On Tuesday, following Russian President Vladimir Putin’s accelerated saber rattling and latest moves on Ukraine, investors are increasing their flight to safe havens, obscuring any action or inaction currently coming from the Federal Reserve.

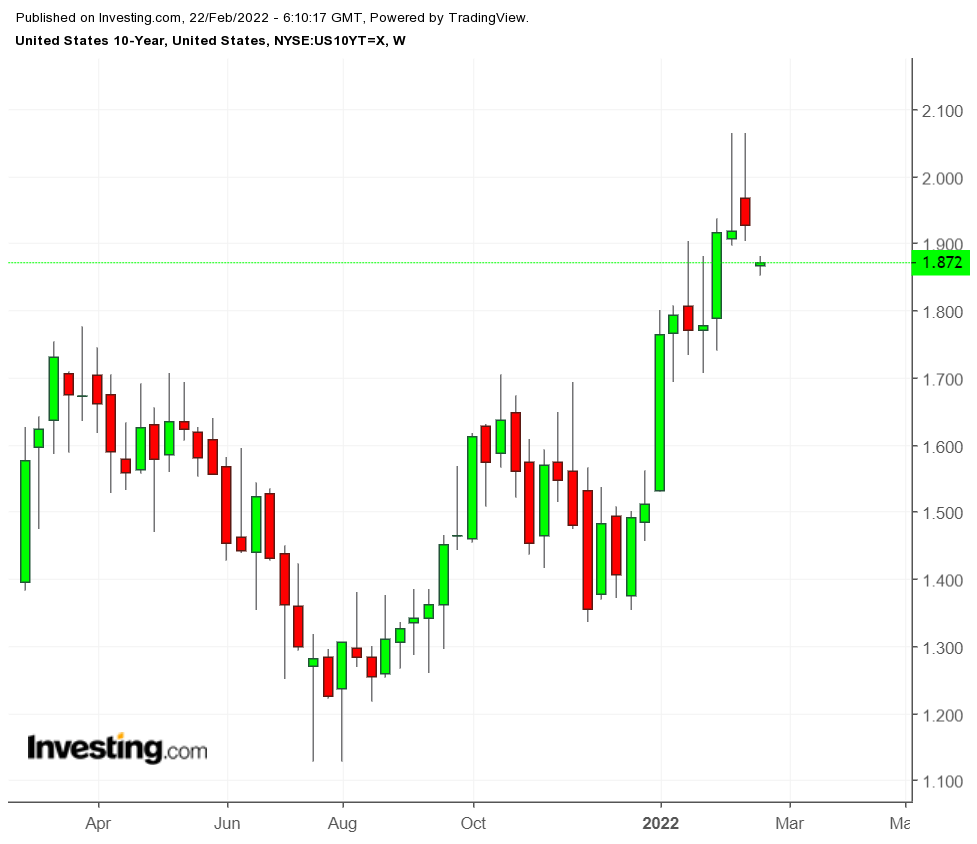

US 10-year Weekly Chart

US 10-year Weekly Chart

Yields on the benchmark 10-year Treasury note rose and declined last week in concert with the news reports about Putin’s intentions with regard to invading Ukraine, falling to well below the 2% level on Friday—to 1.927%—ahead of the long holiday weekend in the US. This morning, yields have slumped even further—down at the time of writing to 1.872% as Treasury buying escalates.

Given this latest state of affairs, a torrid day for global markets, including sovereign bonds, would appear to be expected. Germany’s 10-year bond yield fell closer to 0.2% on Monday, down from above 0.3% last week, and has slipped further, to 0.185% currently. Still, the German benchmark may not be a fair proxy for Treasuries, given Germany’s vulnerability to energy blackmail from Russia.

Overall, the impact on Treasury yields is likely to be greater.

Though French President Emmanuel Macron, who is up for re-election in April, claimed to have arranged a tentative summit between Putin and US President Joe Biden, all that is moot now after Putin formally ‘recognized’ the so-called breakaway republics of Donetsk and Luhansk and is almost certain to use that action as an excuse to have Russian troops cross the border into Ukraine.

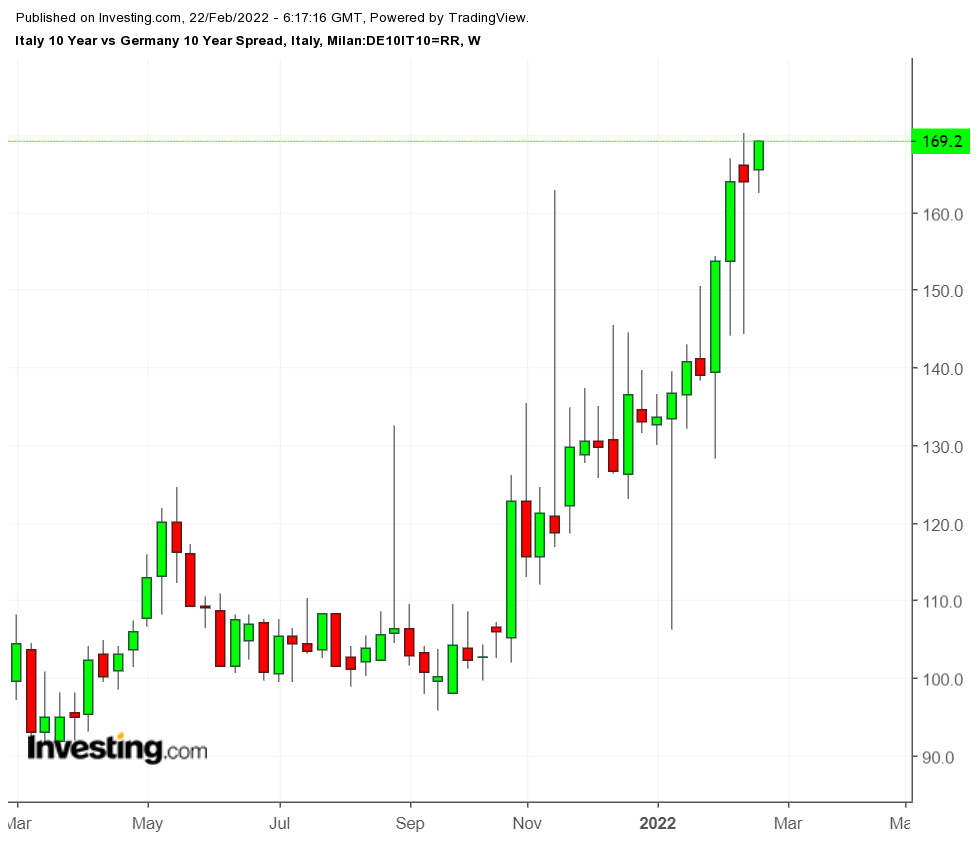

Yields on Italy’s benchmark 10-year were up several basis points on Monday, reaching the 1.90% level in trading, as strong business activity in Europe and a hawkish pivot at the European Central Bank offset Ukraine concerns in peripheral countries.

Italy 10-year vs Germany 10-year spread

Italy 10-year vs Germany 10-year spread

The widening gap between the German and Italian benchmark yields, now at about 170 basis points, raises concerns about eurozone stability. The spread has blown through conservative target of 150 bps and analysts now see it heading anywhere from 180 to 200 bps.

But the threat of a shooting war in Europe has become concrete after Putin’s decision to recognize the Ukraine breakaways, as has the likely economic impact from harsher Western sanctions later today in retaliation.

Volatility is sure to remain high as investors follow events hour by hour; many news feeds are labeled “live” as media try to stay on top of events. It’s not going to get any easier in coming days.

Source: Investing.com