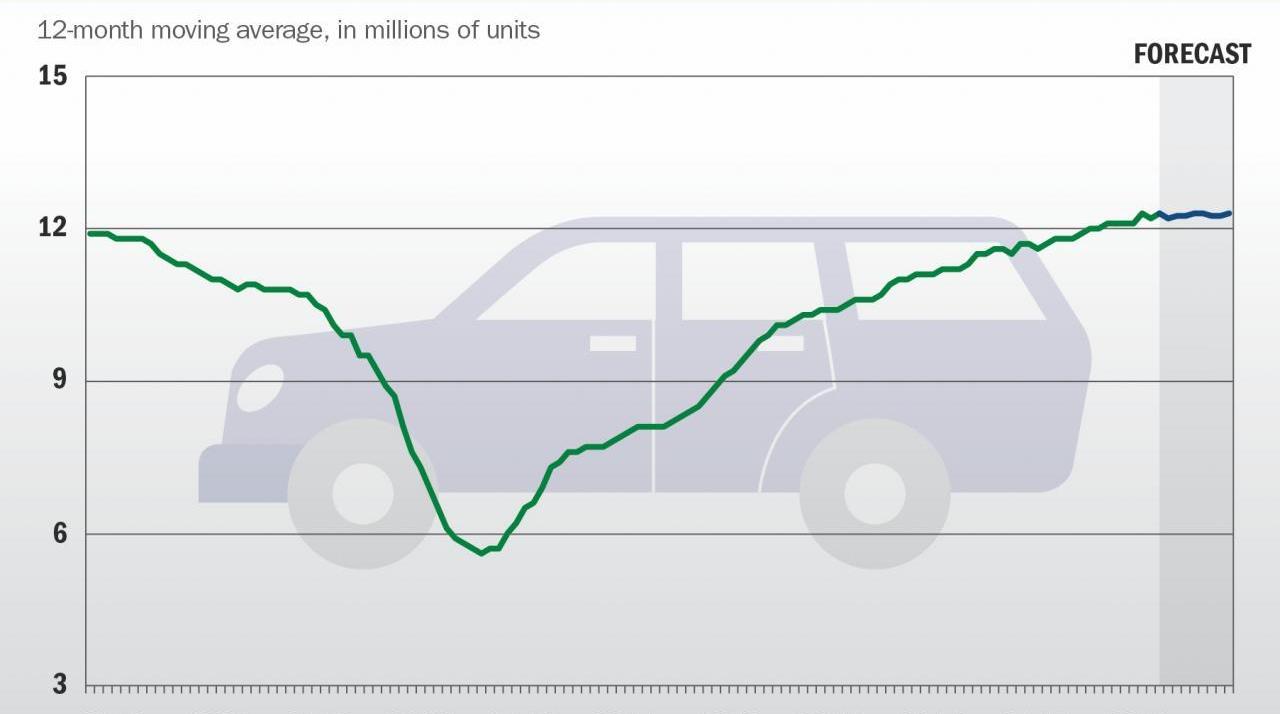

The assemblies data hit a plateau at just over 12 million units in 2015, and my forecast calls for the total to be very close to that level in 2016. The graph shows that the assemblies data is currently above the pre-recession levels, and I expect it to sustain this level for at least another year or two.

Interest rates are low, gasoline prices are reasonable, and the growth rate for total consumer spending is gradually rising. All of these trends will support sales of light vehicles and this will in turn support motor vehicle assemblies in the United States.

I am not expecting another record year for vehicle sales anytime soon — the growth rate in the number of licensed drivers is not growing fast enough to generate that level of demand — but the auto industry should stay strong for the foreseeable future.