Market Review

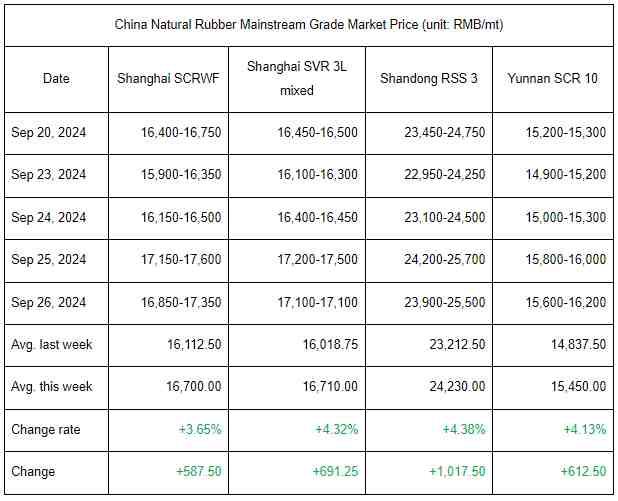

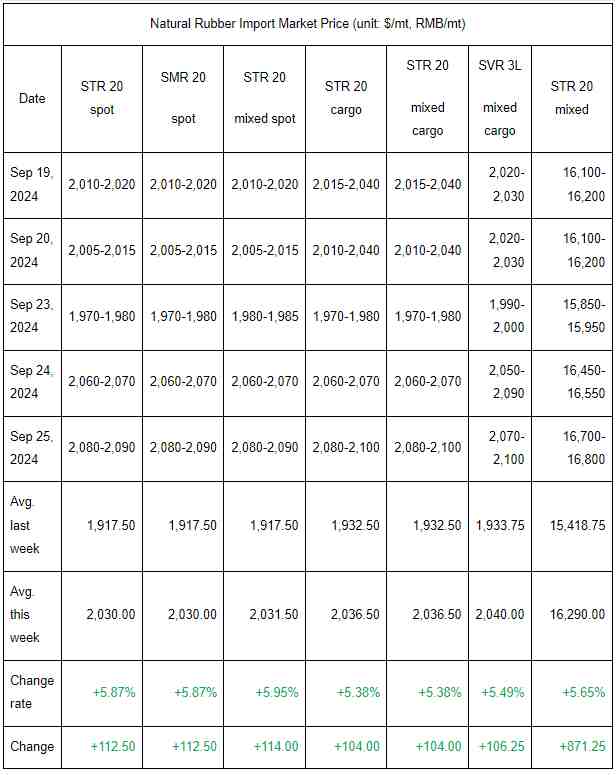

Prices of RMB-denominated natural rubber spot resources moved up this week. Within this week, prices of Shanghai natural rubber futures surged, once rising to a new high since March 2017. Thus, the spot price of natural rubber went higher, in tandem with climbing futures prices. This week, the external macro atmosphere remained bullish, driving up the commodity price. Coupled with tight supply, the natural rubber price remained in an uptrend. However, downstream tire enterprises were reluctant to accept high-priced resources. The actual rigid demand stayed average this week. The dealings mainly covered arbitragers’ position addition and traders’ resource delivery at the end of September.

Market Forecast

Forecast: China’s natural rubber market may trend sideways after inching down next week. On the one hand, with the National Day holiday drawing near, the sentiment to hedge funds may warm up. Besides, the support from the macro environment may weaken gradually. Thus, the overall natural rubber price is likely to decline from highs. Yet, as seen from the current fundamentals, there are many rainfalls in producing areas both at home and abroad. Therefore, the output of new field latex may be released slowly. The cost may remain high, underpinning the natural rubber price from the bottom. Meanwhile, the spot inventory of natural rubber may be low, and the supply of some types of rubber may be tight, bolstering the natural rubber price as well. On the whole, the overall natural rubber price may remain at highs after dropping before the National Day. It is estimated that the weekly average price of SCRWF in Shanghai may be RMB 16,400/mt, and its mainstream prices may be in the range of RMB 16,000-17,000/mt. Players should pay attention to more details of the resource outflow from the National Food and Strategic Reserves Administration as well as the new output release of field latex in China’s and overseas producing areas after the National Day holiday.

Supply: In the short run, the purchase price of feedstock may remain firm. Coupled with many rainfalls in producing areas, the output release of new field latex may be sluggish. Besides, at present, the spot inventory of natural rubber stays low in China. The tight supply of some grades of rubber may bolster the natural rubber price from the bottom.

Demand: Ahead of the National Day holiday, the sentiment to hedge funds may warm up, along with cooldown in the macro atmosphere. Besides, at the end of September, players may mainly adopt a wait-and-see stance in the short run, due to related market sources regarding natural rubber outflow from the National Food and Strategic Reserves Administration. Thus, the natural rubber price is likely to fall from highs.