Stocks on Wall Street ended sharply higher on Friday to close out a volatile week of trading, with the Dow Jones Industrial Average notching its biggest one-day gain since November 2020.

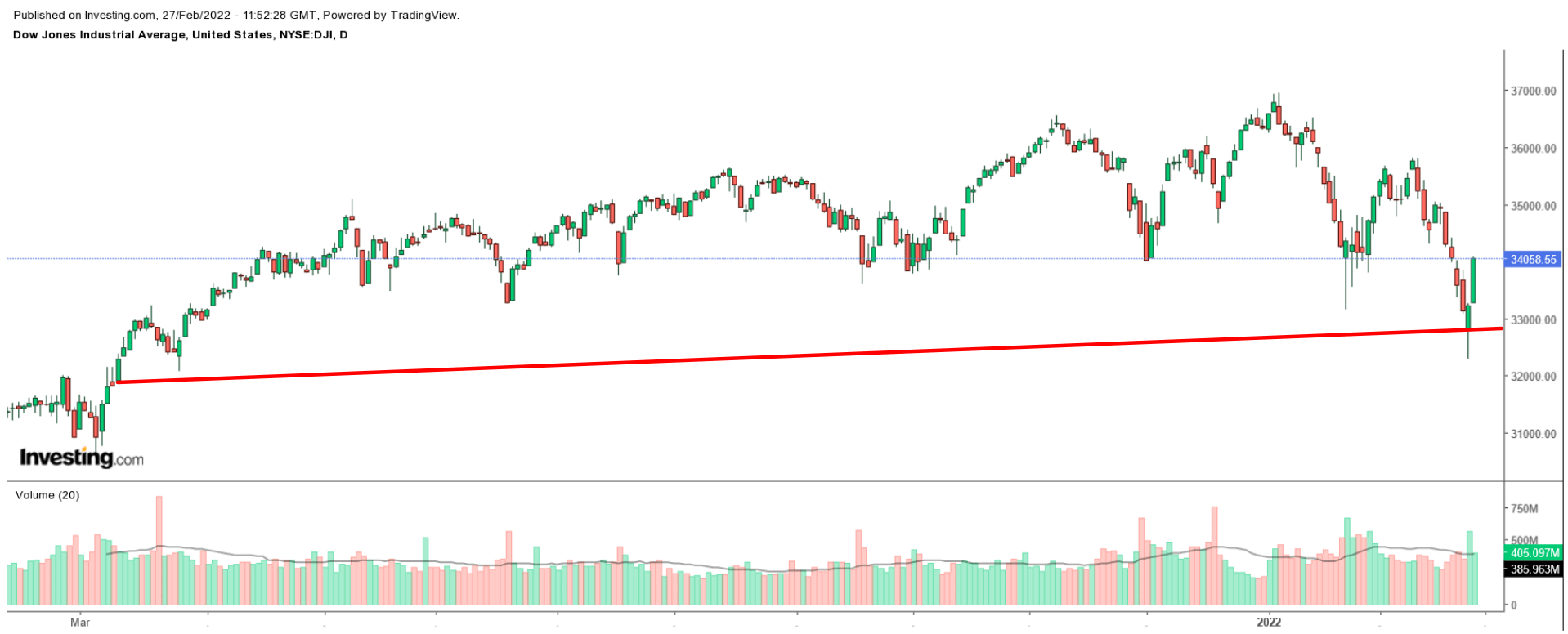

Dow Daily Chart

Dow Daily Chart

The week ahead is expected to be another eventful one as investors monitor fresh geopolitical developments related to the Russia-Ukraine crisis.

In addition, we’ll also hear congressional testimony from Federal Reserve Chair Jerome Powell, as well as see important economic data, such as the latest U.S. employment report and ISM PMI surveys.

Earnings from notable companies like Zoom Video (NASDAQ:ZM), Salesforce (NYSE:CRM), Target (NYSE:TGT), Best Buy (NYSE:BBY), Costco (NASDAQ:COST), and Broadcom (NASDAQ:AVGO) are also on the agenda.

Given the current escalation in geopolitical tensions, anticipated earnings from major retail and high tech firms, and the sensitive U.S. nonfarm payrolls data coming in this week, more volatility is expected. Regardless, however, of which direction the market may take, below we highlight one stock likely to be in demand and another which could see further downside.

Remember though, our timeframe is just for the upcoming week.

Stock To Buy: Palo Alto Networks

Palo Alto Networks (NASDAQ:PANW) shares scored their biggest weekly gain in six months last week despite the current market turmoil. PANW is likely to extend its march higher in the days ahead as the cybersecurity firm continues to benefit from elevated threats of cyberattacks related to the Russia-Ukraine crisis.

Several Ukrainian government websites were knocked offline over the weekend due to a mass distributed denial-of-service attack, according to Mykhailo Fedorov, head of Ukraine’s Ministry of Digital Transformation. Fedorov added that his government will create an “IT army” to fight back against Russia-linked cyberattacks.

The source of the cyberattack has yet to be confirmed, however, experts are pointing the finger at Russia, which is a powerful force in global cyberwarfare, with many high-profile attacks over the past decade traced back to Moscow.

As such, Palo Alto Networks—widely considered the cream of the crop of the cybersecurity software industry—is well-positioned to reap the benefits from the anticipated surge in advanced-persistent-threat (APT) spending amid the current geopolitical environment.

Its core products include advanced firewalls and intrusion prevention systems which offer network security, cloud security, endpoint protection, and various cloud-delivered security services.

PANW Daily Chart

PANW Daily Chart

PANW—which soared 18% last week to record its best weekly performance since August 2021—ended Friday’s session at $569.75, within sight of its all-time high of $572.67 touched on Dec. 27. At current levels, the Santa Clara, California-based tech company has a market cap of $56.1 billion.

Palo Alto has seen its shares buck the recent downward trend in the software sector, rising 2.3% year-to-date to outperform other notable names in the space, such as CrowdStrike (NASDAQ:CRWD), Cloudflare (NYSE:NET), Fortinet (NASDAQ:FTNT), Zscaler (NASDAQ:ZS), and Okta (NASDAQ:OKTA).

The cyber specialist reported fiscal second quarter earnings that easily topped expectations on Feb. 22, prompting it to boost its full-year outlook thanks to soaring demand for security software.

Stock To Dump: Yandex

Shares of Russia’s largest tech company, Yandex (NASDAQ:YNDX), are expected to suffer another challenging week, with a potential drop to new record lows on the horizon, amid worries over the negative impact of mounting Western sanctions on the Russian economy in response to the worsening conflict in Ukraine.

YNDX plummeted almost 58% last week—its biggest one-week drop on record—as investors dumped companies with high exposure to Russia following Moscow’s full-scale invasion of its Slavic neighbor. The stock tumbled to its lowest since March 2016 on Thursday, hitting $14.11 per share. It clawed back some losses to end at $18.94 by close of trade on Friday.

The tech giant, which has a market cap of $6.8 billion, is down an astonishing 68.7% so far in 2022, significantly underperforming the broader market.

YNDX Daily Chart

YNDX Daily Chart

Yandex is an internet and technology company primarily serving Russian and Russian-language users. It offers a wide range of internet-related products and services, including search, online advertising, e-commerce, and mobile applications.

The tech firm, which is the fifth-largest search engine worldwide after Google (NASDAQ:GOOGL), Baidu (NASDAQ:BIDU), Bing (NASDAQ:MSFT), and Yahoo!, also provides a variety of web services to other countries in the region, such as Ukraine, Belarus, Georgia, and Kazakhstan.

While the corporation is registered in Schiphol, the Netherlands, Yandex’s founders, and the majority of employees, are located in the Russian Federation.

Source: Investing.com