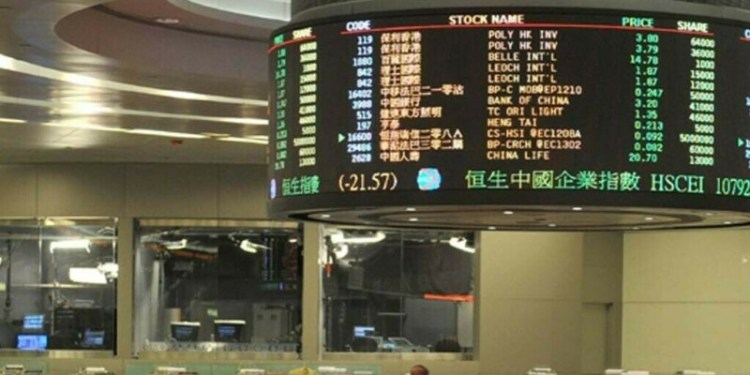

SHANGHAI: China stocks slipped on Thursday as official data underscored persistent deflationary pressure despite fresh government consumption stimulus, intensifying a scramble for offshore assets, while Hong Kong shares closed at a one-month low.

China’s blue-chip CSI300 Index dipped 0.3% and the Shanghai Composite Index lost 0.6%. Hong Kong’s benchmark Hang Seng declined 0.2%.

Consumer prices in China barely rose in 2024, while factory-gate prices extended into a second straight year of declines, official data showed.

This was a day after China, in an effort to revive demand in the sluggish household sector, added more home appliances to the list of products eligible for its consumer trade-in scheme.

Consumer stocks had a muted response to the expanded scheme.

“The deflationary pressure is persistent,” said Zhiwei Zhang, president and chief economist of Pinpoint Asset Management.

“The details on government subsidies for some consumer goods announced yesterday are positive. But the property sector downturn has not ended and continues to weigh on consumer sentiment.”

The view was echoed by Goldman Sachs, which sees China’s significant step-up in policy easing measures only partially offsetting weak domestic consumption.

“We believe that these measures… should help support the real economy and put a floor under Chinese equities, though policy delivery, especially on the fiscal front, will ultimately be necessary to drive equity gains in 2025.”

Domestic investors are scrambling for overseas assets via cross-border channels, including QDII and Mutual Recognition of Funds (MRF), a sign of weak confidence in the local market and triggering subscription suspensions and risk warnings from fund managers.

However, tech shares gained as investors renewed patriotic bets on chip-making and information security stocks amid heightened geopolitical tensions. Defense and rare earth stocks also advanced.

Hong Kong’s tech index rose. Tencent’s stock buybacks helped it rebound from a four-month low after being added by the US Defense Department to a list of companies the department says work with China’s military. .

Source: Brecorder