The Pakistan Stock Exchange’s (PSX) benchmark KSE-100 Index closed marginally lower by 91 points on Wednesday, as the index failed to sustain intra-day gains amid lack of positive triggers.

The KSE-100 started the session positive, hitting an intra-day high of 78,334.61, followed by a selling spree in the latter hours.

The bulls managed to regain their position in the second half, but again fell prey to late-session selling.

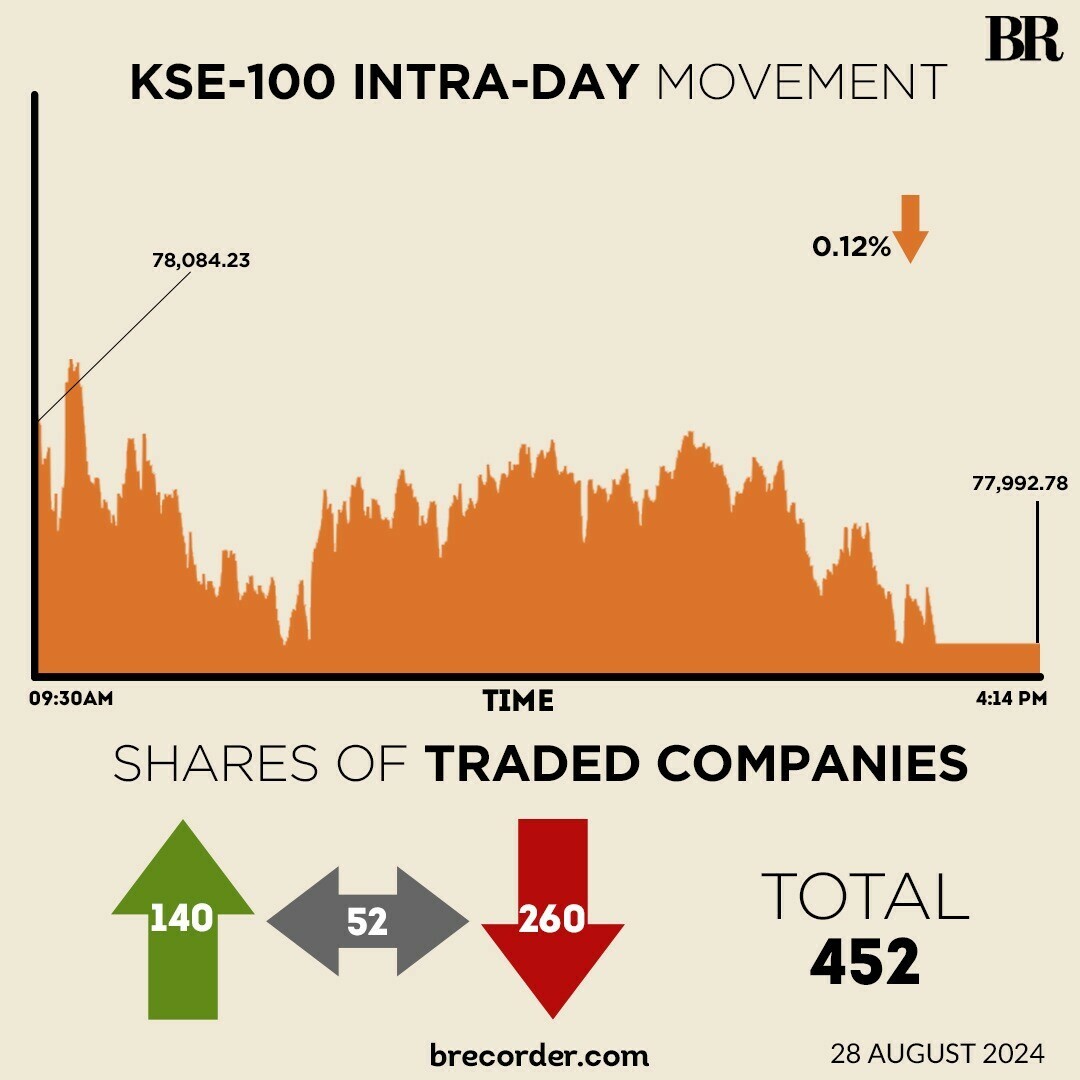

At close, the benchmark index settled at 77,992.78, down by 91.45 points or 0.12%.

“Continuing its yesterday’s trend, Pakistan equities commenced the day on a negative note. Initially, the KSE-100 index witnessed bearish sentiment but in the latter half market saw some positive momentum. However, index couldn’t sustain the positive trend,” brokerage house Topline Securities said in its post-market report.

During the day, BAHL, HINOON, PKGS, MCB & HUBC contributed negatively by losing 104 points, cumulatively. On the flip side, MARI, ENGRO & FFC saw some buying interest as they added 162 points, according to the report.

Another brokerage house Ismail Iqbal Securities said the equity market had closed the day relatively flat, with the benchmark index experiencing volatility throughout the session amid lack of positive triggers.

On Tuesday, the PSX witnessed a bearish session for the second consecutive day, as the KSE-100 closed lower by 487 points despite a positive start.

In three sessions during this week, the KSE-100 has lost more than 800 points as investors have been looking for some fresh positive triggers such as approval for a $7 billion bailout programme from the Executive Board of the International Monetary Fund.

The State Bank of Pakistan (SBP) Governor Jameel Ahmad on Tuesday said Islamabad was looking to raise up to $4 billion from Middle Eastern commercial banks by the next fiscal year (FY26).

Pakistan is also in the “advanced stages” of securing $2 billion in additional external financing required for International Monetary Fund (IMF) approval of the $7-billion bailout programme, according to SBP governor.

In a key development, Moody’s Ratings (Moody’s) on Wednesday upgraded the government of Pakistan’s local and foreign currency issuer and senior unsecured debt ratings to Caa2 from Caa3.

“We have also upgraded the rating for the senior unsecured MTN programme to (P)Caa2 from (P)Caa3. Concurrently, the outlook for Government of Pakistan is changed to positive from stable,” it said.

In its notice to the PSX, Faysal Bank declared a consolidated profit after tax of Rs6.95 billion for the quarter ended June 30, 2024, nearly 60% higher than the Rs4.35 billion recorded in the same period of the previous year.

As per the financial results provided to the Pakistan Stock Exchange (PSX) on Wednesday, Faysal Bank announced an earning per share (EPS) of Rs4.58, as compared to EPS of Rs2.87 in SPLY.

Pakistan Telecommunication Company Limited (PTCL), the country’s telecom and ICT services provider, sustained massive losses to the tune of Rs3.4 billion during the three-month period that ended June 30, 2024.

As per the latest financial results, a copy of which was made available to the Pakistan Stock Exchange (PSX) on Wednesday, the company had registered a loss of Rs2.1 billion in the same period of the previous year.

Global stocks were poised near record highs on Wednesday, with the next move riding on results at chipmaking market darling Nvidia, while sterling notched a 2-1/2 year high as traders bet that Britain will lag the US in cutting interest rates.

MSCI’s broadest index of Asia-Pacific shares outside Japan dipped 0.4%.

Japan’s Nikkei fell 0.2%. Oil retraced a recent spike on Middle East tensions as gloom on Chinese demand returned to the fore and Brent crude futures traded just below $80 a barrel.

Nvidia’s market value has ballooned thanks to its dominance of the computing hardware behind artificial intelligence.

Meanwhile, the Pakistani rupee registered a marginal decline against the US dollar, depreciating 0.05% in the inter-bank market on Wednesday. At close, the currency settled at 278.45, a loss of Re0.13 against the US dollar.

Volume on the all-share index marginally increased to 636.02 million from 591.51 million on Monday.

However, the value of shares decreased to Rs16.27 billion from Rs17.12 billion in the previous session.

Kohinoor Spinning was the volume leader with 124.73 million shares, followed by Fauji Foods Ltd with 39.28 million shares, and Yousuf Weaving with 34.90 million shares.

Shares of 452 companies were traded on Wednesday, of which 140 registered an increase, 260 recorded a fall, while 52 remained unchanged.

Source: Brecorder