April 4, 2013 – Butadiene again illustrated its ability to ‘turn on a dime’ as forecasts of bullishness in Asia very quickly turned bearish in March, causing a sell-off in the region that dragged down US spot prices along with it and capped European prices despite a string of outages there.

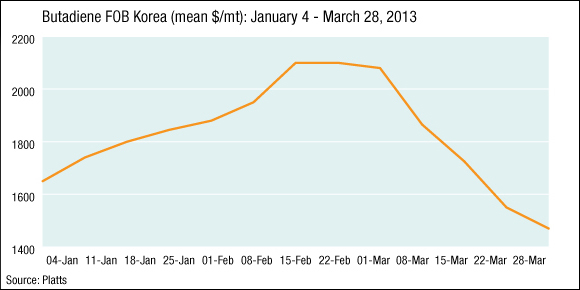

Asian prices for butadiene, which is the major feedstock for synthetic rubber, were unexpectedly volatile in March with FOB Korea prices falling by 29% from $2,080/mt on March 1 to $1,470/mt on March 28, while Western prices were stable.

Prior to the Lunar New Year holidays in Asia, European traders were eyeing export opportunities to both the East and US, but the situation sharply altered after the holidays with traders in Asia looking to shed length by fixing crude C4, butadiene — which is extracted from crude C4 — and derivative cargoes — for export.

A lack of butadiene demand from China for April-loading cargoes and low bids from buyers led South Korean sellers to turn their spot cargoes for the Chinese market into deepsea cargoes bound for either Europe or the US.

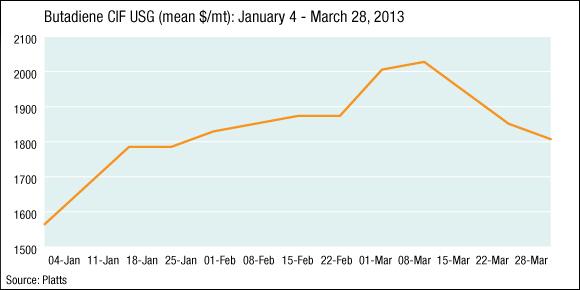

In Europe, the benchmark NWE contract for April-delivered butadiene was fully settled last week at Eur1,415/mt FD NWE ($1,821/mt on a free delivered basis), unchanged from March, while April US butadiene contract prices settled at a rollover of 84-86 cents/lb ($1,852-1,896/mt) on a split settlement basis — occurs when two or more producers conclude their monthly contracts at different prices to each other — sources said.

European spot prices are at a 2-3% premium to the monthly contract price, amid a prevalence of LPG cracking — which can result in 75% lower C4 yields compared to naphtha cracking — and maintenance outages, traders in the region said.

Supply in the US has been described by traders as tight due to producers running their plants at reduced rates and European export supply drying up, sources said.

On April 4, the FOB Korea benchmark for butadiene was assessed at $1,450/mt, Platts data showed, which put the Asian price at a $371/mt and a $402-$446/mt discount to the NWE and US contracts, respectively. Traders and producers see shipping costs to the US and Europe at $350-400/mt.

This situation compares starkly to the market’s position prior to the Lunar New Year, at the start of February.

At that time, sources were seeing the Asian market around $2,100/mt CFR and the European market around $1,700/mt FOB, a situation which had prompted European traders to seek an outlet for selling excess butadiene to the Far East.

Source: .platts.com