S&P 500 futures flat after index nears record

Strong earnings from Nestle and Deliveroo

Bitcoin soars

Key Financials

Equity market attempts to price in solid earnings against a backdrop of inflationary pressures meant futures on the Dow, S&P, NASDAQ and Russell 2000 as well as European stocks traded marginally lower ahead of the New York open on Wednesday.

Yields and the dollar were little changed but Bitcoin’s push toward new highs continued.

Global Financial Affairs

Despite the S&P 500 closing near a record high on Tuesday, futures contracts on the index are indicating that it will open lower later today, as will the NASDAQ and Russell 2000 based on signals this morning from the futures market. Dow futures, however, at the time of writing are marginally up.

In Europe, Nestle (SIX:NESN) and Deliveroo (LON:ROO) outperformed stocks listed on the STOXX 600 after providing strong guidance due to faster growth. Conversely, luxury goods manufacturer and purveyor Kering (PA:PRTP) weighed on the pan-European benchmark after it reported slowing sales at Gucci.

Asian stocks ended mixed after initially advancing as Treasuries edged toward five-month highs, a sign that investors believe in the global economic reopening amid positive corporate earnings.

Regional stocks struggled to maintain headway. Hong Kong’s Hang Seng outperformed, surging 1.1% on fading fears of a Chinese regulatory crackdown. The optimism coincided with Alibaba (HK:9988) founder Jack Ma’s first major public appearance since criticizing Beijing, as the tech giant unveiled one of China’s most advanced chips to help it compete with Amazon (NASDAQ:AMZN) in the cloud space.

On the other side of the digital board, South Korea’s KOSPI fell 0.5%, underperforming the region with institutional selling.

Thanks to solid earnings reports, American stocks extended gains during Tuesday’s New York session, which helped investors turn a blind eye to the risks of elevated inflation.

The S&P 500 gained 0.7%, with Travelers (NYSE:TRV) and Johnson & Johnson (NYSE:JNJ) reporting better than than anticipated earnings. On the other hand, rising freight costs hurt consumer staples giant Procter & Gamble (NYSE:PG).

The launch of the first US futures ETF, the ProShares Bitcoin Strategy ETF (NYSE:BITO) boosted Bitcoin, now in striking distance of its all-time high. The second largest cryptocurrency by market cap, Ethereum, seems to have been overlooked in the meantime, potentially offering better value.

Treasury yields on the 10-year note opened higher, but have since been closing the rising gap.

The dollar tracked yields’ movements, rising slightly.

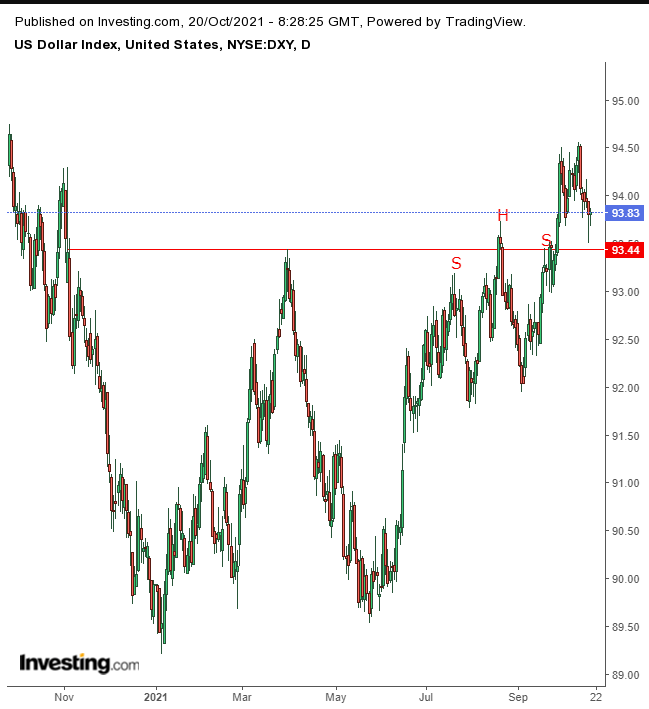

Dollar Index Daily

Dollar Index Daily

The greenback’s pattern of rebounding off lows is extending into the second day. The levels beneath provide support after the price completed a massive double bottom and blew out a H&S top.

Gold rose for the second day, as falling yields gave it an edge in the safe haven space.

Gold Daily

Gold Daily

There’s a short and long-term battle playing out for the yellow metal, as both time frames are producing H&S patterns, albeit in opposing directions. We’re giving more credence to to the longer term view.

Oil retreated from a seven-year high.

Crude Oil 4-Hour

Crude Oil 4-Hour

A fall below $81.09 will establish a short-term downtrend.

Up Ahead

On Thursday the Philadelphia Fed Manufacturing Index is printed

US initial jobless claims are published on Thursday

Fed Chair Jerome Powell takes part in a policy panel discussion on Friday

Market Moves

Stocks

The STOXX 600 rose 0.1% as of 8:46 a.m. London time

Futures on the S&P 500 were little changed

Futures on the NASDAQ 100 were little changed

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia PacificIndex rose 0.9%

The MSCI Emerging Markets Index rose 0.9%

Currencies

The euro fell 0.1% to $1.1620

The Japanese yen was little changed at 114.41 per dollar

The offshore yuan fell 0.2% to 6.3917 per dollar

The British pound fell 0.2% to $1.3775

Bonds

The yield on 10-year Treasuries was little changed at 1.64%

Germany’s 10-year yield declined one basis point to -0.11%

Britain’s 10-year yield fell two basis points to 1.15%

Commodities

Brent crude fell 0.6% to $84.56 a barrel

Spot gold rose 0.4% to $1,775.87 an ounce

Source: Investing.com