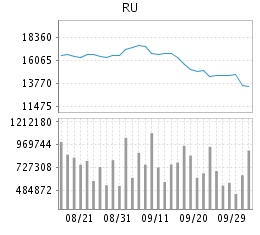

Shanghai, China – Natural rubber futures price on the Shanghai Futures Exchange (SHFE) went down by over 20% in September after rising since July, weaker than almost all other commodities traded on the exchange.

The price has dropped from the high point at €2,183 (17,000 yuan) per tonne at the beginning of the month to €1,734 per tonne. On 28 Sept alone it plummeted by over 7%, according to data from SHFE.

Unlike a number of commodities that benefited from China’s supply side reform in capacity reduction, natural rubber, to some extent an agricultural product, did not get a piece of the action.

Adding to the situation, Thailand, Malaysia and Indonesia failed to reach agreement on curbing rubber exports as expected in mid September.

Rubber demand has also fallen, for reasons such as a slowed tire sector in the wake of tightened environmental regulations. Replacement tires account for a third of natural rubber consumption.