Domestic tyre companies may have to import rubber to bridge any supply gap.

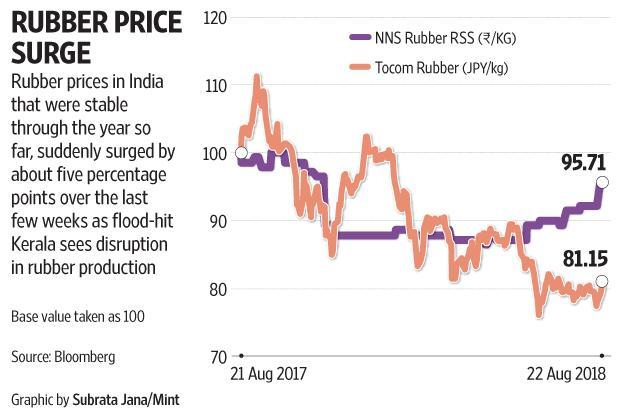

Rubber prices have surged after staying benign for a long time, which could push up production costs at local tyre makers. With Kerala having a near monopoly on India’s rubber output, incessant rains and flooding this month has left the industry in doldrums. The devastation of acres of rubber plantation is likely to impact production and disrupt supply for some time.

Earlier in the year, when untimely and heavy monsoon showers hampered tapping of rubber during the season, industry experts were doubtful about reaching the estimated output of 600,000 metric tonnes (MT) for FY2019. Although exact estimates of the damage to plantations are yet to be calculated, experts believe the year could be a washout.

The 5% rise in prices since the first week of August is a problem but a bigger one is the looming supply shortage. This may mean that domestic tyre companies may have to import rubber to bridge any supply gap. While this may lead to higher costs, buoyant demand from auto companies could offset the impact of high rubber prices on profitability.

The disruption in rubber supply is unlikely to be tided over soon, as growers would be battling losses in their business as well as personal property. The rubber plantation areas of Idukki and Kottayam have been badly affected by the Kerala floods.

Since international rubber prices are at comfortable levels, tyre companies may not face much inflation in input costs if they have to import more rubber.

Apollo Tyres Ltd said the landed cost of imported rubber despite a weaker rupee is at present less than domestic rubber. If local supply turns out to be worse than expected, then it could also push up international prices.

Also, tyre companies such as MRF Ltd and Apollo have experienced substantial production losses at their plants in Kerala due to lower employee turnout during the floods.

Once a comprehensive estimate of the damage to plantations and rubber output becomes available, it will lend a more clear direction to rubber prices and to growers. Meanwhile, if rubber prices continue to trend up, shares of tyre companies may remain wobbly for some time, since rubber makes up nearly two-third of their input costs.