Geopolitical worries will continue moving markets

Retail sector earnings ahead

Powell’s Congressional testimony and NFP will provide policy clues

Will investors continue to buy the dip—as occurred during the final days of last week’s trade—on speculation that Russia’s invasion of Ukraine will slow the planned pace of US Federal Reserve tightening which many believe could begin in mid-March? Unless Russian President Vladimir Putin rolls back his troops shortly, which at this point seems doubtful, we don’t believe risk-on appetite in markets will continue much longer.

As such, expect volatility to increase and stocks to decline as risk-off sentiment takes hold.

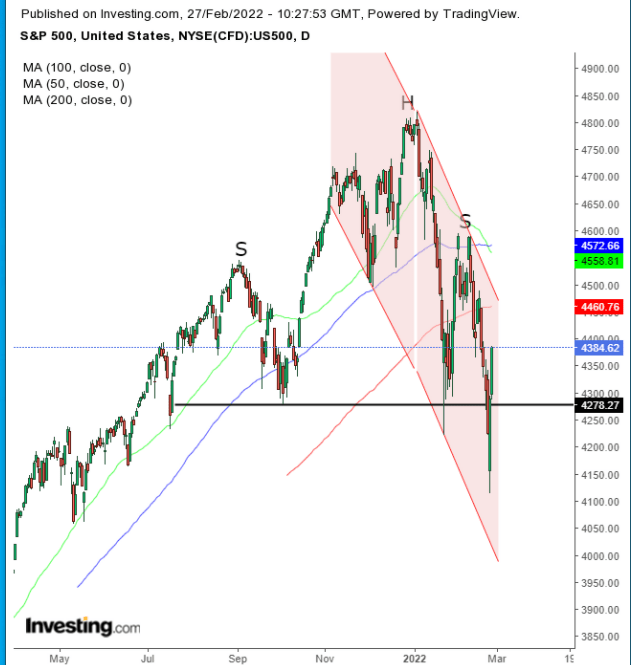

While the S&P 500 Index jumped over 6% from Thursday’s lows to the close on Friday to end the trading week on an upnote, the market action over the last two days wasn’t a conventional buying opportunity. The rebound followed a 12% correction since the Jan. 3 record, providing what does indeed look like a buying dip via the give-and-take of supply and demand cycles among freely traded assets. But the technical chart provides additional insight into where the broad benchmark could actually be heading:

SPX Daily

SPX Daily

The broad market gauge recently jumped off the bottom of its falling channel. Now that it has neared the top of the downtrend’s boundaries, the chances of the SPX completing an H&S top have increased, after falling below the 200 DMA and the 50 DMA and now sinking beneath the 100 DMA as well.

Savvier traders will focus on the sector breakdown. While all of the S&P 500’s 11 sectors finished green on Friday, Technology and Communication Services were higher by 1.36% and 1.62%, respectively, rendering them the laggards of the bunch.

Traditionally defensive sectors Consumer Staples and Utilities, along with cyclical sector Materials all gained more than 3%. The remaining economically sensitive sectors, such as Industrials and Energy, all finished north of 2%. So did Healthcare for that matter, which, since the outbreak of COVID, according to some analysts, has morphed into a “defensive growth” sector.

In other words, going forward, defensive and cyclical sectors are likely to outperform, as they provide more value. Healthcare is the only growth sector likely to do better than the traditional growth stocks, i.e., technology shares.

Therefore, within the equity arena we expect to see the above distribution play out. Nonetheless, expect whipsaws considering that the S&P 500 is still down 8% since the start of the year, its sharpest selloff since the March 2020, COVID-outbreak plunge, when the index lost a third of its value.

However, any hints from the Fed that they might adopt a wait-and-see approach to rate hikes because of the crisis in Eastern Europe is likely to provide investors willing to look past the noise a reason to take some long-term positions. Traders will be paying close attention to Fed Chief Jerome Powell’s Congressional testimony on Thursday, in search of any language that suggests any geopolitical considerations vis-à-vis monetary policy.

Of course, should the current conflagration escalate in intensity or across borders, all bets are off.

But absent any doomsday scenario, the next most significant market-moving event during the upcoming week could be Friday’s Nonfarm Payrolls release. It would contain the last meaningful data points for the Fed before its Mar. 15-16 monetary policy meeting.

Beyond the above developments, investors who are growing anxious about stocks will likely be monitoring this coming week’s crop of earnings reports with such closely watched tech companies as Salesforce.com (NYSE:CRM) and Zoom Video (NASDAQ:ZM) on tap along with retailers including Target (NYSE:TGT), Best Buy (NYSE:BBY) and Costco Wholesale (NASDAQ:COST) all scheduled to report in the coming week.

Treasury yields, including for the 10-year benchmark note, provide a leading indicator signaling where rates are likely heading. Indeed, we expect additional clues this week.

UST 10Y Daily

UST 10Y Daily

Yields have closed at the top of a potential falling flag, bullish after an initial surge. An upside breakout would confirm that the uptrend for yields will resume following the preceding pennant and symmetrical triangle.

Rising yields could weigh on stocks, as higher rates make shares more expensive. Also, the higher payouts from bonds would then compete with equities for investor funds.

The dollar jumped last week after Russia invaded Ukraine, but settled a bit lower during Friday’s trade.

Dollar Daily

Dollar Daily

The greenback found resistance at the top of a Diamond, which is expected to also be a USD top. If, however, the price repeats Thursday’s upside breakout and endures above the pattern, its bearish implications will reverse. A downside breakout will top out the buck.

Gold slumped on Friday, but we expect it to continue rallying in the coming week.

Gold Daily

Gold Daily

Gold has been overbought. Once traders take profits, the symmetrical triangle that started shortly after the yellow metal’s August 2020 record high will turn into support.

Bitcoin is up today, trading around $39K at time of writing.

BTC/USD Daily

BTC/USD Daily

However, after completing an H&S top, we expect it to continue back toward $30K.

Oil had an extremely volatile week, with traders expecting sanctions on Russia, the world’s second-largest exporter after Saudi Arabia, will lower supply. Of course, Russia may punish Europe by no longer sending them oil and gas, but that all remains to be seen right now.

On the other hand, the US’s nuclear negotiations with Iran could cause a return of exports to the global market from that Middle Eastern country.

Oil Daily

Oil Daily

After jumping far above its pennant, oil prices closed within it. An upside breakout on a closing basis would signal that buyers have absorbed all available supply and are looking for more.

The Week Ahead

All times listed are EST

Sunday

19:30: Australia – Retail Sales: expected to jump to 0.4% from -4.4% MoM.

Monday

20:30: China – Manufacturing PMI: seen to fall to 49.9 from 50.1.

20:45: China – Caixin Manufacturing PMI: forecast to edge up to 49.5 from 49.1.

22:30: Australia – RBA Interest Rate Decision

Tuesday

3:55: Germany – Manufacturing PMI: anticipated to remain at 58.5.

4:30: UK – Manufacturing PMI: likely to remain flat at 57.3.

8:30: Canada – GDP: predicted to fall to 0.1% from 0.6%.

10:00: US – ISM Manufacturing PMI: expected to edge higher to 58.0 from 57.6.

Tentative: US President Joseph Biden Speaks

19:30: Australia – GDP: probably fell to -2.7% from -1.9% QoQ.

Wednesday

5:00: Eurozone – CPI: seen to rise to 5.3% from 5.1%.

8:15: US – ADP Nonfarm Employment Change: likely to surge to 350K from -301K.

10:00: Canada – BoC Interest Rate Decision: predicted to rise to 0.5% from 0.25%.

10:30: US – Crude Oil Inventories: the previous week’s print came in at 4.515M.

Thursday

4:30: UK – Services PMI: expected to remain unchanged at 60.8.

7:30: Eurozone – ECB Publishes Account of Monetary Policy Meeting

8:30: US – Initial Jobless Claims: to edge down to 226K from 232K.

10:00: US – Fed Chair Jerome Powell Testifies before Congress.

10:00: US – ISM Non-Manufacturing PMI: anticipated to edge up to 61.0 from 59.9.

Friday

4:30: UK – Construction PMI: seen to drop to 54.3 from 56.3.

8:30: US – Nonfarm Payrolls: predicted to ease to 450K from 467K.

8:30: US – Unemployment Rate: seen to decline to 3.9% from 4.0%.

Source: Investing.com