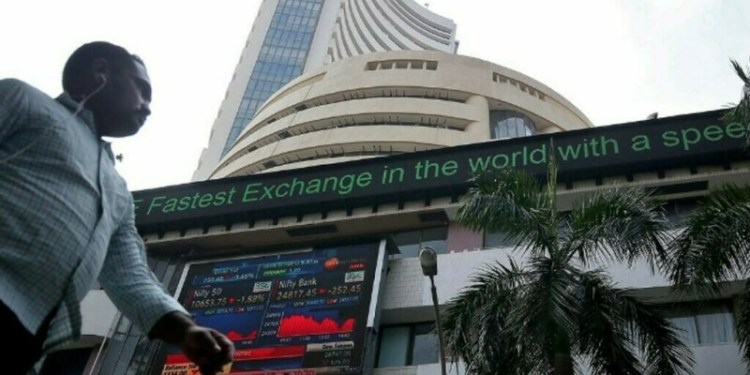

Indian shares opened lower on Friday, dragged down by metal stocks on a strong US dollar and lack of clarity around stimulus measures by top consumer China.

The NSE Nifty 50 was down 0.51% at 24,421.35 points as of 9:26 a.m. IST, while the BSE Sensex shed 0.54% to 80,853.8. All 13 major sectors declined.

The metals index declined 1.7% and was the top sectoral loser on the back of a stronger US dollar as well as a lack of policy details about China’s stimulus measures.

More clarity on the stimulus is expected to boost metal producers globally.

A strong dollar makes metals more expensive for holders of other currencies.

Indian shares settle lower as caution ahead of inflation data

High-weightage financials lost 0.6% on Friday, while information technology stocks fell 0.5% after gaining 2.2% in the last four sessions.

Meanwhile, data on Thursday showed that domestic inflation eased in November was within the Reserve Bank of India’s 2%-6% tolerance band.

However, a stronger dollar is a concern since it could lead to a rise in imported inflation, said VK Vijayakumar, chief investment strategist at Geojit Financial Services.

Source: Brecorder